Bitcoin's Rally Underpinned by Institutional Interest: A Technical Perspective

Key Takeaways

- Institutional Influx Fuels Rally: BlackRock's IBIT significantly contributes to BTC's ascent.

- Technical Indicators Favor Bulls: Majority signals suggest continued bullish momentum.

- Vigilance Against Reversal Signs: Noteworthy bearish divergence calls for cautious optimism.

Market Dynamics and Institutional Influence

Bitcoin's recent surge past the $52,000 mark is a testament to the growing institutional interest, particularly highlighted by BlackRock's IBIT. The ETF, channeling substantial inflows into the crypto market, underscores a pivotal shift in perception towards digital assets. Despite a historical skepticism, the narrative around Bitcoin evolves, likening it to a digital gold in the investment sphere.

Institutional Inflows:

- BlackRock's IBIT captures 58% of weekly BTC ETF inflows, underscoring institutional confidence.

- The shift towards digital assets reflects a broader recognition of their potential as a legitimate investment class.

Technical Analysis: Bullish Undertones Amidst Consolidation

The BTC/USD pair's trajectory within an ascending channel highlights a bullish trend, with the price consistently marking higher highs and lows. This pattern is further reinforced by key technical indicators and moving averages.

Technical Highlights:

- Price Above DEMA 50: Indicates short-term bullishness, with DEMA 50 acting as immediate support.

- EMA 100 as Resistance: A break above could signal further bullish momentum.

- RSI Moderation: Suggests room for growth before reaching overbought conditions.

Chart Patterns and Momentum:

- Bullish patterns, including a "Bullish Engulfing" and a "Hammer," suggest potential for continued upward movement.

- Bearish divergence warrants attention, potentially signaling upcoming consolidation or reversal.

Intraday Indicators and Sentiment Analysis

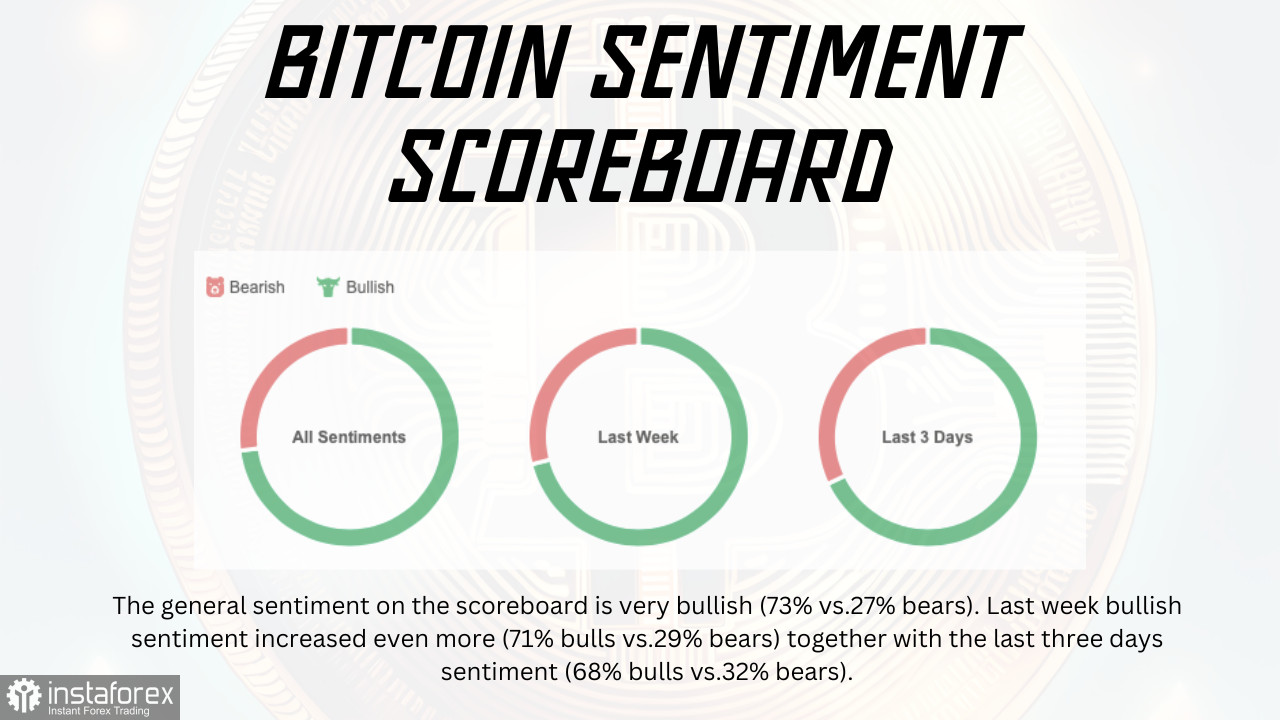

A predominantly bullish sentiment is mirrored in the intraday indicators, with a significant majority signaling buy. This sentiment aligns with the overall market optimism, as reflected in the sentiment scoreboard.

Sentiment Overview:

- The sentiment scoreboard reveals a robust bullish bias, reinforcing the positive outlook among traders and investors alike.

Trading Insights:

For BTC/USD Bulls: Opportunities arise from maintaining positions above the DEMA 50, with potential targets along the ascending channel's upper boundary. Strategies focusing on buying dips, with cautious stop-loss management, could capitalize on the bullish trend.

For BTC/USD Bears: A confirmed break below the DEMA 50, prompted by bearish divergence, could indicate a shift towards a bearish scenario. In this case, short positions with strategic stop-loss placements above recent highs may offer tactical advantages.

Conclusion: Strategic Considerations in a Dynamic Market

As Bitcoin consolidates its gains amidst significant institutional interest, the market's technical posture suggests a predominantly bullish outlook. However, traders should remain vigilant for signs of momentum weakening, adapting strategies to navigate potential market shifts. In essence, the interplay between bullish indicators and bearish divergences underscores the importance of a balanced, informed approach to trading in the dynamic crypto landscape.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.