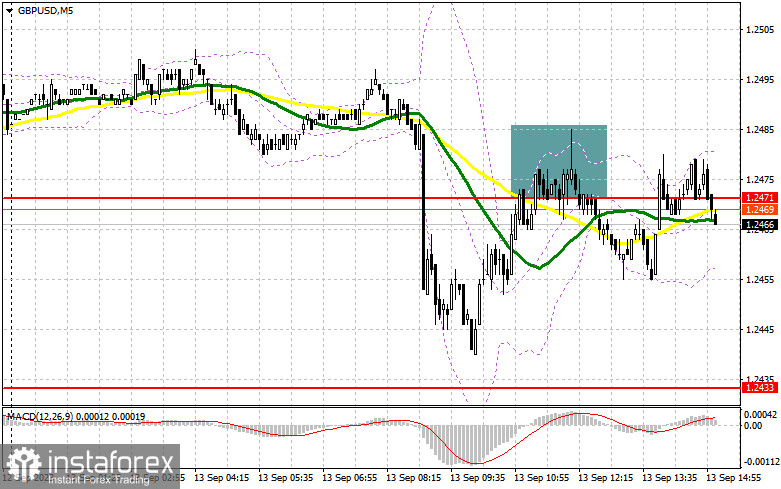

In my morning forecast, I emphasized the level of 1.2471 and advised considering it when making entry decisions. Let's examine the 5-minute chart and analyze what happened there. The breakout and subsequent retest of 1.2471 after weak GDP data from the UK signaled a selling opportunity. However, a major pound drop has yet to occur due to the anticipated significant US economic statistics. The technical picture was partially revised for the second half of the day.

To Open Long Positions in GBP/USD:

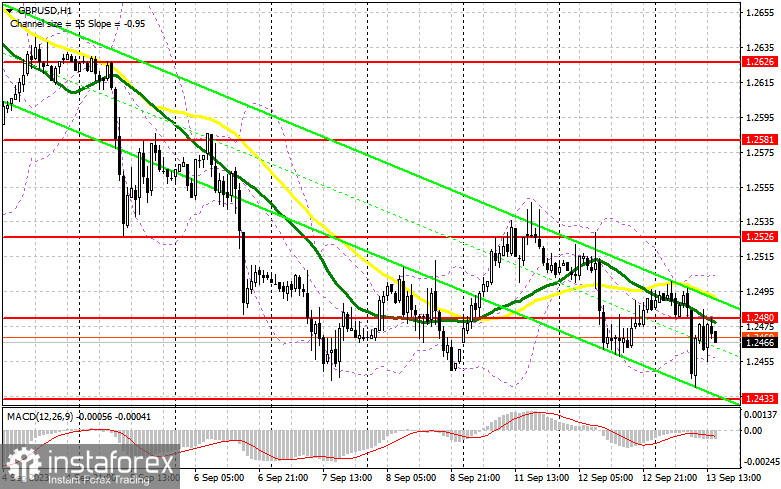

Disappointing data on the growth rate of the British economy led to a sharp decline in the pound during the first half of the day, which may continue. However, everything depends on the figures from the US Consumer Price Index. If basic prices suddenly rise and exceed economists' forecasts, demand for the dollar will likely return, leading to further pound depreciation. If, on the other hand, prices demonstrate a slowdown in growth, the dollar is likely to weaken, providing a reason to increase long positions on the pound, counting on an upward correction and a break in the bearish trend. In the case of a further GBP/USD decline, I plan to act against the bearish market only if a false breakout occurs at 1.2433, providing an entry point for buying with a recovery towards the resistance at 1.2480, formed after the first half of the day. A breakout and consolidation above this range will restore confidence among buyers, giving a buy signal with a target of 1.2526. The ultimate target will be around 1.2581, where I will lock in profits. In the scenario of a decline and the absence of bulls at 1.2433 in the second half of the day, which is quite possible, if US inflation turns out to be significantly higher than economists' forecasts, things will go badly for buyers. In such a case, only the defense of the next area at 1.2395 and a false breakout there will signal the opening of long positions. I plan to buy GBP/USD only on a rebound from the minimum of 1.2340, targeting a correction of 30-35 pips within the day.

To Open Short Positions on GBP/USD:

Bears must defend the nearest resistance at 1.2480, where moving averages are located. This should be enough to expect a monthly minimum update, especially after the US inflation data release. Shorting GBP/USD will only be considered after an unsuccessful consolidation at 1.2480, leading to a decline towards 1.2433. A breakout and retest of this range from below will deal a more serious blow to bullish positions, providing an opportunity to establish a downward trend with a minimum update at 1.2395. The ultimate target remains around 1.2360, where I will take profits. In the case of GBP/USD rising and a lack of activity at 1.2480 in the second half of the day, bulls may quickly take the initiative. In such a case, I will postpone selling until a false breakout at 1.2526. If there is no downward movement, I will sell the pound on a rebound from 1.2581, but only with the expectation of a pair correction downwards by 30-35 pips within the day.

Indicator Signals:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, indicating the likelihood of further pound depreciation.

Note: The author considers the periods and prices of moving averages on the H1 hourly chart, which differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator at around 1.2460 will act as support.

Indicator Descriptions

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

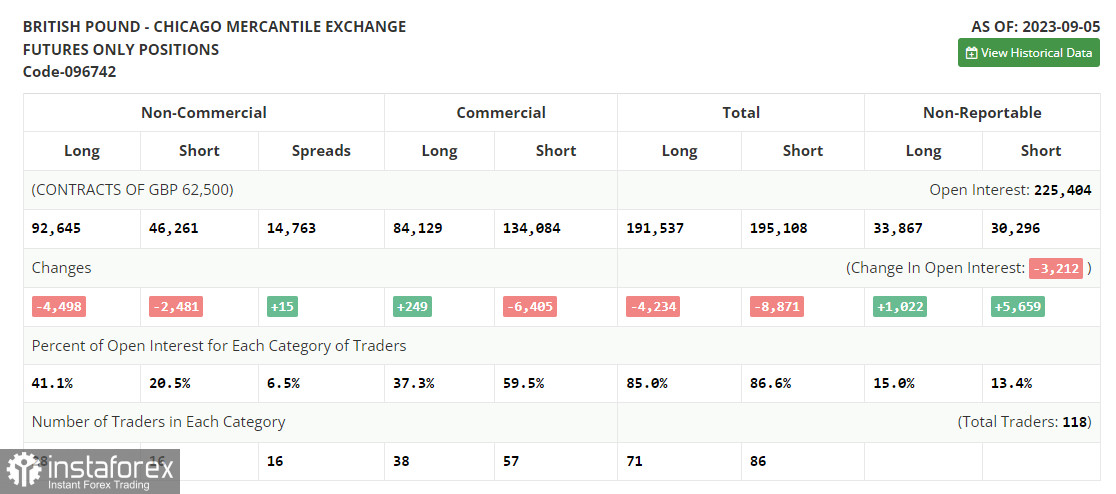

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.