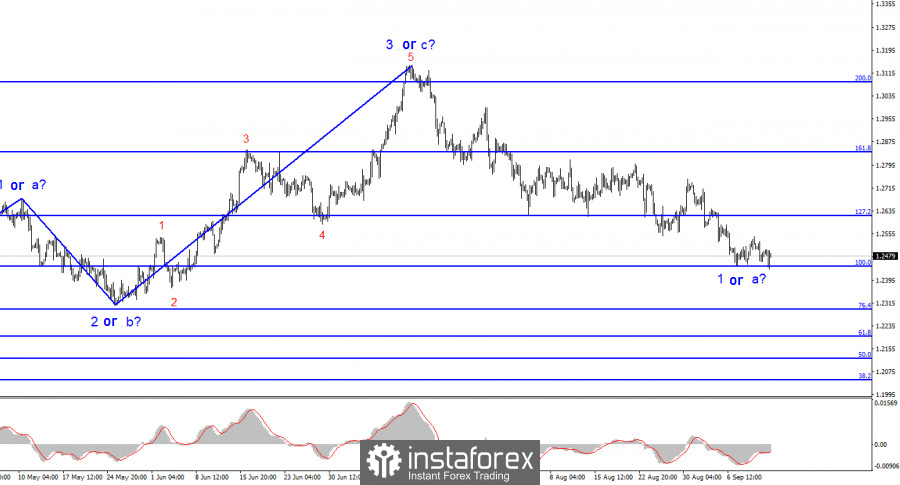

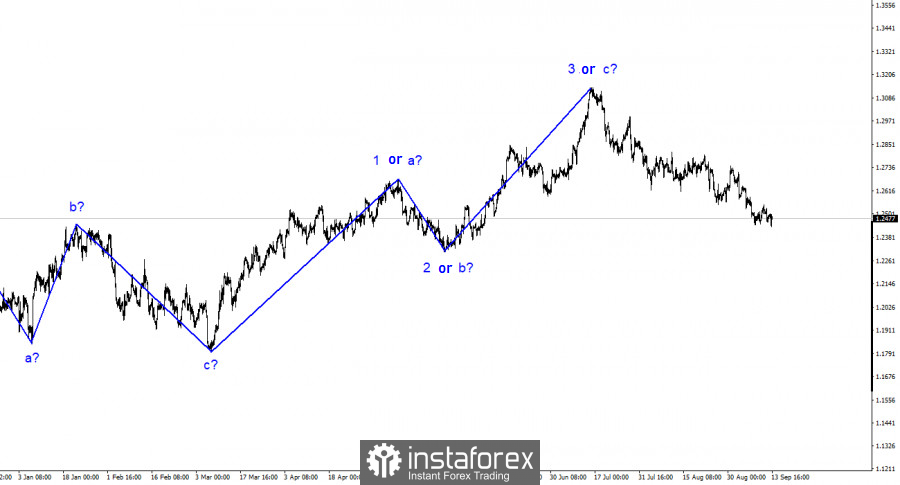

As for the GBP/USD pair, the wave analysis remains relatively straightforward and clear. The construction of upward wave 3 or c is complete, and the theoretical building of a new downward trend segment, which could be wave d, has begun. Still, the probability of this is now close to zero. I see no reason for the British pound to resume its rise; however, the wave analysis has transformed into a more complex one. Wave 3 or c has taken on a more prolonged form than many analysts expected several months ago. The entire upward trend segment may still take on a five-wave structure if the market finds new reasons for long-term purchases. I don't see any such reasons at the moment.

The internal wave structure of the first wave of the new trend segment looks complex, and it is difficult to identify five waves within it. However, five waves can be seen for the euro, while the British pound has already made two unsuccessful attempts to break through the 1.2444 level, equivalent to 100.0% according to Fibonacci. This rebound could indicate the completion of wave 1 or a. If this assumption is correct, both pairs will build a corrective wave 2 or b later this week.

The British pound did not receive support from the news background on Wednesday.

The GBP/USD pair's exchange rate increased by ten basis points on Wednesday. The day has not ended yet, so the pound may be slightly above the current levels in a few hours. A few hours ago, a report on inflation in the United States was released, which is undoubtedly more important than British and European statistics for Wednesday. However, in this review, I will analyze the British reports available in the morning.

In July, GDP declined by 0.5% m/m. The market expected to see another decrease in the indicator, but not a significant one. Industrial production decreased by 0.7%, which is worse than market expectations. Manufacturing declined by 0.8%, which is also worse than expected. Therefore, all three reports were weaker than market forecasts, and the pound rightfully fell back to the 1.2444 level this morning. However, the attempt to break this level was weak and uncertain, so it failed. This level is currently key for both pairs. The pound and the euro continue to move very similarly; therefore, as long as this level does not stay above, there is a 90% probability that neither the euro nor the pound will continue to decline. Tomorrow, the ECB meeting will have a greater impact on the euro, and the divergence in movements between it and the pound may be noticeable. But then everything will return to its place, and the movements will once again be very similar.

General Conclusions:

The wave picture of the GBP/USD pair suggests a decline within the framework of the downward trend segment. There is a risk of completing the current downward wave if it is d, not 1. In this case, the building of wave 5 may start from the current levels. However, we are currently witnessing the construction of the first wave of the new segment. The maximum buyers can expect is wave 2 or b construction. The unsuccessful attempt to break through the 1.2444 level, which corresponds to 100.0% according to Fibonacci, may indicate the market's readiness to build an upward wave.

The picture is similar to the EUR/USD pair on a larger wave scale, but there are still some differences. The downward correctional segment of the trend is complete, and the construction of a new upward one continues, which may already be complete or take on a full-fledged five-wave structure.