The fate of today's decision by the ECB leaders on interest rates is practically decided: they will remain at the same level of 4.25% and 3.75%, respectively. The greater interest here will be represented by the ECB press conference. If its head, Christine Lagarde, sends "hawkish" signals, the euro may sharply strengthen. A soft tone in her statements and hints at a halt or a reversal in the ECB's monetary policy direction will have a negative impact on the euro. In this case, we need to prepare for further, deeper weakness of the euro and a decline in the EUR/USD pair.

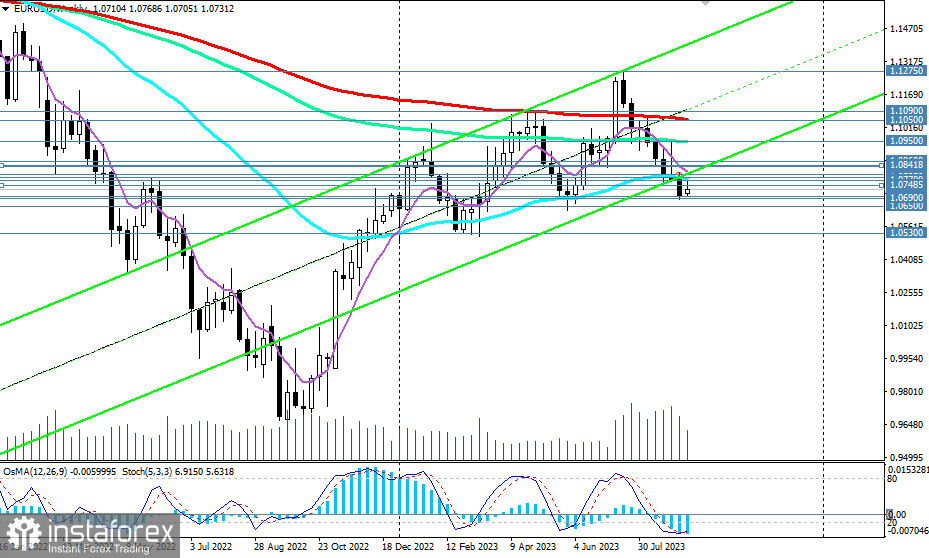

In this scenario, a break of local support levels at 1.0700 and 1.0690 will confirm this assumption, sending the pair towards March lows near the 1.0500 mark. The earliest signal for this could be a break of the local support at today's low of 1.0725.

In general, EUR/USD is moving within the realm of medium-term and long-term bearish markets, respectively, below key resistance levels at 1.0800 (200 EMA on the daily chart) and 1.1050 (200 EMA on the weekly chart), making short positions preferable.

In an alternative scenario, after breaking the resistance level of 1.0800, EUR/USD will return to the medium-term bullish market area and continue to rise within the upward channel on the weekly chart with intermediate targets at important long-term resistance levels of 1.1050 and 1.1090 (50 EMA on the monthly chart).

Their breakout, in turn, will confirm the resumption of the long-term upward trend with immediate targets near the resistance levels of 1.1275 (local resistance level), 1.1300 (upper line of the upward channel on the weekly chart), and further levels near the 1.1600 resistance level (200 EMA on the monthly chart).

The first signal to implement this scenario could be a break of the important short-term resistance level at 1.0748 (200 EMA on the 1-hour chart).

A rise above the 1.1600 mark will indicate a return of EUR/USD to the global bullish market area.

Support levels: 1.0725, 1.0700, 1.0690, 1.0650, 1.0600, 1.0530, 1.0500

Resistance levels: 1.0748, 1.0770, 1.0785, 1.0800, 1.0835, 1.0842, 1.0860, 1.0900, 1.0950, 1.1000, 1.1050, 1.1090, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600