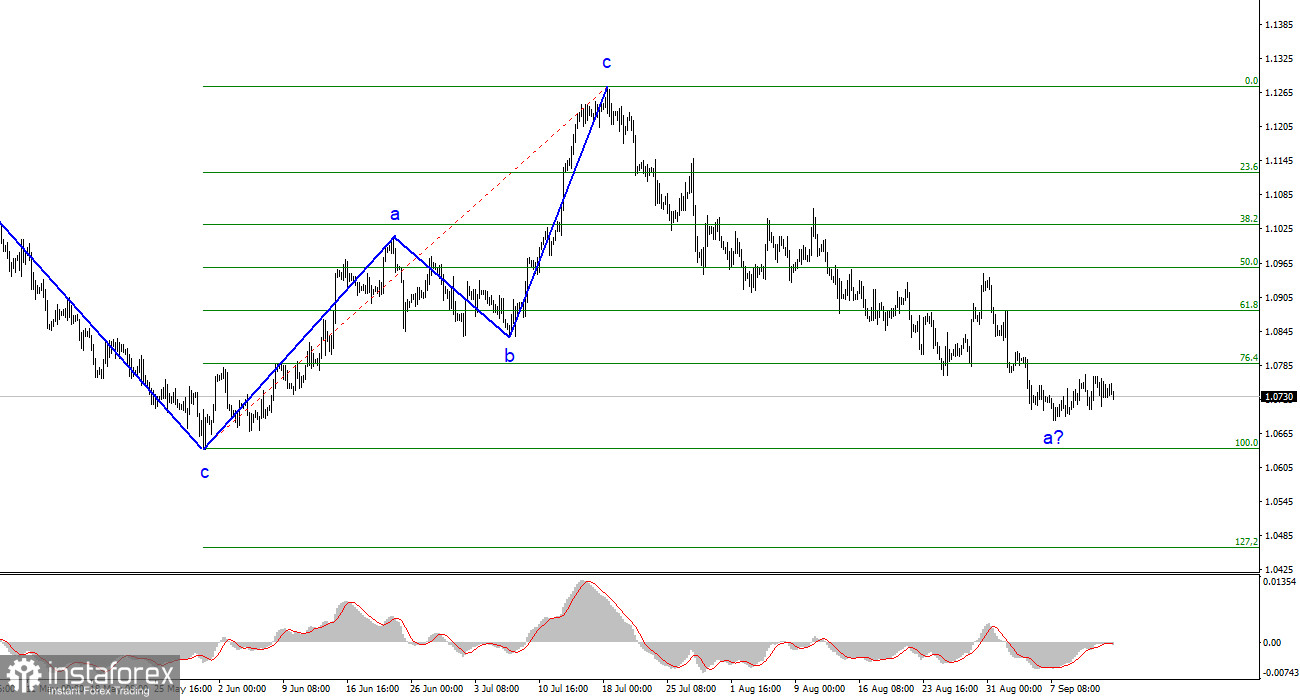

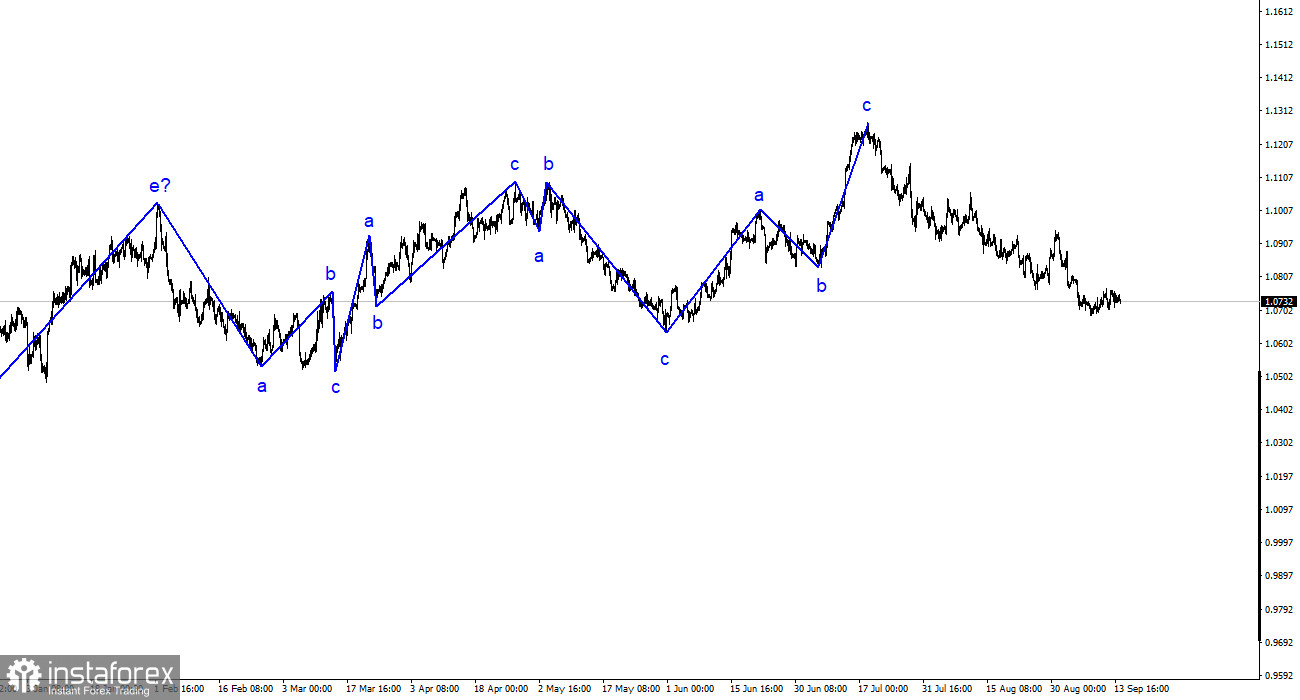

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The entire upward trend segment, which began its formation last year, has taken on a complex structure, and in the past year, we have seen only three wave structures alternating. Recently, I have consistently mentioned that I expect the pair to approach the 5th figure, where the construction of the last upward three-wave structure began. I still stand by my words. Another upward three-wave structure has been completed, so the market continues to build a downward trend segment.

The recent increase in quotes looks like a partial-fledged wave 2 or b. We saw a similar wave from August 3rd to 10th. Most likely, this is an internal corrective wave in 1 or a. If this is the case, the decline in quotes may continue for some time within the framework of the first wave of the downward trend segment. And this drop in the European currency will not be over because the construction of the third wave is still needed. Five internal waves can already be traced within the first wave, so its completion is approaching.

The ECB did everything it could.

The euro/dollar pair's exchange rate dropped by 50 basis points on Thursday. Everything would have been fine if there had not been a meeting of the European Central Bank today. There was no unanimous opinion in the market regarding the interest rate. About 50/50 were divided on whether the interest rate would be raised. As it turned out a few hours ago, those who advocated for a new tightening of monetary policy won. The ECB raised all three rates by 25 basis points each and did not take a pause. And demand for the euro dropped instantly, even without waiting for Christine Lagarde's speech. Why did this happen?

It is impossible to give a definite answer to this question. We have the first wave of a new downward trend segment, and there are no convincing signs of its completion. Until today, the pair has been trying for several days to move away from the previously reached lows, but it has hardly succeeded. Therefore, even half an hour before the ECB meeting results were announced, it was impossible to conclude that the construction of wave 2 or b had begun.

Since the market expects the ECB to tighten policy in any case this year, it doesn't matter when it happens. Therefore, today's interest rate hike could have led to increased demand for the euro, but it did not happen, and this is a perfectly reasonable market reaction. Market participants have already played out a full tightening cycle, so there is no reason to increase demand for the euro now. This explanation is the most convincing.

General conclusions.

Based on the analysis, the construction of the upward wave set is complete. I still consider targets for the downward trend segment in the range of 1.0500-1.0600 to be quite realistic. Therefore, I recommend selling the pair with targets near 1.0636 and 1.0483. An unsuccessful attempt to break the 1.0636 level, which corresponds to 100.0% according to Fibonacci, will indicate a possible completion of the first wave, which has taken on a rather extended form.

On the higher wave scale, the wave labeling of the upward trend segment has taken on an extended form but is likely completed. We have seen five upward waves, most likely the structure a-b-c-d-e. Furthermore, the pair has built four three-wave structures: two downward and two upward. It has likely entered the stage of constructing another downward three-wave structure.