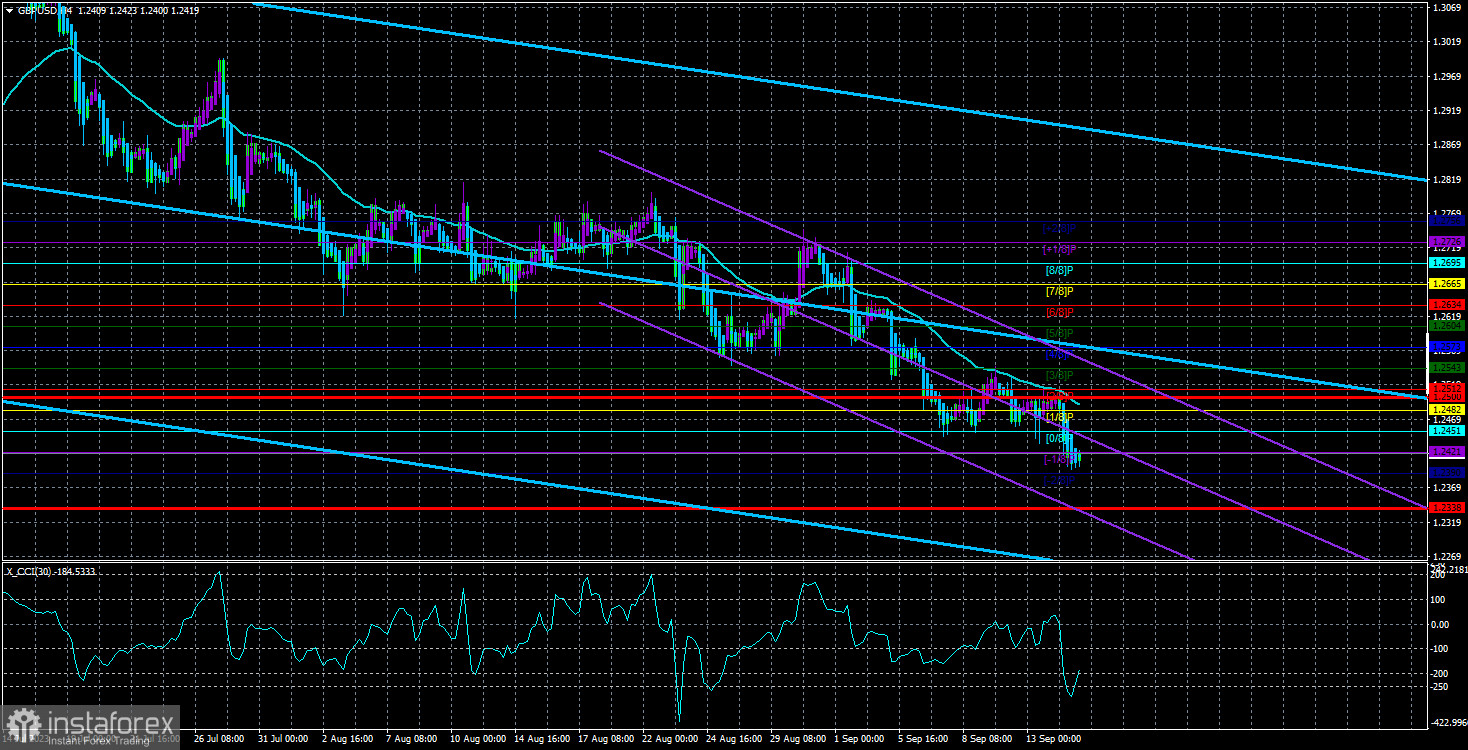

The GBP/USD currency pair fell along with the euro on Thursday, but the ECB meeting had no relevance to the British pound. Nevertheless, the market didn't delve into this matter and started buying dollars, anticipating the impending end of the tightening cycle in the European Union. Now, the technical picture of the British pound is becoming interesting. The decline has been ongoing for almost two months, corrections have been relatively weak, and the CCI indicator has again entered the oversold zone, which, as a reminder, is a strong buying signal.

Therefore, our previous forecast remains valid. A correction should occur soon (possibly next week when new triggers emerge), but in the medium term, there is only one way for the pound: down. How can we not again recall that the British currency had been appreciating for almost a year? The Bank of England had been raising the key rate, but so had the Fed. So why was the dollar falling while the pound was rising? Because the market had already priced in all the Fed's rate hikes in advance. If you remember, inflation started to decline first in the United States, which was a signal for selling the dollar since the market realized that the hawkish sentiment in the US would now weaken. It realized this too early, but until September of last year, the dollar also rose for a long time.

And now the market understands that the end of the tightening cycle in the United Kingdom is also not far off. Therefore, there is no reason to buy the British pound. The British currency remains overbought and excessively expensive. If the pound had been falling logically and consistently since 2016 due to Brexit and its economic problems, what was the basis for its rise in the last year? Thus, the year-long fairy tale for the pound is ending. Of course, if a recession begins in the United States in 2024 or the Fed starts lowering the interest rate, there will be new reasons to eliminate the dollar. However, at the moment, there is no basis for this.

The Bank of England cannot support the pound.

Yesterday's ECB meeting showed us what to expect next week from the Bank of England and the pound. There still needs to be more information from the British regulator. There were no clear signals about whether they are ready to pause or end the tightening cycle, but, for example, Hugh Pill (Chief Economist of the BoE) stated that he supports keeping the rate high for an extended period rather than further tightening. Since the market had plenty of time to anticipate all the rate hikes, it will not lead to a trend reversal even if the BoE raises the rate again next week.

So, from a fundamental point of view, everything remains as it was. The Bank of England may raise the rate one or two more times, and the pound may temporarily rise, but it will continue to fall in the medium term. In the 24-hour timeframe, the GBP/USD pair is approaching the Fibonacci level of 50.0%, which could be a starting point for an upward correction. However, traders should note that the two-month downward movement is a correction. Only a breakthrough of the 1.2300 level would indicate a new downward trend. Therefore, despite the pound's 700-point drop, an upward trend could still resume. However, the pound must drop to at least the 1.18 level for this to happen.

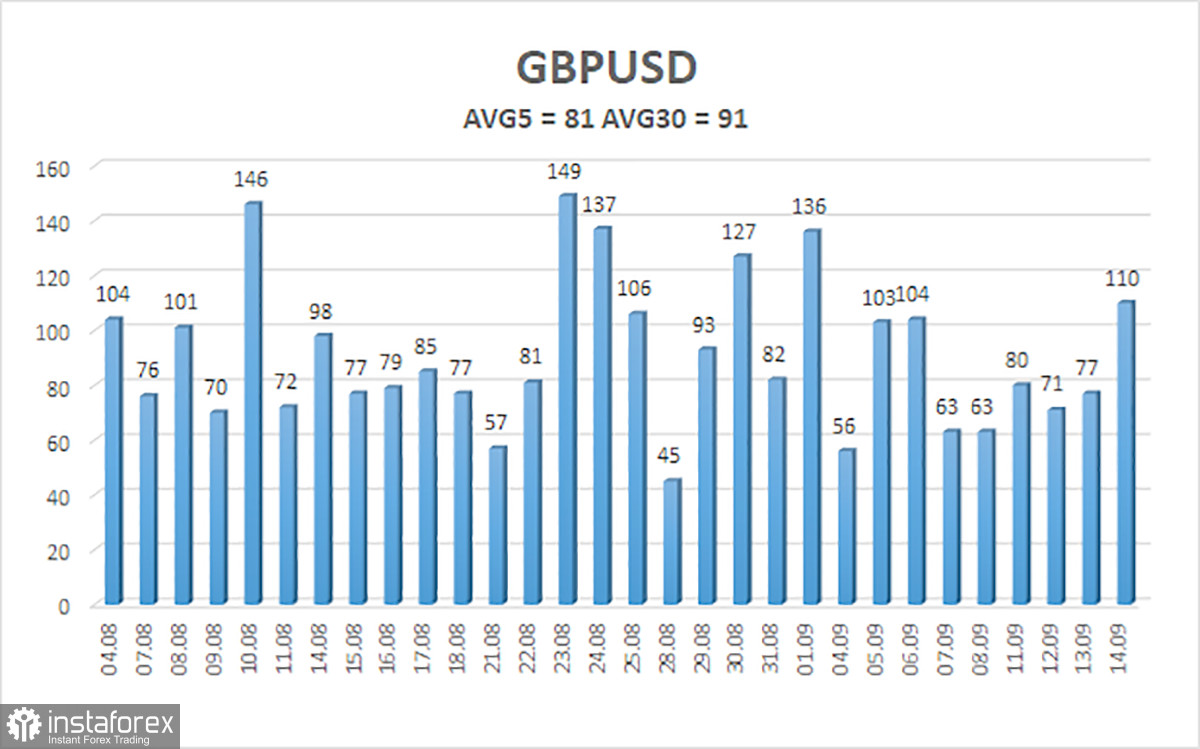

The average volatility of the GBP/USD pair for the past five trading days, as of September 15, is 71 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, September 15, we expect movement within the range delimited by the levels of 1.2338 and 1.2500. A reversal of the Heiken Ashi indicator upwards will signal a new upward correction phase.

Nearest support levels:

S1 - 1.2421

S2 - 1.2390

The nearest resistance levels:

R1 - 1.2451

R2 - 1.2482

R3 - 1.2512

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to hover near its local lows and regularly updates them. Therefore, at the moment, it is advisable to stay in short positions with targets at 1.2390 and 1.2338 until the price consolidates above the moving average. Consideration of long positions can be postponed until the price consolidates above the moving average line, with targets at 1.2573 and 1.2604.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will move over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates that a trend reversal in the opposite direction is approaching.