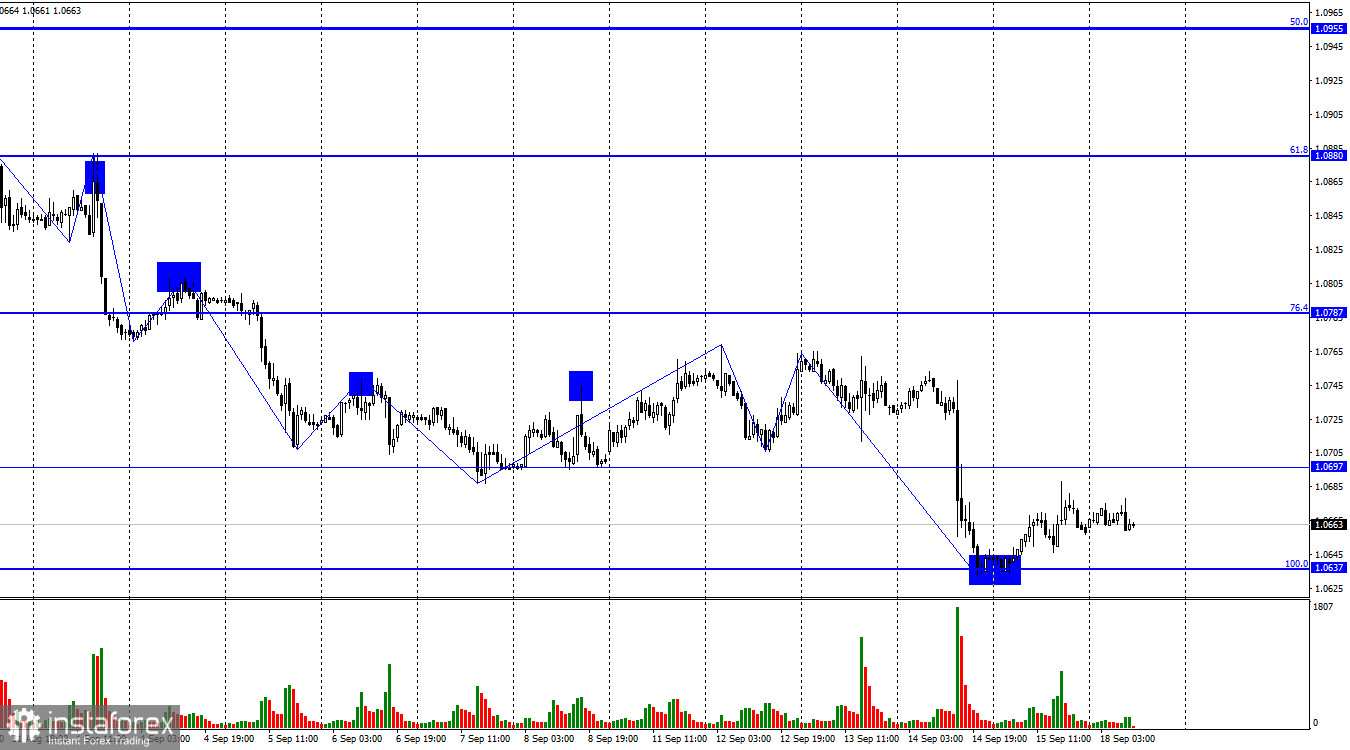

On Friday, the EUR/USD pair rebounded from the corrective level of 100.0% (1.0637), reversed in favor of the European currency, and rose toward 1.0697. A rebound of the pair's rate from this level will favor the US dollar and a return of quotes to the level of 1.0637. A consolidation below the level of 1.0637 increases the likelihood of further decline towards the next level at 1.0533. The market's bearish sentiment persists, which is evident even without waves.

However, the waves also indicate a bearish trend. The last downward wave easily broke through the two previous lows, and the upward wave on Friday looks rather feeble. We now need a price move above last week's peak or a new downward wave that does not break Friday's low. Only in this case will there be one or two signs of the end of the bearish trend. Without this, one should expect a close below 1.0637 and a further euro decline.

On Friday, the news background was quite weak. I want to discuss something other than the US industrial production report in this article (after last week's ECB meeting). It's better to pay attention to the words of Luis de Guindos and Bostjan Vasle on Friday. De Guindos stated that the current interest rate level will be maintained for a long enough time for inflation to return to 2%. His colleague Bostjan Vasle, on the other hand, believes that it is impossible to completely rule out a rate hike in the future because economic data will determine the impact on inflation. If the data deteriorates, it could compel the ECB to take further tightening measures.

Vasle also stated that the APP bond and securities purchase program could be reduced in size because the current interest rate level is high enough to have the desired impact on the economy.

On the 4-hour chart, the pair has dropped to the 100.0% Fibonacci level and continues to trade within the descending trend corridor. Therefore, a rebound from the level of 1.0639 would allow for some growth, but I advise against counting on a significant strengthening of the euro until the price is firmly above the trend corridor. A close below 1.0639 increases the chances of further decline towards the corrective level of 127.2% (1.0466). There are no noticeable divergences with any indicators today.

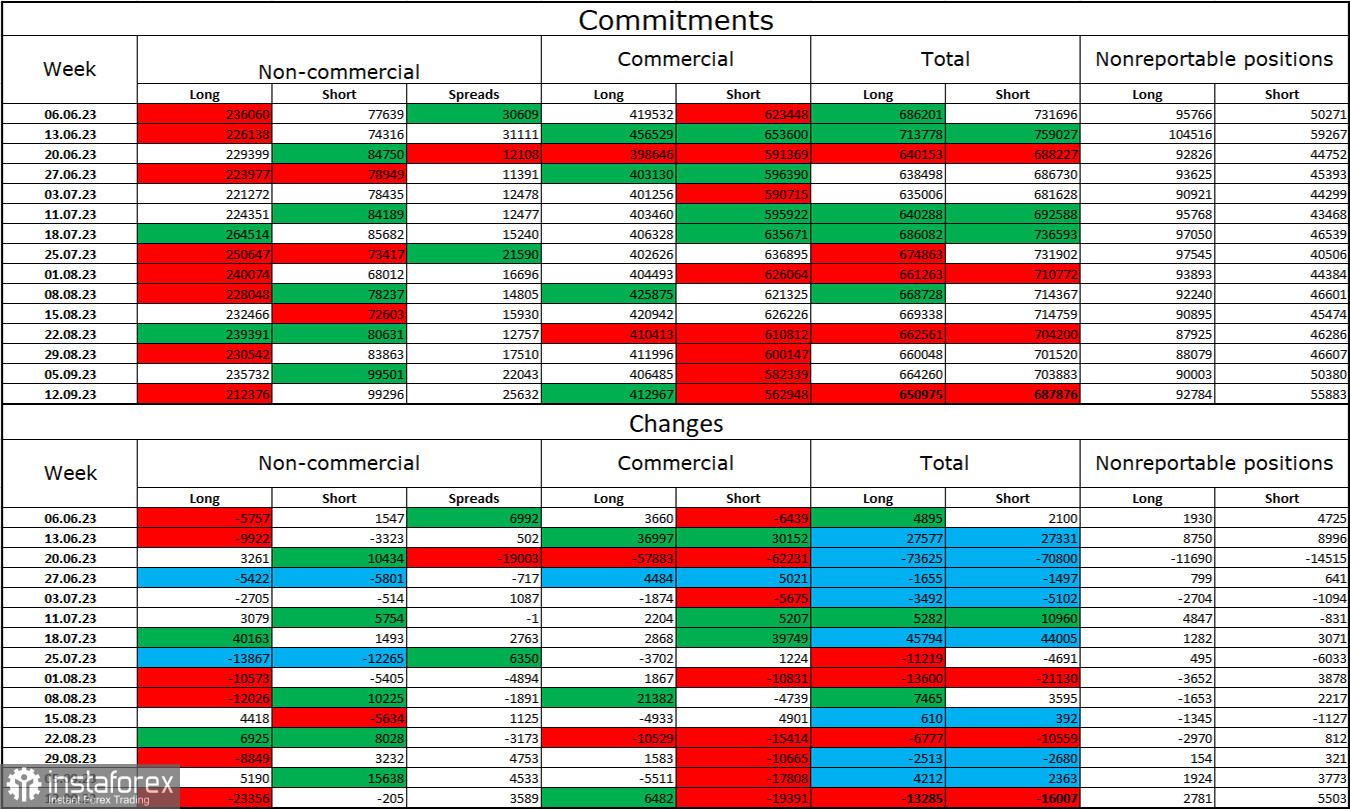

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 23,356 long and 205 short contracts. The sentiment of large traders remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now stands at 212,000, while short contracts amount to 99,000. The situation will continue to shift towards the bears over time. Bulls have dominated the market for too long, and now they need a strong news background to maintain this pressure. Such a background needs to be improved. The high value of open long contracts indicates that professional traders may continue to close them soon. The current figures allow for continuing the euro's decline in the coming weeks. The ECB is increasingly signaling the completion of the tightening of monetary policy.

News Calendar for the US and the European Union:

On September 18th, the economic events calendar contained no significant entries. The impact of the news background on traders' sentiment will be absent today.

Forecast for EUR/USD and trader recommendations:

New pair sales are possible today if it closes below the level of 1.0637 on the hourly chart, targeting 1.0533. Or on a rebound from the level of 1.0697 with a target of 1.0637. Buying was possible on a rebound from the level of 1.0637, with targets at 1.0697 and 1.0760.