The EUR/USD pair continued its upward movement on Monday after rebounding from the corrective level of 100.0% (1.0637), heading towards 1.0697. The price reached this level this morning. A rebound from this level will indicate a reversal in favor of the US dollar and a return to the 100.0% Fibonacci level. Meanwhile, a close above 1.0697 will favor further growth towards the next corrective level at 76.4% (1.0787). However, I see the level of 1.0765 (the peak of the two previous waves) as a more realistic target.

The waves still indicate a "bearish" trend. Yesterday, I noted that for signs of the end of the "bearish" trend, prices should rise to 1.0765 and above. With the current market activity, this will take a few more days. Alternatively, the new downward wave should refrain from breaking through the level of 1.0637. However, with the current trader activity, we must wait a few days for a new downward wave. Therefore, as long as the information background does not intensify, I do not expect changes in the waves and market sentiment. The background information can only intensify tomorrow evening.

Today, the consumer price index for the Eurozone will be released in its final estimate, but I expect little from this indicator. Inflation will likely remain at 5.3% y/y, as in the initial estimate. Moreover, some members of the ECB Governing Council have already decided on future interest rates, so inflation is no longer an important report. On Friday, Luis de Guindos stated that the rate would remain at its peak value for a long time, and today, the same was said by Villeroy de Galhau, the President of the French Central Bank. De Galhau noted that the current rate level is sufficient to bring inflation back to 2%, so no additional tightening is required. All of this is not the best news for the euro.

On the 4-hour chart, the pair has completed its decline to the 100.0% Fibonacci level and remains within the descending trend corridor. A rebound from the level of 1.0639 allowed for a slight increase, but I advise only counting on a significant strengthening of the euro once the price is firmly above the trend corridor. A close of the pair's rate below 1.0639 will increase the chances of further decline towards the corrective level of 127.2% (1.0466). There are no imminent divergences observed in any of the indicators today.

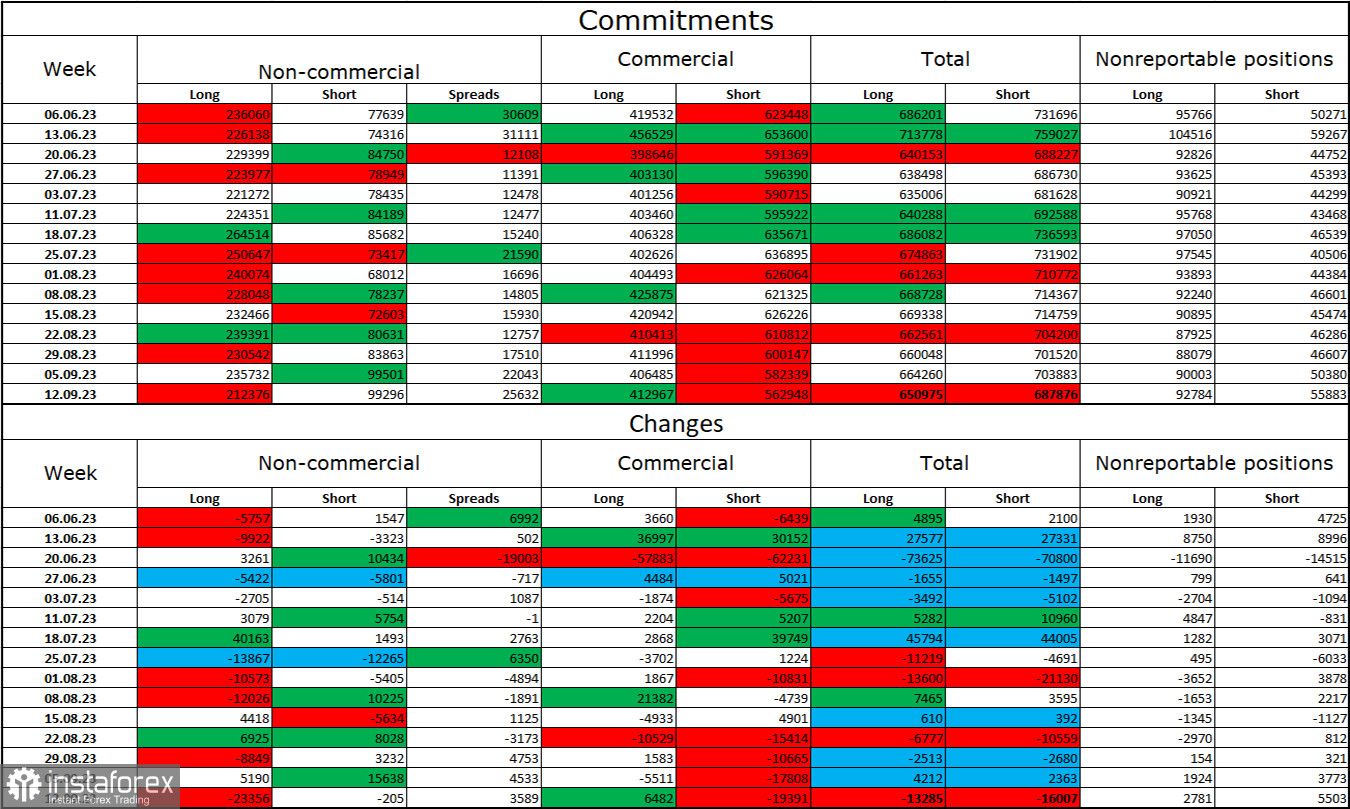

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 23,356 long and 205 short contracts. The sentiment of large traders remains bullish," but it has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators now stands at 212,000, while short contracts amount to 99,000. The situation will continue to shift toward the bears over time. The bulls have dominated the market for too long, and now they need strong news to maintain this pressure. Such news is absent. The high value of open long contracts indicates that professional traders may continue to close them soon. The current figures allow for continuing the euro's decline in the coming weeks. The ECB is increasingly signaling the end of the tightening procedure of the APP.

Economic Calendar for the US and the European Union:

European Union - Consumer Price Index (CPI) (09:00 UTC).

US - Building Permits (12:30 UTC).

On September 19, the economic calendar contains no significant entries. The impact of the information background on trader sentiment today will be weak.

Forecast for EUR/USD and trader advice:

New pair sales are possible today on a rebound from the level of 1.0697, with a target of 1.0637. Buying on the hourly chart was possible on a rebound from the 1.0637 level, with targets of 1.0697 and 1.0760. The first target has been reached. If it breaks, hold long positions with the next target.