The global economy will continue to slow down, but central banks should not rush to lower interest rates. This is the opinion expressed by the OECD, stating that the pace of global GDP growth will decrease from 3% in 2023 to 2.7% in 2024. Slower recovery in China and the consequences of the aggressive tightening of monetary policy by the Federal Reserve and other major central banks worldwide will hinder economic growth. This is not great news for a pro-cyclical currency like the euro.

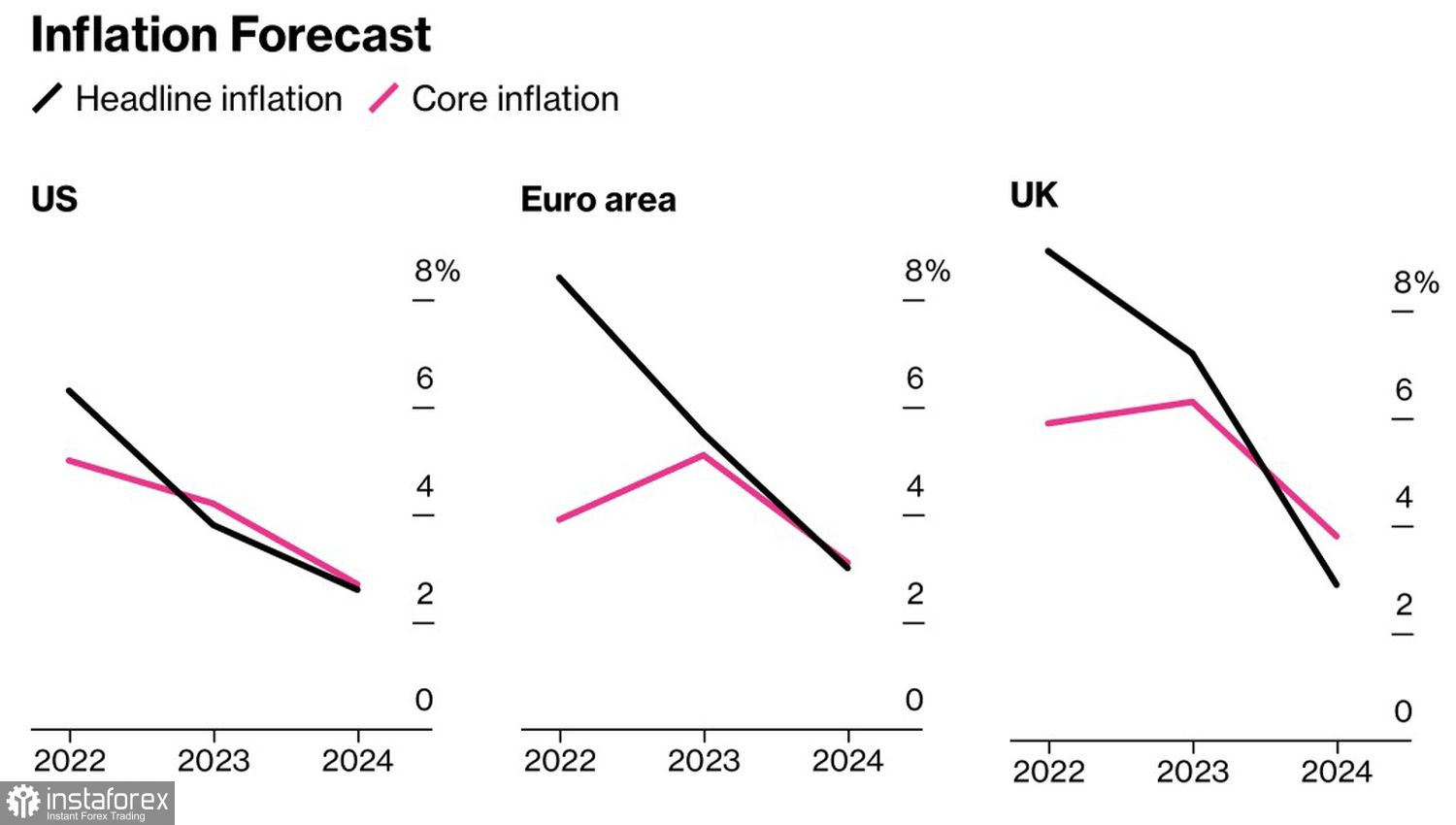

The Organization for Economic Co-operation and Development (OECD) does not expect inflation in the USA, the eurozone, and the UK to return to the 2% target before 2025. Hence, the recommendation not to rush with easing monetary policy. The main goal is to bring interest rates to the required levels and maintain them there for as long as possible.

OECD inflation forecasts

Bank of France Governor Francois Villeroy de Galhau holds a similar opinion. He believes that the eurozone has the right prescription. It needs to take medicine for an extended period to cure itself of high inflation. Apparently, the official is comfortable with the current deposit rate of 4%. ECB Vice President Luis de Guindos shares the same sentiment and is confident that "the worst is already behind us," and consumer prices will continue to slow down.

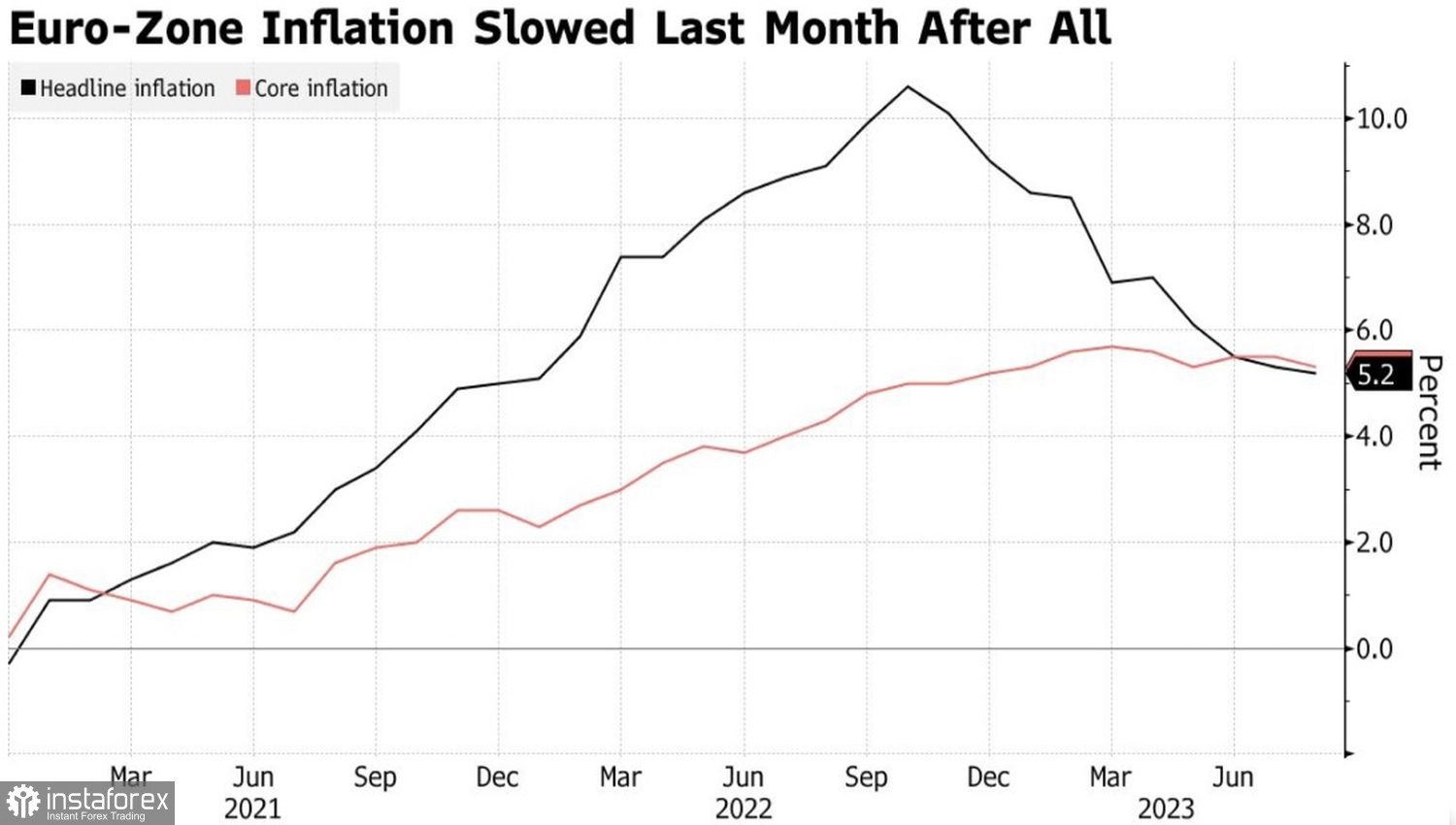

Indeed, final inflation estimates for August showed that the CPI growth rate decreased not to 5.3% but to 5.2%, with core inflation at 5.3%. The deviation was insignificant and had no significant effect on the market.

Dynamics of European inflation

However, Reuters reports suggest that the ECB intends to start tackling excess liquidity in the near future. An excessively bloated balance has smoothed the process of tightening monetary policy, making it less effective. Therefore, at least six sources have informed Reuters that the European Central Bank will take action in October to rectify the situation. The main measures under consideration include accelerated asset sales as part of the Quantitative Tightening (QT) program, changes in the volumes of reserves held by commercial banks at the ECB, and a new scheme for managing short-term interest rates.

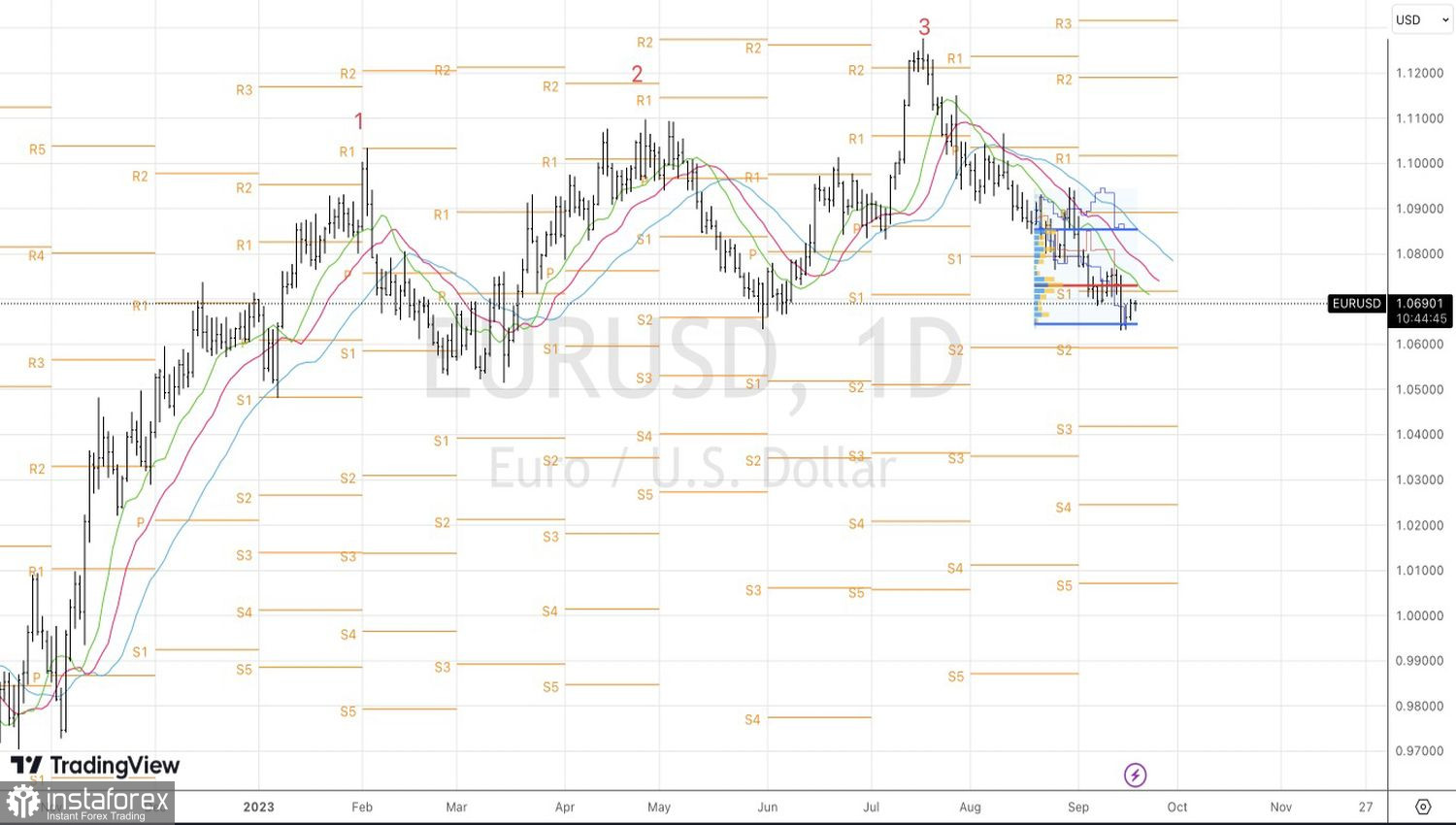

These measures should be seen as a "bullish" factor for EUR/USD. News of their imminent implementation allowed the main currency pair to find its footing. The "bulls" counterattacked but did so at an inopportune moment. Investors prefer to adopt a wait-and-see stance ahead of the Fed's verdict. Some doubt the central bank will leave the federal funds rate at 5.5%. Still, everyone is concerned about the updated forecasts from the FOMC and Jerome Powell's speech.

If the market is confident that the Federal Reserve will maintain its assessment of the expected peak borrowing cost at 5.75%, no one knows what it envisions for the rate a year from now.

Technically, the "bulls" for EUR/USD are trying to play out an inside bar on the daily chart. The buying strategy from 1.0685 proved correct, but the rejection from levels 1.072 and 1.0735 could lead to increased selling pressure.