Analysts do not expect any more rate hikes from the European Central Bank in 2023, but they anticipate monetary policy easing in 2024. The past few days (starting from last Thursday) unexpectedly became entirely dedicated to the ECB and its interest rates. The ECB meeting unexpectedly received an informative development in the next few days. In particular, comments were made by Luis de Guindos, Peter Kazimir, Bostjan Vasle, Francois Villeroy de Galhau, and Madis Muller. Such an abundance of comments related to inflation and interest rate situations could have triggered a significant market reaction. However, this did not happen, but now we have a clear and distinct understanding of what to expect from the ECB for the remainder of the year.

There is nothing more to expect from it in terms of interest rate changes. Muller, de Guindos, and Villeroy openly stated that they no longer expect rate hikes in the current cycle. Vasle and Kazimir mentioned the highly likely conclusion of tightening in September but left room for another rate hike "if necessary". Recall that before the September meeting, there were rumors about a pause in tightening, all based on the same statements by ECB officials. There was no pause, but it is highly likely that the tightening cycle has concluded. Based on this, I see no reason for the euro to rally in the coming weeks. A corrective wave is possible, but once it ends, the euro should resume its downward movement, and it may continue for a long time.

In the coming months, the key theme in the currency market will change. If in the past year, it was the theme of "Central Banks Raising Interest Rates," by the end of 2023, it will be the theme of "Timelines for the Start of Central Banks' Monetary Policy Easing." It is widely expected that the Federal Reserve will be the first to start discussing the need to lower rates, as inflation in the United States is the lowest. However, over the past two months, it has been accelerating, so the timing for the start of the Fed's policy easing may be pushed well into 2024.

Majority of analysts surveyed by Reuters expect a rate cut from the ECB this year. Despite the fact that interest rates in the European Union are lower than in the United States and inflation is higher, most expect that in the third quarter of 2024, we may see the first rate cut from the ECB. Therefore, the start of the easing process in the US and the EU could almost coincide. This is a quite distant perspective, so it's better to focus on events in 2023. By the end of this year, there is now a higher probability of an FOMC rate hike than the ECB, which may continue to support the dollar.

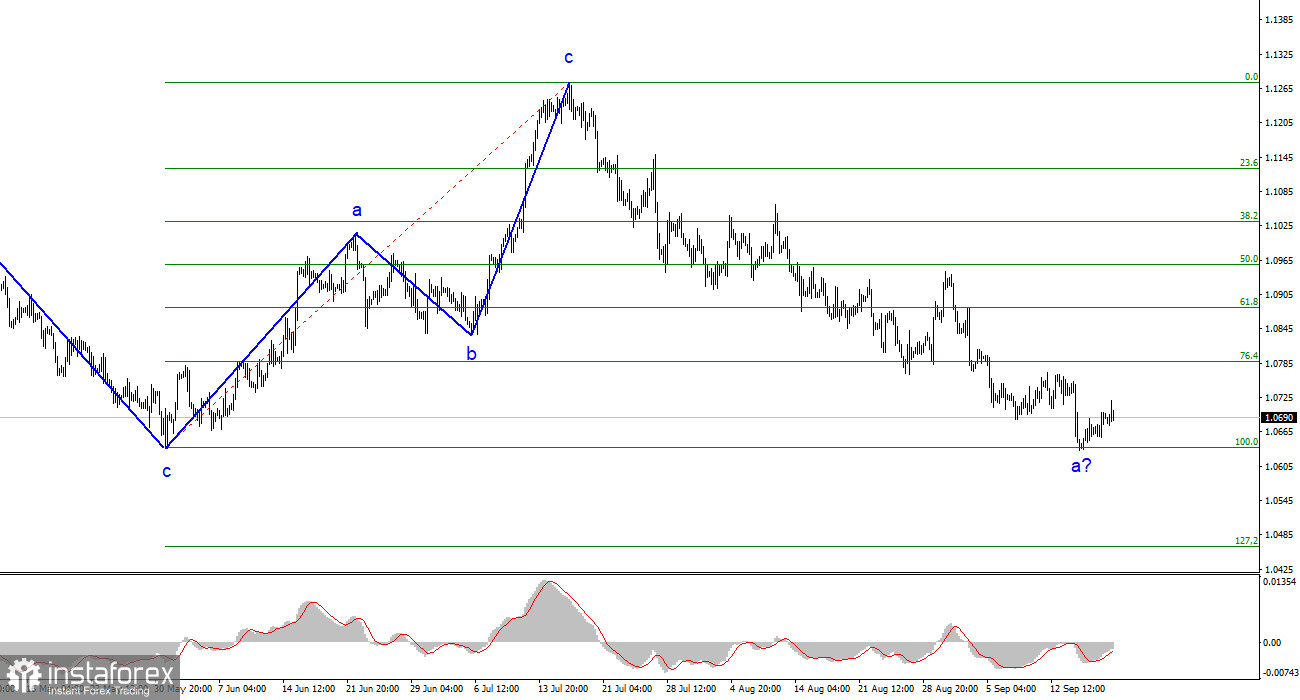

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range for the downtrend are quite feasible. Therefore, I will continue to sell the instrument. Failure to break the 1.0636 level suggests the possible end of the first wave, which took on quite an extended form. So far, the presumed wave 2 or b looks highly unconvincing.

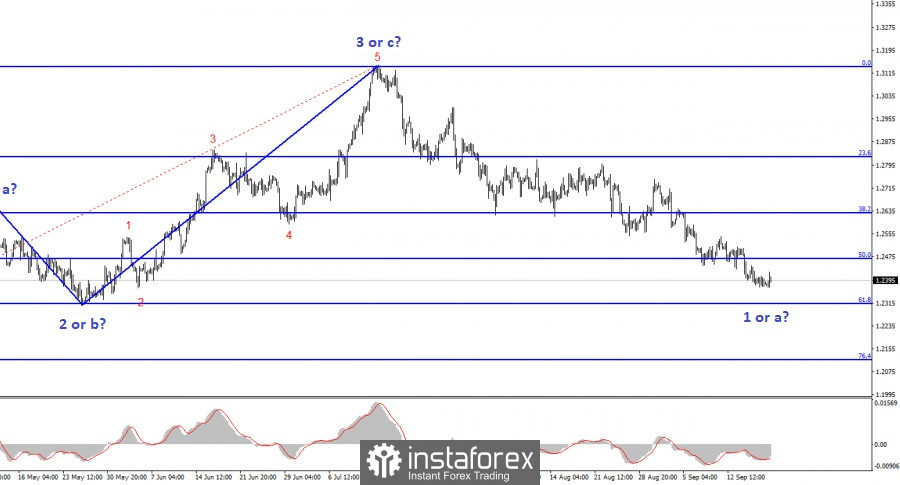

The wave pattern of the GBP/USD pair suggests a decline within the downtrend. There is a risk of completing the current downward wave if it is d, and not wave 1, but in my opinion, we are currently witnessing the construction of the first wave of a new downtrend. Therefore, the most that we can expect in the near future is the construction of wave "2" or "b". A successful attempt to break the 1.2444 level, corresponding to 100.0% on the Fibonacci scale, may indicate the market's readiness to extend the decline, so I still recommend staying in short positions with targets around 1.2311, which is equivalent to 61.8% according to Fibonacci.