US stock futures opened in the green, extending their gains from yesterday. This rally is fueled by hopes that the Federal Reserve will remain cautious and not further tighten interest rates, allowing the economy to dodge a recession next year—or at least delay it. At the moment, S&P 500 futures are up 0.2%, while the tech-heavy NASDAQ has climbed 0.3%. US Treasury yields fell after Tuesday saw five and 10-year bond rates hitting their highest since 2007.

European indices are also up. The pound weakened after an unexpected slowdown in UK inflation caught traders off-guard, as they braced for decisions from the Federal Reserve and the Bank of England. UK's Consumer Price Index in August rose by 6.7% year-over-year, its slowest pace in 18 months, against economists' prediction of a 7% increase. The previously almost certain quarter-point rate hike by the Bank of England this Thursday has now seen its odds drop to 50%. Consequently, the sterling dipped by a hefty 0.5% against the dollar. Traders are also growing wary of the Bank of England nearing its rate-hiking cycle. However, by the time of this report, the pound's decline had been fully offset. UK bonds surged, and the yield on two-year government bonds fell 12 basis points to 4.88%, the lowest since August 10. The UK's FTSE 250 jumped 1.5%. The European Stoxx 600 index also benefited from positive investor sentiment, gaining for the first time in three days.

Later today, the Federal Reserve will announce its interest rate decision. Borrowing costs are expected to remain unchanged. With recent inflation slowing down, it is likely the Fed will wait for more data before making a move. Still, many economists believe the door remains open for a potential rate hike in November. The long-term trajectory of interest rates is uncertain.

Brent crude has dropped below $94 a barrel after its recent surge, but prices are still nearing a 10-month high. However, analysts at Goldman Sachs Group Inc. have revised their oil price forecast to triple digits, driven by record global demand and ongoing OPEC+ supply constraints. The Wall Street bank has raised its 12-month Brent price outlook from $93 to $100 a barrel. The report indicates that most of the rally is already behind us.

Regarding the S&P 500, Bank of America Corp. has become the latest Wall Street strategist to raise its index target, after the sharp 2023 rally exceeded the bank's expectations. The new prediction is for the broader market indicator to finish the year at 4,600 points, up from the previous target of 4,300 points. This suggests an approximate 3.5% increase from its current level.

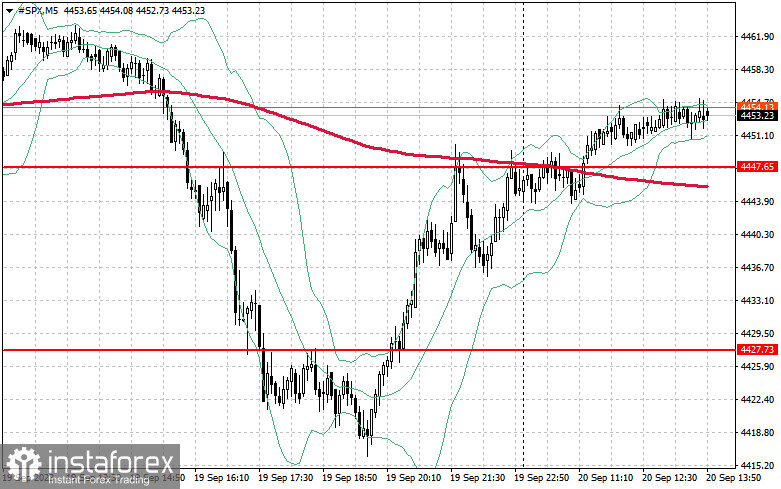

As for the technical picture of the S&P 500, the demand for the index has increased slightly, but it is too early to say anything about the further prospects. Bulls need to take control of $4,469. Settling above this level, they can push the price above $4,488. Bulls also should take control of $4,515, strengthening the bull market. In case of a bearish move on the back of diminishing risk appetite, bulls will have to protect $4,447. Breaking through this level, the trading instrument may return to $4,427 and $4,405.