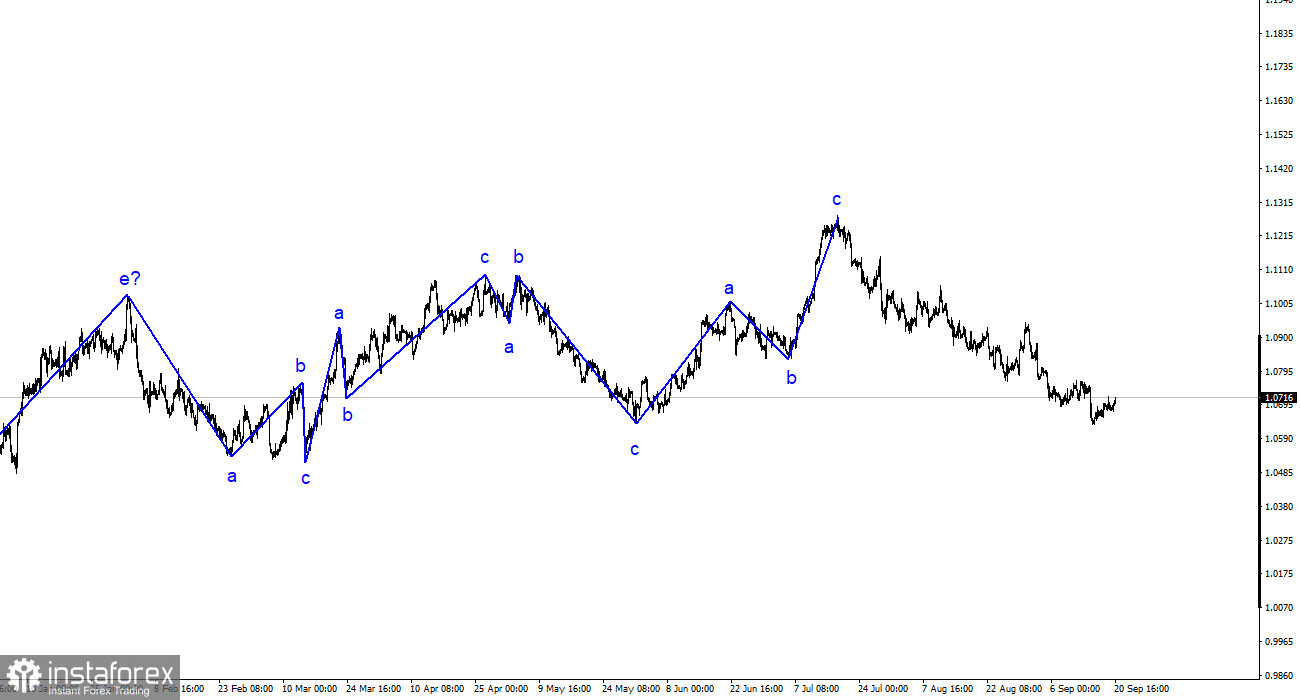

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to approach the 5th figure, where the construction of the last upward three-wave structure began. The pair has yet to reach the 5th figure, but it has come very close to the 6th. Another ascending three-wave structure is completed, so the market continues to build a downward trend.

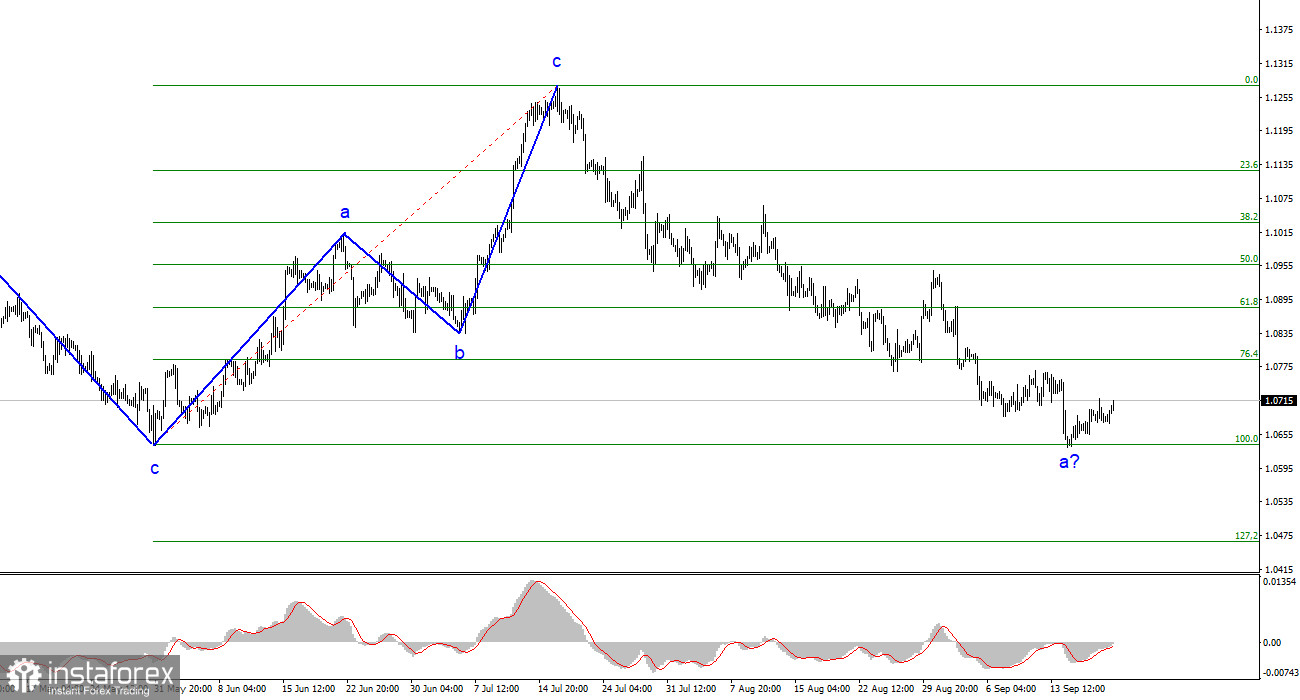

The recent increase in quotes does not resemble a full-fledged wave 2 or b. We saw a similar wave on August 3-10. Most likely, this is an internal corrective wave 1 or a. If this is the case, the decline in quotes may continue for some time within the framework of the first wave of the descending trend. And this may not be the end of the decline in the European currency, as the construction of the third wave is still needed. Five internal waves are already visible within the first wave, so its completion is approaching. An unsuccessful attempt to break through the level of 1.0637, which is equivalent to 100.0% according to Fibonacci, may indicate the readiness to build a corrective wave.

The Fed will not raise rates but leave the "door open."

On Wednesday, the euro/dollar pair's exchange rate increased by 35 basis points. It can be stated that the American currency is weakening in anticipation of the announcement of the FOMC meeting results, as well as the publication of economic forecasts and a press conference with Jerome Powell. However, the movement of 35 points should not be considered for now. The pair has been on the rise for three days but has covered a very short distance during this time. Undoubtedly, the US dollar may decline even more this evening, but its decline before the meeting suggests it may strengthen after this event.

As for the interest rate, the question can be considered closed. Several hours before the results are announced, analysts and economists do not expect the regulator to raise the rate. This fully corresponds to the plans of the regulator itself, which intends to raise the rate at most once every two meetings until the end of the year. However, it turns out that the process of tightening the Fed's monetary policy is still ongoing, and in September, the regulator will take a second pause. The "hawkish" sentiment will remain, with the Fed's rate higher than the Bank of England's rate and, especially, the ECB's rate. Based on all this, I see excellent prospects for the US currency – demand for it may remain high. I still expect the construction of a corrective wave, but this wave will not affect the market's bearish sentiment.

General Conclusions:

Based on the analysis conducted, the construction of the upward set of waves is complete. The descending trend targets around 1.0500-1.0600, which is very realistic. Therefore, I continue to recommend selling the pair. An unsuccessful attempt to break through the level of 1.0636 indicates a possible completion of the construction of the first wave, which has taken quite an extensive form. For now, the presumed wave 2 or b looks very unconvincing but may continue its construction (if it is indeed the case).

On a larger wave scale, the wave labeling of the ascending trend has taken an extensive form but is likely complete. We have seen five upward waves, which are likely to be a-b-c-d-e structure. Next, the pair formed four three-wave structures: two down and two up. It has probably transitioned to the stage of building another descending three-wave structure.