While there were prerequisites for another interest rate hike due to ongoing inflationary pressures, the Federal Open Market Committee decided to leave rates unchanged. Overall, this was the most expected development, and the market focused on Fed Chair Jerome Powell's subsequent remarks. Powell did not disappoint, reaffirming the intention to continue tightening the parameters of the monetary policy. However, he made a caveat that the Bank has nearly reached the peak of interest rates. In addition, he expressed satisfaction with the latest report from the U.S. Department of Labor, which incidentally showed an increase in the unemployment rate. This means that the U.S. central bank is seriously concerned about labor market overheating, and a slight deterioration in the data reduces the associated risks. But these are just the initial signs of an improving economic situation, and it is too early to talk about a pivot in monetary policy. So interest rates will continue to rise, but possibly not as slowly and perhaps not as significantly. The dollar edged up solely for this reason.

As for the UK inflation data, it had almost no impact on the market, except for a brief spike in volatility that didn't lead to anything. However, the unexpected slowdown in the consumer price growth rate from 6.8% to 6.7%, despite forecasts of an increase to 7.1%, adds some intrigue to today's Bank of England meeting. It's quite possible that the British central bank may refrain from the planned increase in the rate from 5.25% to 5.50%. They may not cancel it, but rather postpone it to the next meeting. However, this is unlikely. But if it does happen, the pound will certainly continue to lose its positions. If everything goes according to the previously planned schedule, then it all depends on the BoE's subsequent remarks. Any words indicating an intention to continue raising interest rates will strengthen the pound, and the British currency may even fully recover all its losses from yesterday. However, if the rhetoric turns out to be slightly more moderate, the pound may not rise, and instead it will weaken further.

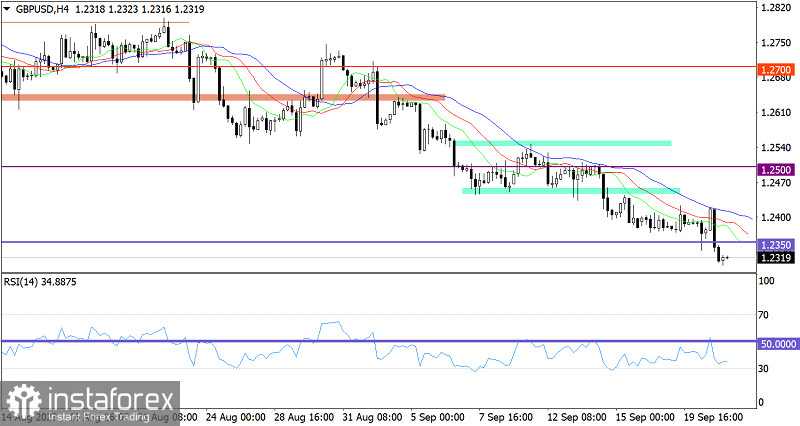

The GBP/USD pair extended its downward cycle due to the strong information-news flow. As a result, it breached the support level at 1.2350.

On the daily chart, the RSI technical indicator shows signs that the pound is oversold. In the intraday period, the indicator is moving in the lower area of 30/50, thus reflecting bearish sentiment among traders.

On the four-hour chart, the Alligator's MAs are headed downwards, corresponding to the main cycle's direction.

Outlook:

Speculators are placing the main emphasis on the upcoming results of the BoE meeting. Price movements will depend on the upcoming information. From a technical perspective, to extend the bearish scenario, the price must firmly settle below 1.2300. To trigger the bullish scenario, the price needs to return above 1.2350.

Complex indicator analysis suggests a bearish signal in the short-, mid- and long-term timeframes.