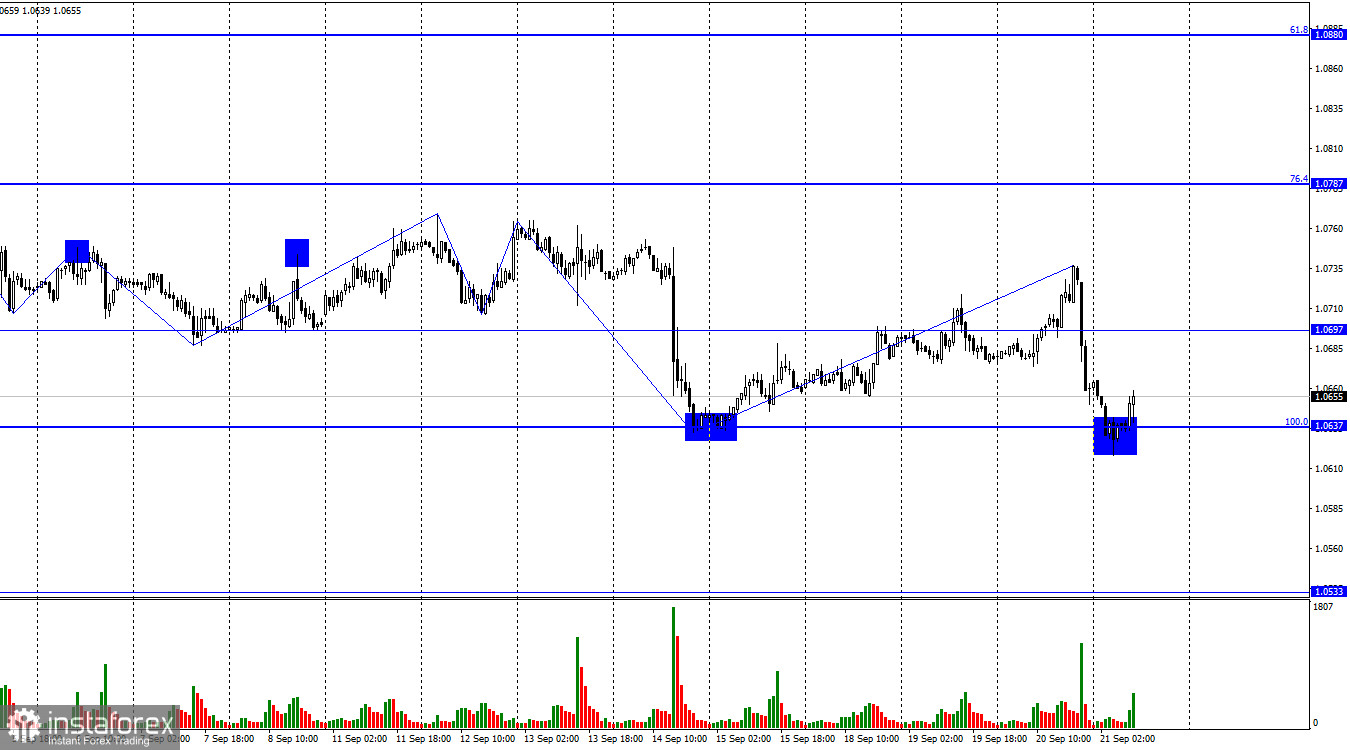

The EUR/USD pair continued its upward movement on Wednesday towards the corrective level of 76.4% (1.0787) but, quite predictably, did not reach it. Closer to the evening, the pair reversed in favor of the American currency and returned to the Fibonacci level of 100.0% (1.0637). The second rebound from this level has been achieved, allowing us to expect new growth towards the levels of 1.0735 and 1.0760. If the pair's rate is sustained below the level of 1.0637, the chances of further decline towards the next level of 1.0533 will increase.

After three days of the pair forming an upward wave, the situation has not changed. I warned that for a trend change to bullish, the pair needed to rise to the peaks of September 12th and convincingly surpass them. This did not happen, and yesterday, the pair fell to the low of September 14th and confidently broke through it. Thus, the bearish trend persists, and there are still no signs of completion. A pair's rise above 1.0735 is required to see these signs again.

Last night, FOMC announced the results of its meeting, which few expected to bring significant decisions or statements. The interest rate remained at 5.25-5.50%, and Jerome Powell assured that the "hawkish" monetary policy stance remains and will continue until inflation returns to 2%. If necessary, the rate will increase at the next meeting on November 1st or the last meeting in December 2023. Thus, FOMC once again did not finalize the issue of raising interest rates, which probably pleased the EUR/USD pair's bears, who are buyers of the American currency. I do not share their optimism, as strengthening the "hawkish" rhetoric is needed for the dollar to rise, which did not happen. The level of 1.0637 will withstand the bearish pressure.

On the 4-hour chart, the pair experienced a new decline to the 100.0% Fibonacci level and remained within a descending trend corridor. A rebound from the level of 1.0639 allowed for a slight increase, but I advise only counting on a significant strengthening of the euro once the price is sustained above the trend corridor. Closing the pair's rate below 1.0639 will increase the chances of further decline towards the corrective level of 127.2% (1.0466). An RSI indicator has formed a "bullish" divergence, suggesting some growth.

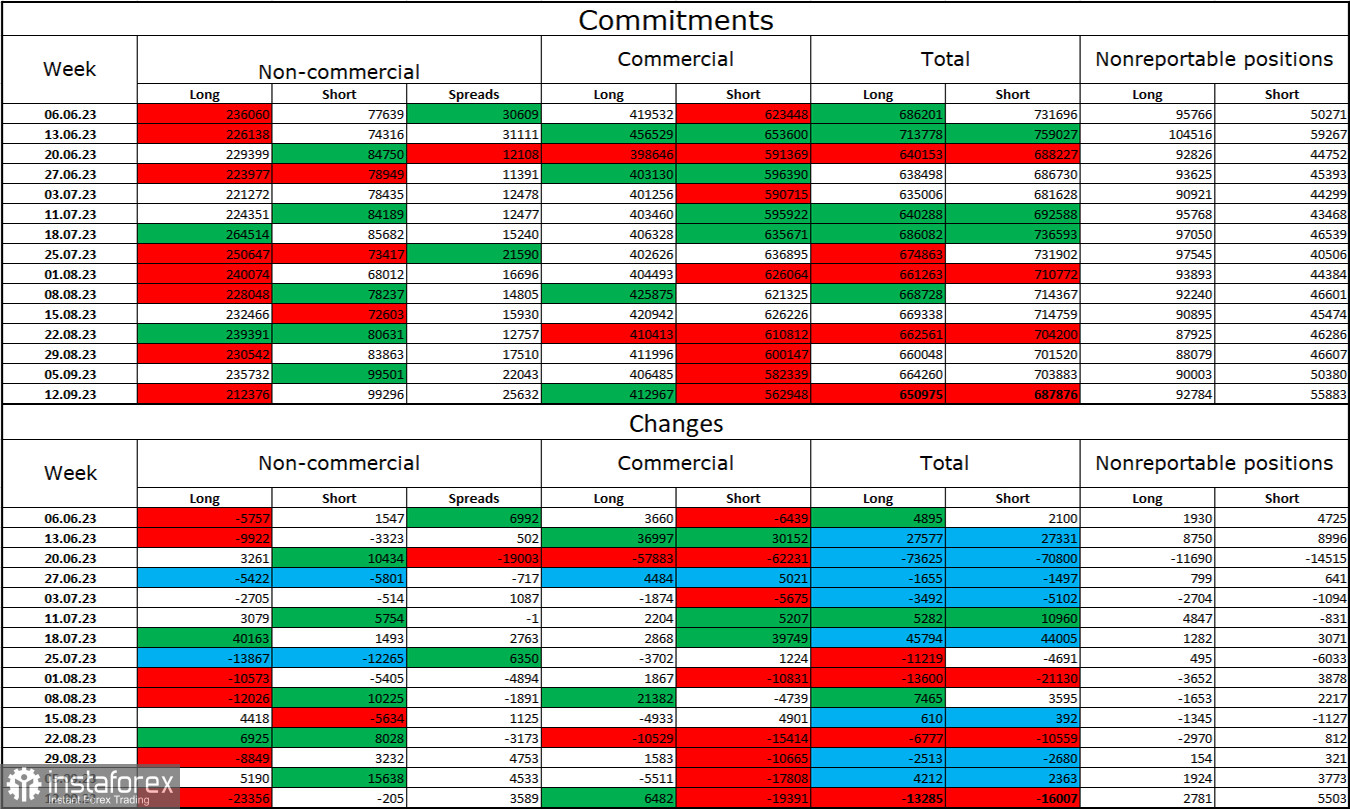

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 23,356 long and 205 short contracts. The sentiment of large traders remains "bullish" but has noticeably weakened in recent weeks and months. The total number of long contracts speculators hold is 212,000, while Short contracts amount to 99,000. The situation will continue to change in favor of the bears over time. Bulls have dominated the market for too long, and now they need strong news to maintain this pressure. Such news is not available. The high value of open Long contracts suggests that professional traders may continue to close them soon. The current figures allow for continuing the euro's decline in the coming weeks. The ECB is increasingly signaling the end of the tightening of the monetary policy.

Economic Calendar for the United States and the European Union:

USA - Philadelphia Fed Manufacturing Index (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

USA - Existing Home Sales (14:00 UTC).

European Union - ECB President Lagarde will deliver a speech (14:00 UTC).

On September 21st, the economic events calendar includes four moderately significant entries. The impact of the information background on traders' sentiment today can be strong but is overshadowed by the Bank of England's meeting.

Forecast for EUR/USD and trader advice:

Selling the pair is possible today if it closes below the level of 1.0637 with a target of 1.0533. Buying could have been done on the hourly chart with a bounce from the level of 1.0637, targeting 1.0697 and 1.0735.