Overall, dollar buyers reacted positively to the "moderately hawkish" rhetoric in Fed Chairman Jerome Powell's statements yesterday, expecting another interest rate hike from the Federal Reserve by the end of the year.

The dollar sharply strengthened after the Federal Reserve meeting, and at the beginning of today's trading day, its DXY index reached 105.37, returning to the zone of the multi-month high of 105.43 reached earlier this month.

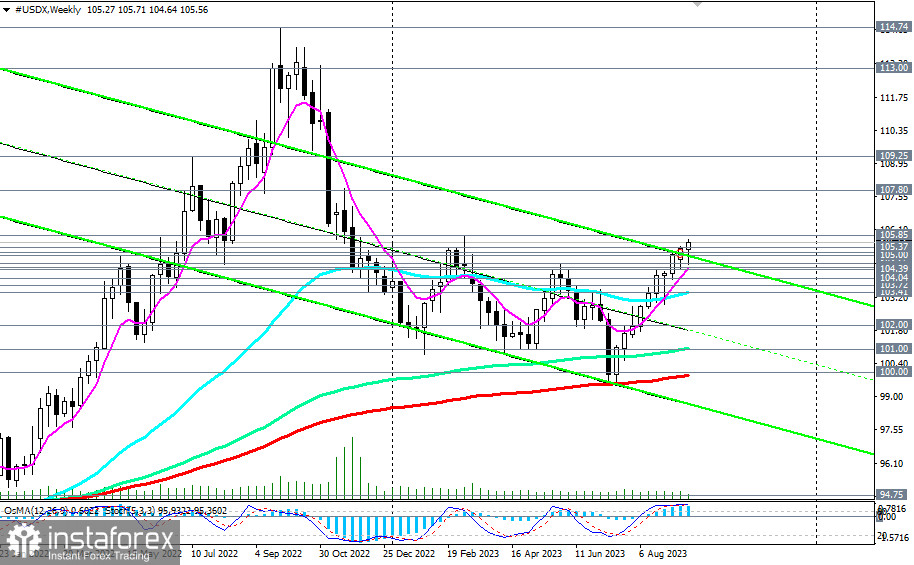

From a technical point of view, the DXY index (CFD #USDX on the MT4 terminal) is trading in a stable bullish market, short-term—above support levels of 105.00, 104.04, medium-term—above the key level of 103.41, long-term—above the key support levels of 101.00, 100.00.

The first signal for new purchases could be a breakout of today's high at 105.71, with confirmation coming from a breakout of the local resistance level at 105.85.

In an alternative scenario, a break below the key support level at 103.41 (200 EMA on the daily chart) would return DXY to the medium-term bearish market zone. The first signal to start implementing this scenario and open short positions could be a break of the local support level at 105.37 and today's low at 105.29, with confirmation from breaking through the local support level at 105.13 and the important short-term support level at 105.00 (200 EMA on the 1-hour chart).

A break below the key support level at 100.00 (200 EMA on the weekly chart) in the event of further decline in DXY would place it in the long-term bearish market zone.

Support levels: 105.37, 105.29, 105.13, 105.00, 104.65, 104.50, 104.39, 104.04, 103.72, 103.41, 102.00, 101.00, 100.00

Resistance levels: 105.71, 105.85, 106.00, 107.00, 107.80, 108.00, 109.00, 109.25