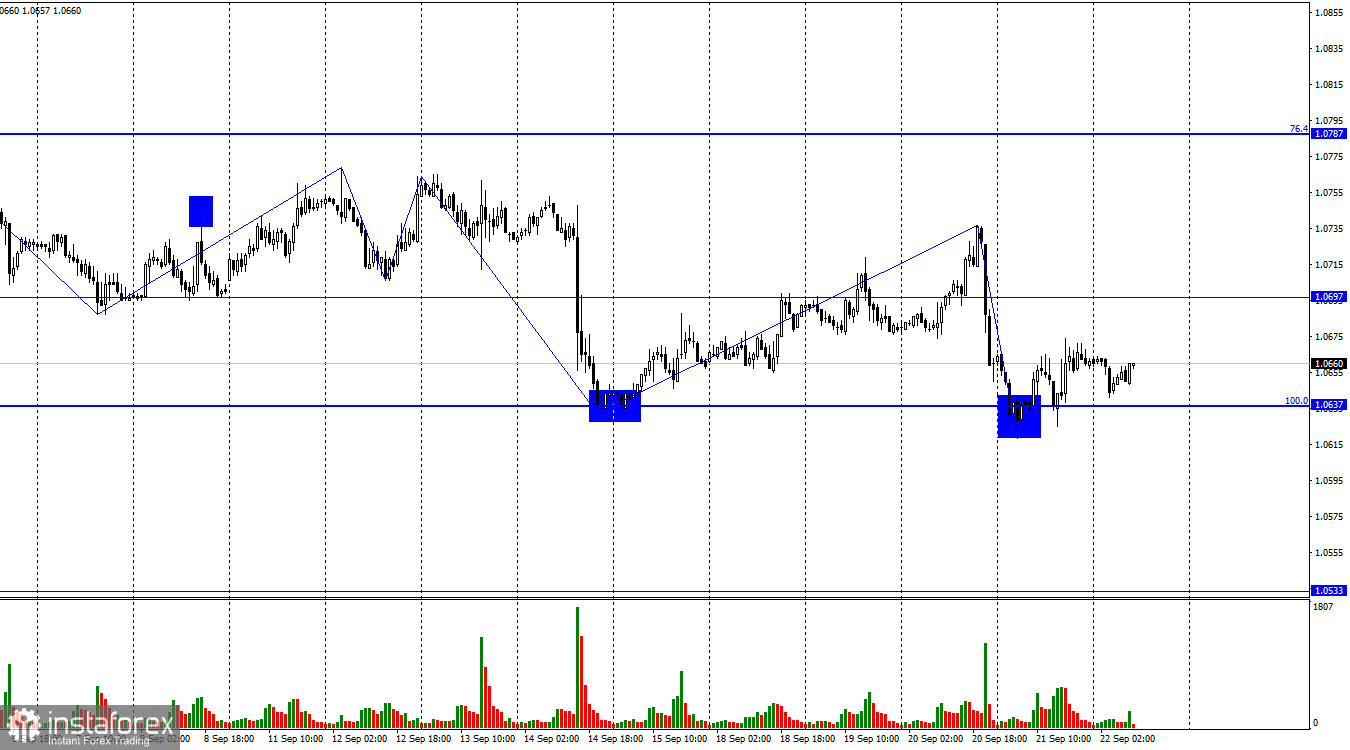

The EUR/USD pair rebounded from the corrective level of 100.0% (1.0637) yesterday, favoring the European currency and starting an upward movement towards the level of 1.0697. The bears failed to break through the 1.0637 level three times this week, but their positions remain strong. These are unfavorable positions for the bulls and have not improved this week. I believe more in the closing of quotes below the 1.0637 level, allowing traders to count on further declines toward the next level of 1.0533 rather than an increase in the pair.

Although the pair did not solidify below 1.0637 on Thursday, the last downward wave broke through the previous low. The breakthrough was not significant, and it can be assumed that the pair is again moving towards horizontal trading, although there are few signs of such movement style. The upward wave that developed during the day today looks simply insignificant and has no chance of interrupting the bearish trend. The waves also indicate a bearish trend and predict a closing below the 1.0637 level.

The information background on Thursday was strong and important for the British pound but weak for the euro. Therefore, yesterday's low trading activity reflects the news related to the dollar or the euro. And there was not much such news. In the United States, the report on initial jobless claims was released, and the number was slightly lower, as well as the report on new home sales, which slightly decreased. Two minor reports, one of which was slightly better than expected, the other slightly worse. In general, they did not affect trader sentiment. We saw a slight increase in the pair due to the rebound from 1.0637.

On the 4-hour chart, the pair experienced a new decline to the 100.0% Fibonacci level and remained within a descending trend corridor. A rebound from the 1.0639 level allowed for a small increase, but I advise only counting on significantly strengthening the euro once the price is fixed above the trend corridor. Closing the pair's rate below 1.0639 will increase the chances of further decline towards the 127.2% correction level at 1.0466. The RSI indicator has formed a bullish divergence, increasing the probability of an upward movement in the pair.

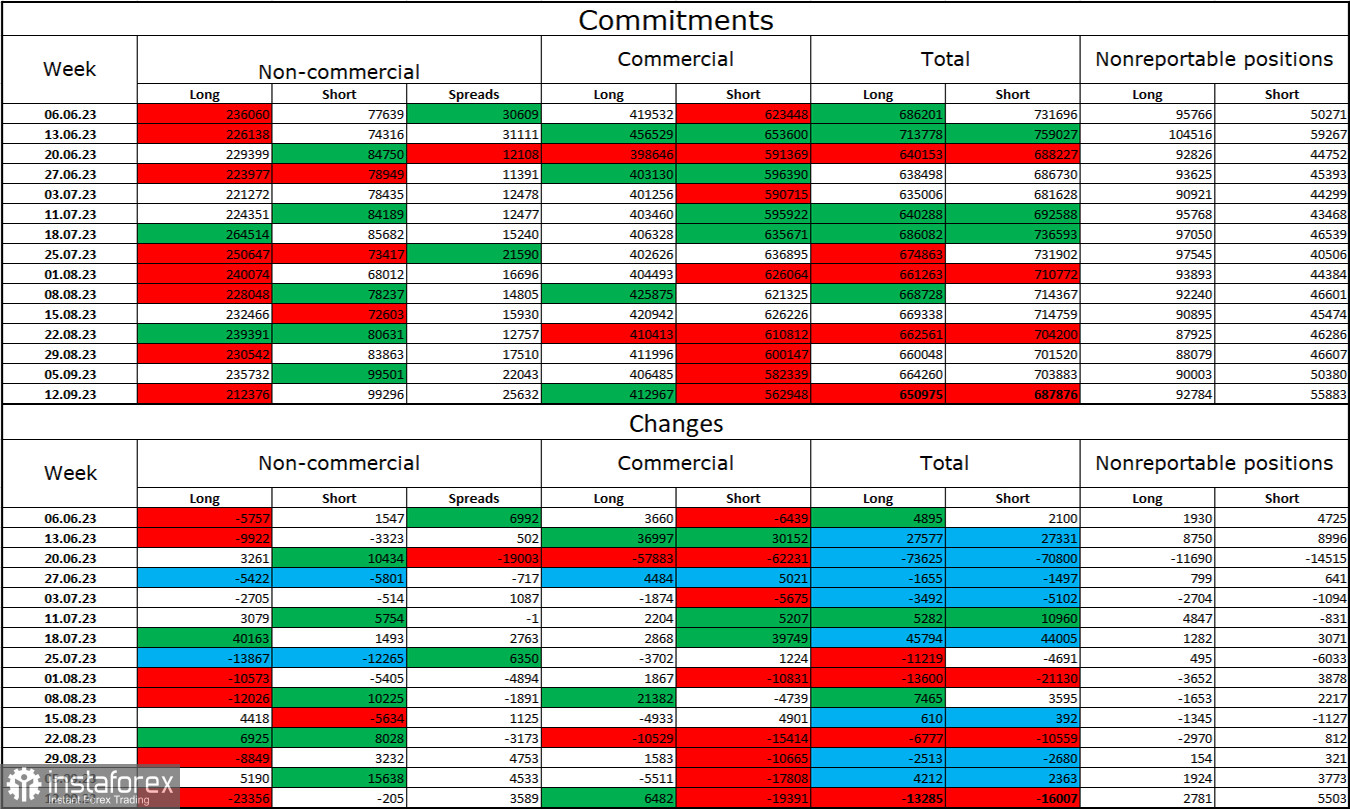

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 23,356 long and 205 short contracts. The sentiment of large traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts speculators hold is 212,000, while short contracts amount to 99,000. The situation will continue to shift towards the bears over time. Bulls have dominated the market for too long, and now they need strong news to maintain this pressure. Such news is currently absent. The high value of open Long contracts suggests that professional traders may continue to close them soon. The current figures allow for a further decline in the euro in the coming weeks. The ECB increasingly signals the completion of the monetary policy tightening procedure.

News Calendar for the United States and the European Union:

European Union - Germany's Manufacturing Purchasing Managers' Index (PMI) (07:30 UTC).

European Union - Germany's Services Purchasing Managers' Index (PMI) (07:30 UTC).

European Union - Manufacturing Purchasing Managers' Index (PMI) (08:00 UTC).

European Union - Services Purchasing Managers' Index (PMI) (08:00 UTC).

United States - Manufacturing Purchasing Managers' Index (PMI) (13:45 UTC).

United States - Services Purchasing Managers' Index (PMI) (13:45 UTC).

On September 22, the economic events calendar includes six entries of moderate significance. The impact of the news on traders' sentiment today may be relatively weak.

EUR/USD Forecast and Trader Recommendations:

Selling the pair is possible today if it consolidates below the level of 1.0637 with a target of 1.0533. Buying was possible on the hourly chart with a rebound from the level of 1.0637, targeting 1.0697 and 1.0735, but as we can see, there was no strong upward movement. Sales of the pair are more interesting at the moment.