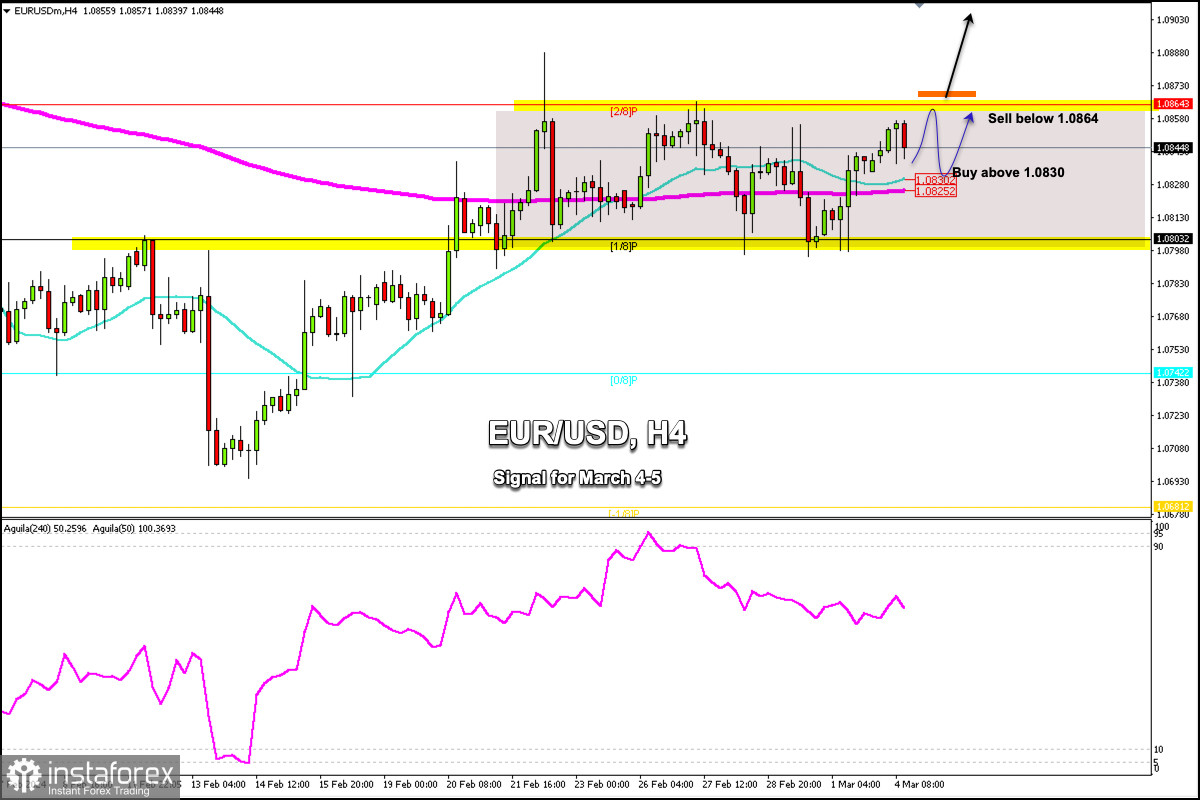

Early in the American session, the euro is trading around 1.0845, below 2/8 Murray, and above the 21 SMA. On Friday after the US data, the euro bounced above 1/8 Murray around 1.0800 and now is showing signs of exhaustion. Therefore, a technical correction is likely in the next few hours if the instrument trades below 1.0864.

The 1.0864 area has become a strong barrier for the euro as this level could offer strong resistance in case the euro tries to break it. This could be seen as a signal to sell with targets at 1.0825 (200 EMA) and 0/8 Murray at 1.0742.

This week the nonfarm payrolls data will be published which could affect the outlook for the euro. If the data is positive, we could expect a fall in the euro with the target at 1.07.

In case the euro consolidates above 1.0864 in the coming days, EUR/USD could reach 3/8 Murray located at 1.0925 and finally, the psychological level of 1.10.

Since February 26, the Eagle indicator has been giving overbought signals. So, if the euro trades below 1.0864, it will be seen as an opportunity to sell.