Friday started with a weaker pound, and the reason lies in extremely weak economic reports. While the pace of retail sales decline slowed down, going from -3.1% to -1.4%, with a forecast of 1.3%, other indicators disappointed. The business activity index in the manufacturing sector increased from 43.0 points to 44.2 points, instead of the expected rise to 44.0 points. However, the services PMI plummeted from 49.5 points to 47.2 points, instead of rising to 49.6 points. As a result, the composite PMI, which was supposed to grow from 48.6 points to 49.0 points, decreased to 46.8 points.

But towards the end of the trading week, the pound managed to edge up as preliminary estimates of business activity indices in the United States also turned out worse than expected. Despite the manufacturing business activity index jumping from 47.9 points to 48.9 points, with a forecast of 48.0 points, the services index dropped to 50.2 points instead of rising from 50.5 points to 50.6 points. Given that it carries much more weight, it contributed to a decline in the composite business activity index from 50.2 points to 50.1 points.

However, although the US reports were somewhat better than that from the UK, the pound resumed its decline after some time and has now returned to Friday's lows. Despite the pound's oversold condition, it is evident that the downtrend persists. As a result, the pound may continue to decline, especially since the economic calendar is basically empty today.

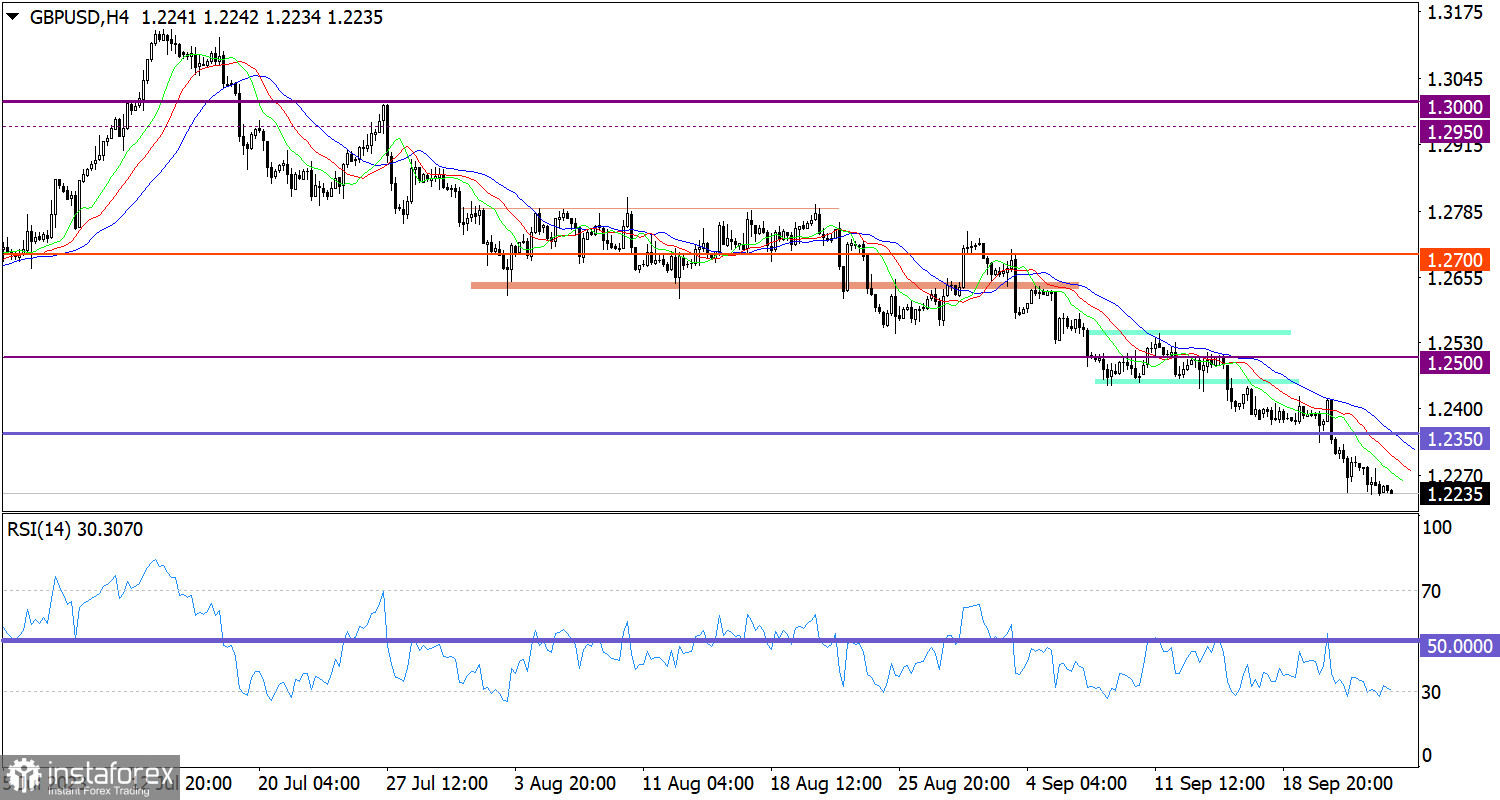

The GBP/USD pair is under pressure from sellers, resulting in a move that updates the local low of the downward cycle.

On the four-hour and daily charts, the RSI indicates oversold conditions.

On the four-hour chart, the Alligator's MAs are pointing downward, in line with the main cycle's direction.

Outlook

Market participants ignore the oversold status; otherwise, a technical rebound would have occurred by now. If things proceed as we expect it to, the exchange rate could easily drop to the 1.2150 level. However, the longer speculators ignore the oversold status, the bigger the impact when short positions are suddenly closed, leading to a sharp rebound.

Complex indicator analysis suggests a bearish signal in the short-, mid- and long-term timeframes.