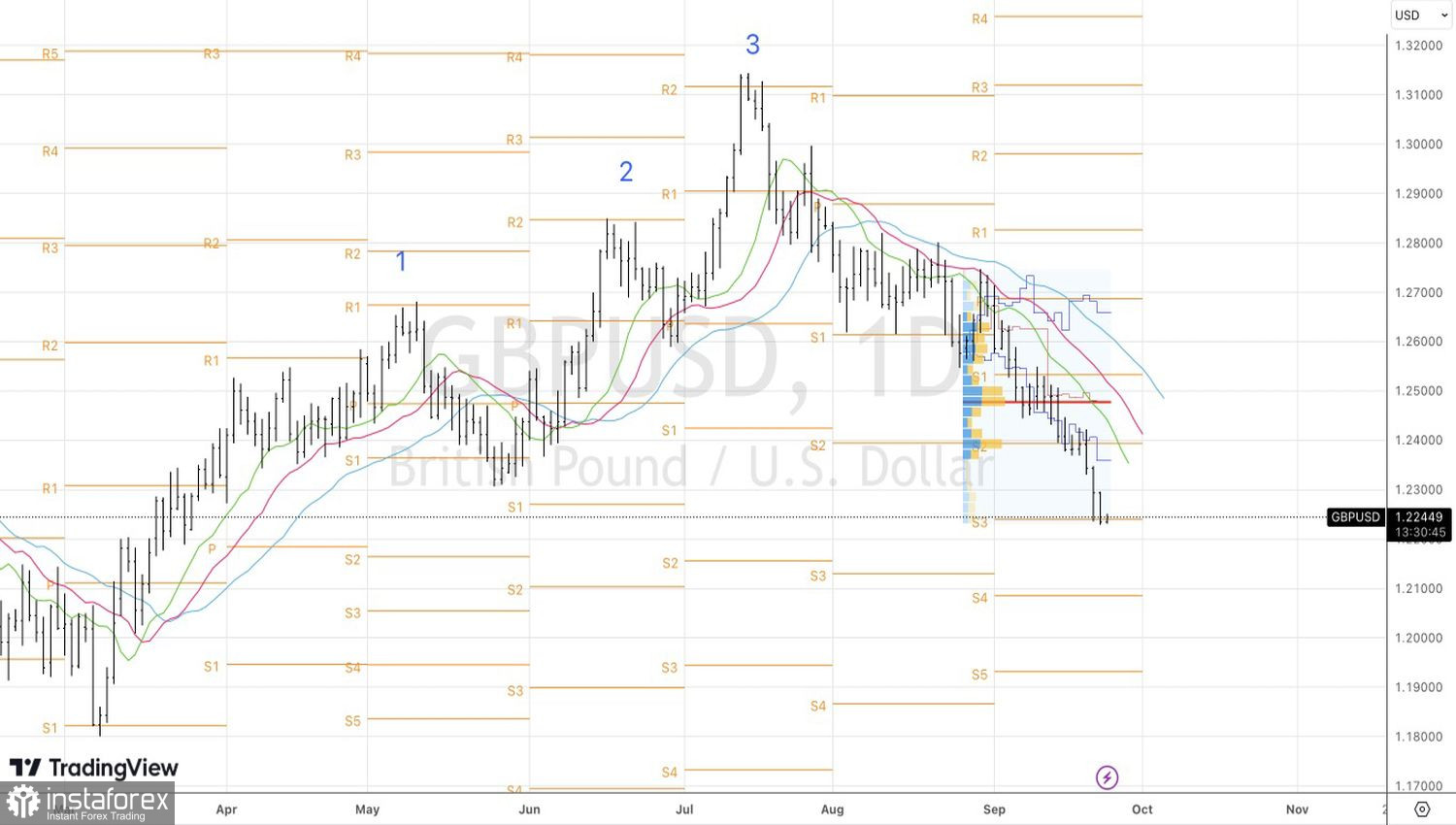

Nearly a year ago, the loss of trust in the fiscal policy of the temporary government led by Liz Truss nearly pushed the pound to parity with the U.S. dollar. At the end of September, investor confidence in the monetary policy of the Bank of England wavered, pushing GBP/USD quotes towards a six-month low. And this may not be the limit. Commonwealth Bank of Australia predicts a drop in the pound to $1.2075, while Nomura predicts a drop to $1.18.

In its latest meeting, the Bank of England, with five votes in favor and four against, decided to keep the repo rate at 5.25%. Thus, the cycle of 14 monetary policy tightening measures that began in the autumn of 2021 was paused. Just a week before, the futures market was indicating an 80% probability of a 25 basis point increase in borrowing costs to 5.5%. However, unexpected inflation slowdown reduced the chances to 50%.

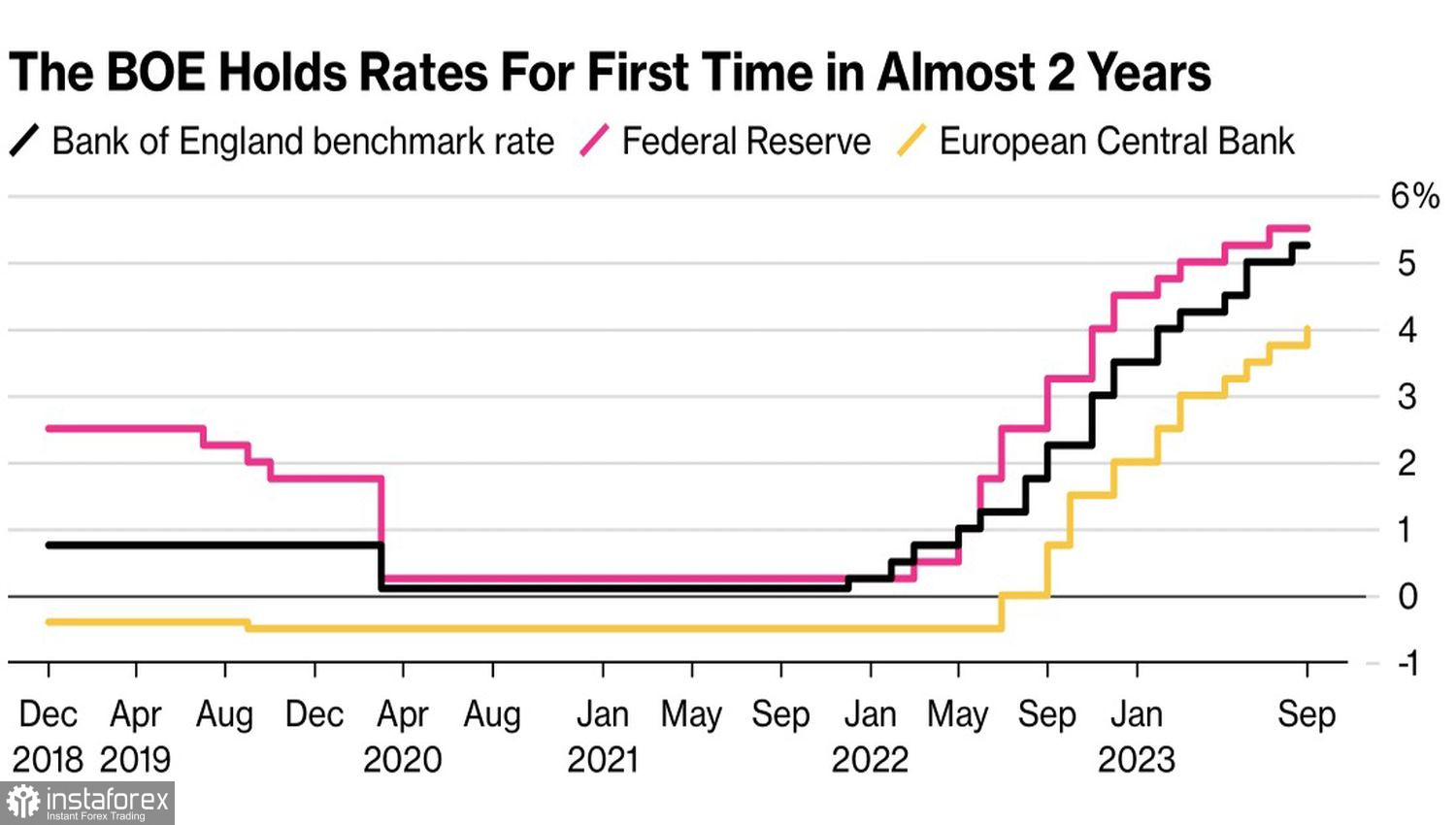

The monetary tightening by the Bank of England is more aggressive than that of the ECB but less severe than the Fed's. Unlike the U.S. economy, the British one cannot withstand it. The maintenance of business activity below the critical mark of 50 in September signals a downturn.

Central Bank Interest Rate Dynamics

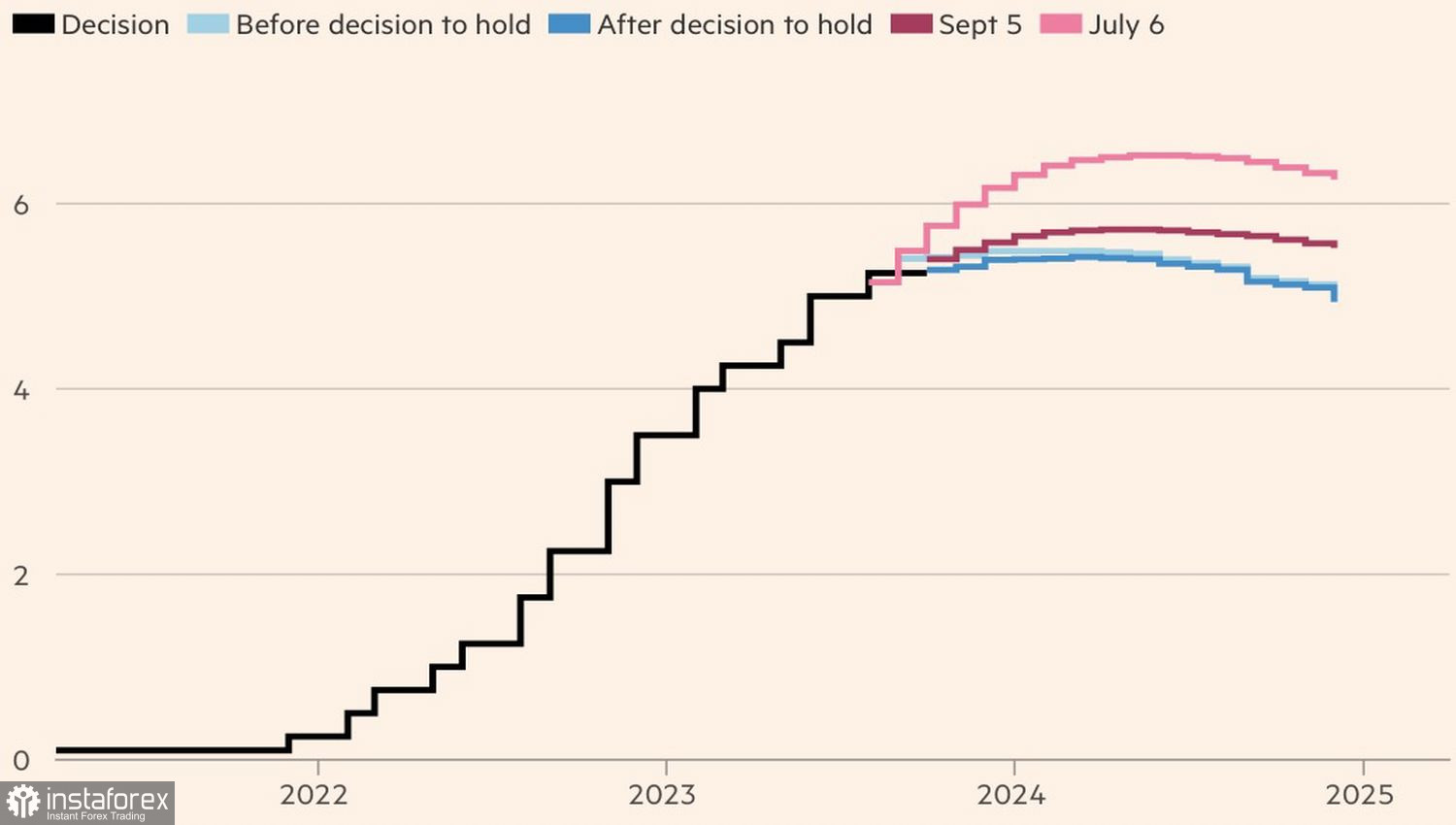

The Bank of England has tried to replicate the "hawkish" pause trick previously performed by the Fed. This refers to when the interest rate remains unchanged but the regulator signals that it may increase in the near future. The markets saw this as a bluff, and the loss of confidence in the Bank of England led to a beating of the pound. Goldman Sachs and Nomura have stated that the cycle of monetary restriction in Britain is over, and the futures market has started betting on a loosening of monetary policy in 2024.

Repo Rate Expectation Dynamics

However, derivatives still believe in an increase in borrowing costs to 5.5% by the end of the year, which could further weaken the pound. It was the reduction in the assumed ceiling of the repo rate by more than 6% that catalyzed the drop of GBP/USD from July highs. If investors' hopes are not met, the currency is doomed to a "bearish" trend.

In the near future, the Bank of England may maintain a "hawkish" rhetoric, but few are likely to believe it. It's one thing when you have a strong economy behind you, as is the case with the Fed. It's another when the country teeters on the brink of recession and stagflation.

The pressure on the pound may only be eased by the closing of speculative GBP/USD shorts against the backdrop of disappointing economic data from the United States. In this regard, data releases on durable goods orders and personal consumption expenditures can provide a breath of fresh air to the "bulls" in the analyzed pair. However, medium-term prospects for the pound remain bearish.

Technically, on the GBP/USD daily chart, the downward trend formed thanks to the Three Indians pattern is gaining momentum. If the pair fails to hold above the pivot level of 1.224, the risks of continuing the decline to 1.21 will increase. We will have the opportunity to add to the shorts formed from 1.239.