Last Friday, in the early European session, traders received fresh data on business activity in Europe (preliminary PMIs for France, Germany, the euro area, and the UK). All in all, statistics indicated a continued economic slowdown. Both the euro and the British pound fell sharply against the dollar, weighed down by the reports.

Moreover, their slide accelerated in the North American trade, after the US reported stronger business activity indicators.

Thus, S&P's manufacturing PMI ticked higher to 48.9 in September from 47.9 in August, beating forecasts of 48. The services PMI fell to 50.2 in September from 50.5 a month ago, below market expectations of 50.6. Nevertheless, the indicator remained above the 50 mark separating growth from contraction. Meanwhile, the composite PMI also stayed above the 50 threshold, coming in at 50.1 versus 50.2 in August.

Last week, Fed officials decided to leave monetary policy parameters unchanged but signaled the possibility of another rate hike by the year-end.

The US central bank also made upward revisions to its projections for economic growth and the labor market situation. The regulator anticipates US GDP to grow by 1.5% next year, up from the previous estimate of a 1.1% pick-up. The unemployment rate is forecast to be 3.8%, down from the prior 4.1%.

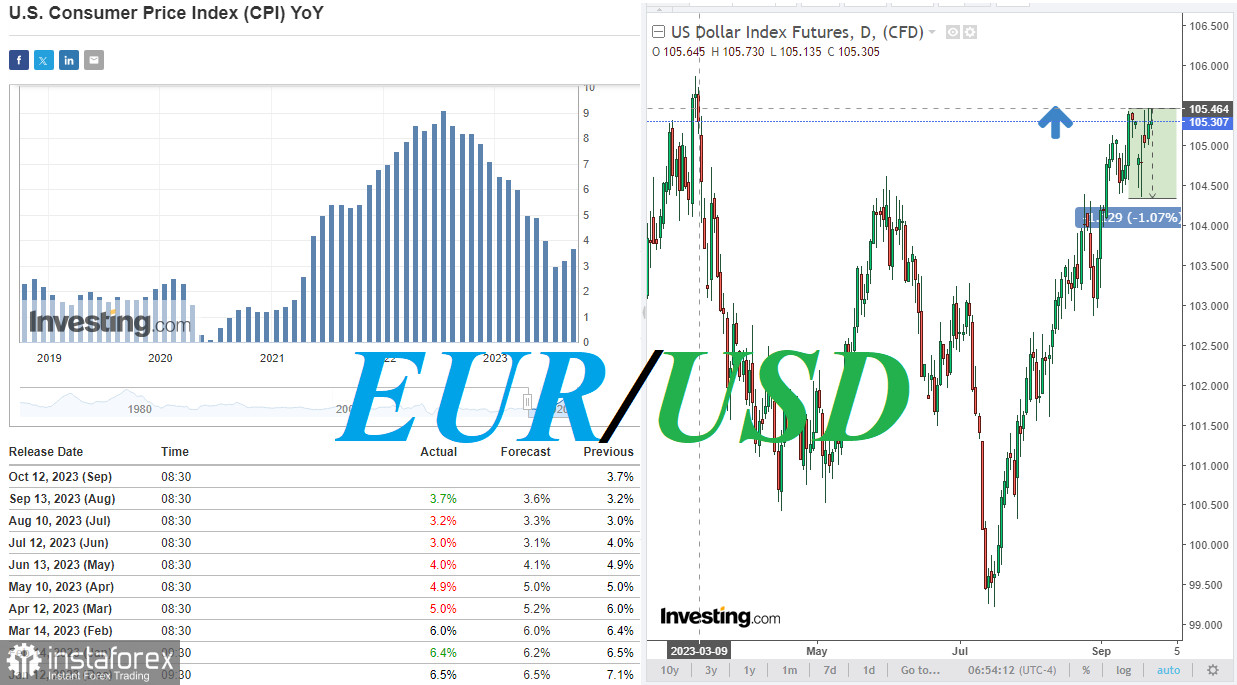

"Broadly, stronger economic activity means we have to do more with rates" and "there will have to be some softening in the labor market," Fed Chair Jerome Powell said, expressing concern about high inflation rates. Notably, the CPI increased by 0.6% in August, after rising by 0.2% a month ago. The annual CPI surged to 3.7% from 3.2% in July, above analyst estimates of 3.6%, with the rate increasing for the second consecutive month.

Overall, the past week proved to be favorable to the greenback and its buyers. The US dollar index rose slightly above its one-year peak at 105.46. At the moment, the DXY is trading upwards at the level of 105.31.

The euro is the largest component of the index, making up 57.6% of the basket followed by JPY (13.6%) and GBP (11.9%). Due to their decline against the dollar, the DXY index shows an uptrend. Its rally is fueled by upbeat macroeconomic statistics coming from the US and the central bank's intention to keep fighting inflation.

The euro, the dollar's main competitor in the foreign exchange market, came under pressure today after statements from senior ECB officials that interest rates should remain at current levels for an extended period of time. According to ECB Governing Council member Martins Kazaks, "the rate hike from the ECB in September may allow a pause in October."

The EUR/USD pair also declined at the start of today's European trading session. Now, market participants, watching the dynamics of this currency pair, are awaiting a speech by ECB President Christine Lagarde before the European Commission's economic and monetary affairs committee.

"The Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target," the ECB said in a statement following the September meeting.

Thus, today's remarks of ECB President Christine Lagarde are unlikely to signal a shift in her tone towards tighter monetary policy. Hence, One should not expect a rise in the euro after her speech. However, surprises are not ruled out. If the head of the ECB hints at the possibility of further policy tightening, the euro will have a chance of gaining ground.