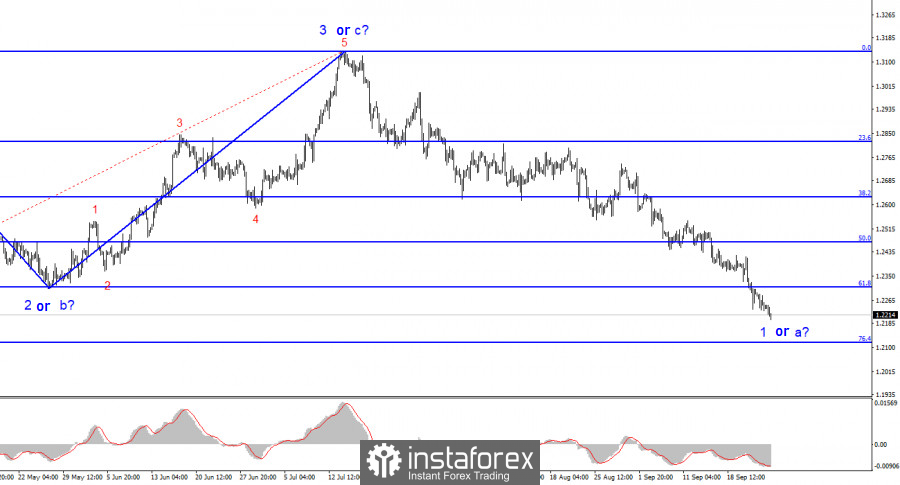

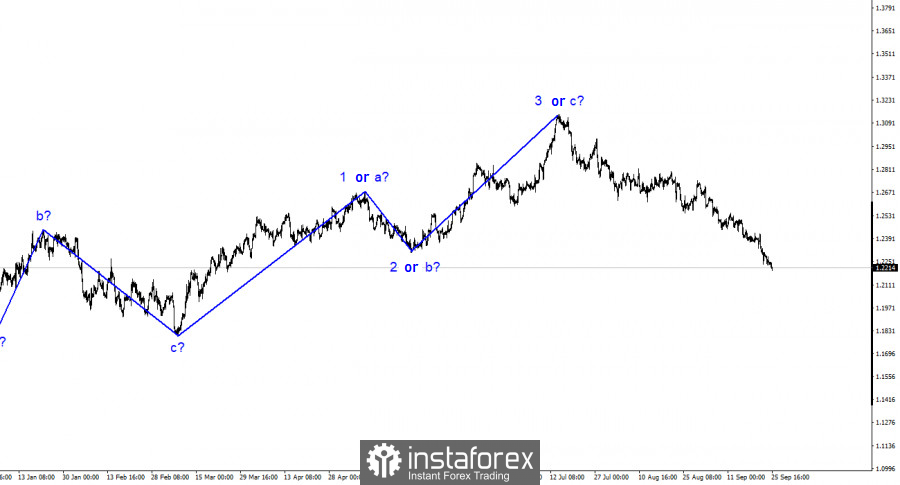

The wave analysis for the pound/dollar pair remains quite simple and clear. The upward wave 3 or C construction is completed, and a new downward trend segment has begun. There is no reason for the British pound to resume rising, so I do not consider the scenario with a new upward segment. The first wave of the downward trend segment has already taken on a protracted form, but the demand for the pound continues to decline. I want to remind you that there are no specific wave target sizes. The first wave can be constructed for as long as necessary without restrictions.

The internal wave structure of the first wave of the new trend segment looks complex, and it is challenging to discern five waves within it. But five waves are visible in the euro. If the downward set of waves is completed for the euro, then with an 80% probability, it will also be completed for the pound. However, on Thursday, the pound made a successful attempt to break through the level of 1.2314, which corresponds to 61.8% according to Fibonacci, so it may fall, and the euro also made a successful attempt to break through the level of 1.0637, so it may also fall. The construction of corrective waves is currently postponed.

The pound/dollar pair rate dropped by another 40 basis points on Monday. The demand for the British currency has been declining almost every day. Some of my readers probably needed to prepare for such events, especially when you recall how the pound traded over the past year. I'll remind you: even if there's a trend, it doesn't always mean the pair should rise or fall daily. That's what we're seeing now. In recent weeks, the decline in the pound hasn't exactly intensified, but it has become more stable.

It's hard not to discuss the reasons for the pound's decline. But to understand these reasons, you first need to consider the reasons for its possible rise. And there are simply none. Therefore, the demand for the pound is declining simply because the market has no other options or alternatives. What should the market do if the Bank of England has not raised rates for the first time in a year and a half? If the Bank of England has possibly already completed the process of tightening policy, what should the market do? What should the market do if British economic reports come out weak time after time?

Roughly speaking, the markets have no reason to increase demand for the pound after this currency has been rising for almost 12 months. The trend has shifted downward, so we're witnessing a decline. The second wave must be constructed and does not require a strong news background. Therefore, I advise focusing on Fibonacci levels. The construction of this wave can start from one of them.

General conclusions.

The wave pattern for the pound/dollar pair suggests a decline within a new downward trend segment. The maximum the British pound can expect soon is wave 2 or B construction. However, as we can see, even with a corrective wave, there are significant problems. At this time, I would be cautious about staying in sales, as the construction of an upward corrective wave may begin soon, but there are currently no signals for the start of this wave.

The picture resembles the euro/dollar pair on a larger wave scale, but some differences remain. The downward correctional trend segment continues its construction, and its first wave has already taken on an extended form and is completely unrelated to the previous upward trend segment.