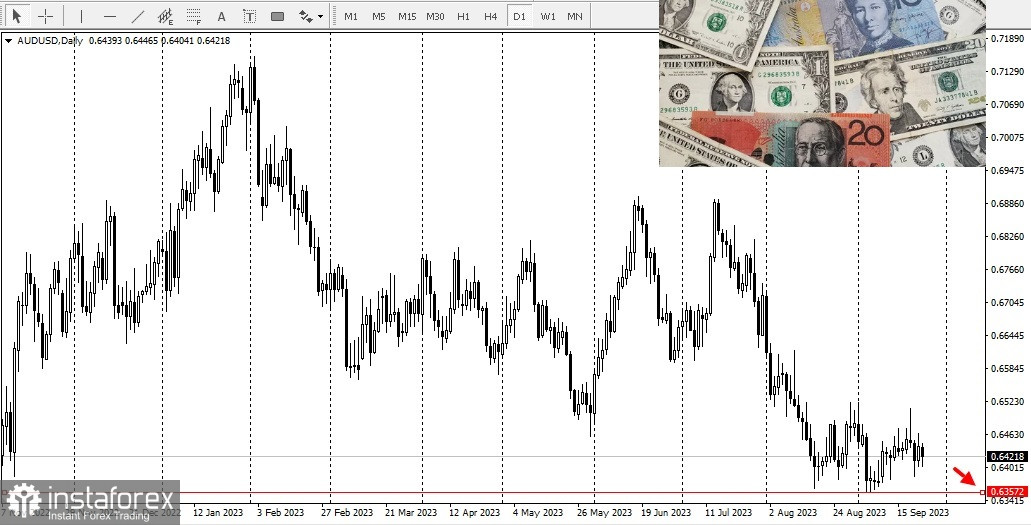

After the developer China Evergrande Group said that there was a problem regarding debt obligations due to the ongoing government investigation into the division of Hengda Real Estate Group, concerns about the crisis in the real estate market in China resurfaced. This led to an outflow of funds from the Australian dollar.

On the other hand, the U.S. dollar has overcome the highest level in the last six months, and is still well supported by the Federal Reserve's hawkish outlook. And this, in turn, is seen as another factor exerting pressure on the AUD/USD pair.

Last week, the Fed confirmed that interest rates will remain high for a long time and warned that sustained inflation in the U.S. will lead to another increase in interest rates by the end of 2023. In addition, according to the Fed's dot plot, there will be only two rate cuts in 2024, instead of four.

Also, according to the incoming macro data for the United States, the picture of the stability of the economy is clear, which suggests prospects for further tightening of the Fed's policy. This led to a sell-off in the U.S. bond market and pushed the yield of interest rate sensitive two-year government bonds to the highest level since 2006. Moreover, the yield on 10-year U.S. Treasury bonds has risen to a 16-year high, supporting the dollar.

On the other hand, the Reserve Bank of Australia has probably completed the rate hike cycle, which puts additional pressure on the AUD/USD pair.

In fact, according to the minutes of the RBA's September meeting published last Tuesday, it was clear that all members considered it necessary to allow more time to see all the consequences of monetary policy tightening from May 2022. The Australian Central Bank also noted that the recently released data corresponded to the return of inflation to the target level in a reasonable time, while the cash rate remained at the current level.

Next on the Australian economic data releases will be the consumer inflation scheduled for Wednesday.

Nevertheless, the dynamics of U.S. dollar prices still plays an important role in influencing the AUD/USD pair. So note the news from the U.S. scheduled today, affecting the U.S. dollar market.

However, the aforementioned fundamental background suggests that the path of least resistance for spot prices lies in the downward direction, and any attempt at recovery should be sold.