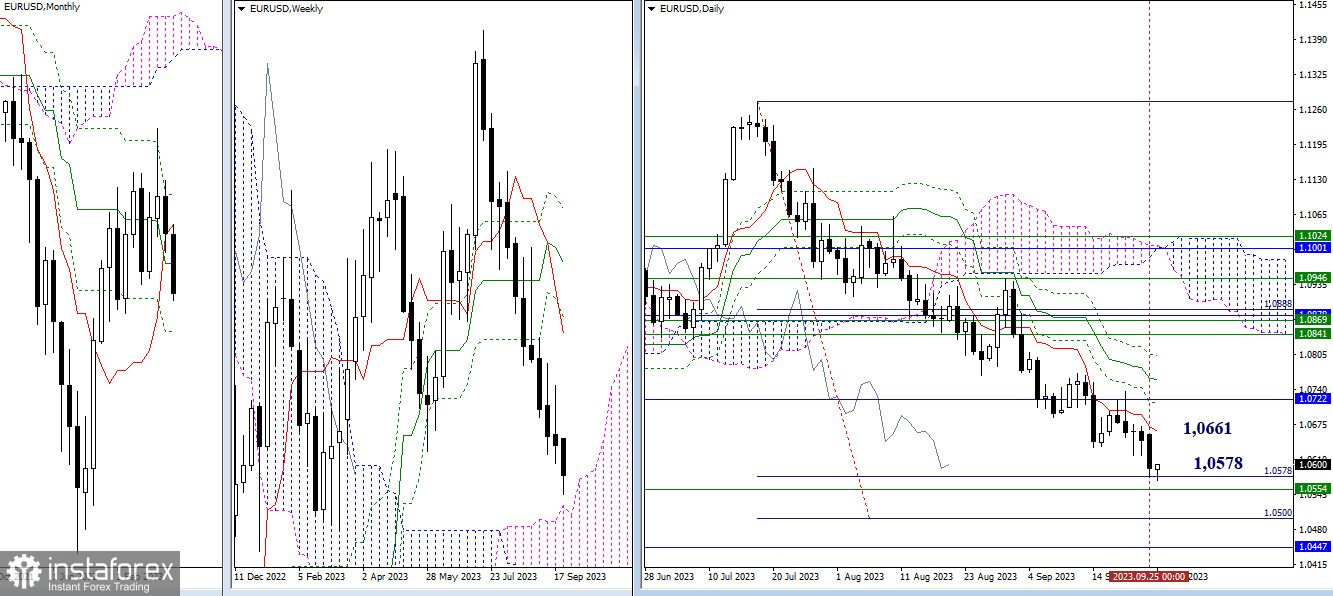

EUR/USD

Higher Timeframes

Bears continued the decline yesterday and began testing the first target level (1.0578) of the breakout of the daily Ichimoku cloud (1.0578 - 1.0500). This level also serves as the first support within a fairly wide support zone (1.0578 - 1.0554 - 1.0500 - 1.0447), which combines supports from different timeframes, and each support can act as a basis for a pause or a rebound. If the bearish players take a break, the opposition will strive to complete the current stage of the daily downward trend in order to develop a corrective rise. The first immediate target in this case will be the resistance of the daily short-term trend (1.0661).

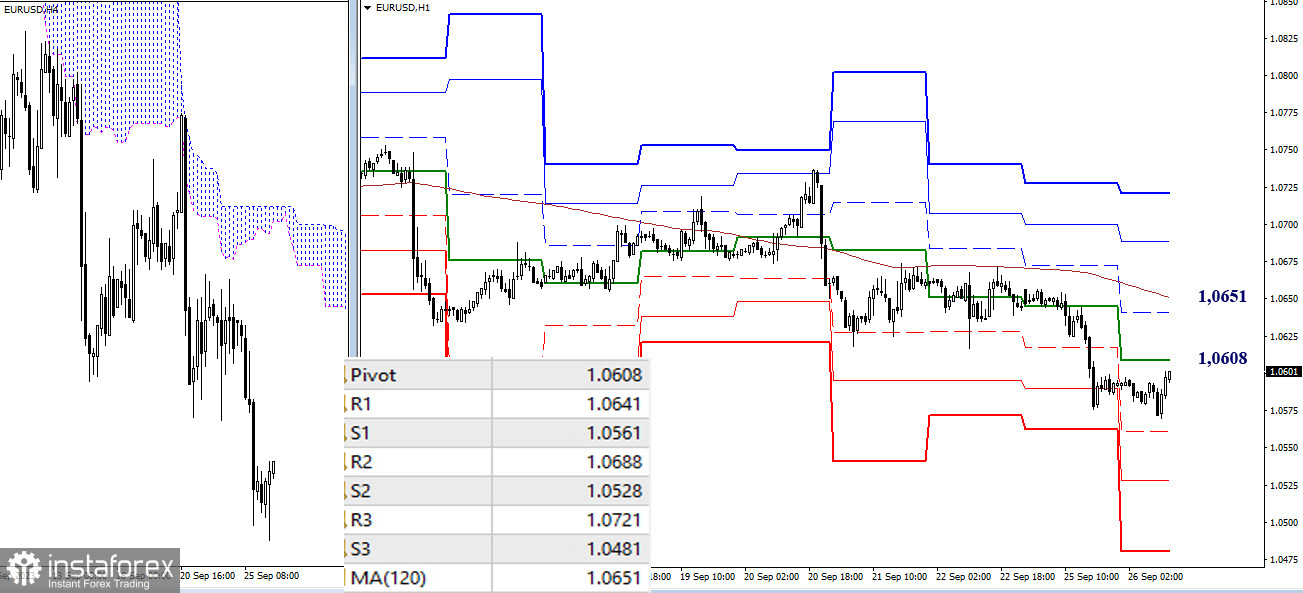

H4 – H1

On the lower timeframes, the advantage continues to be in favor of the bearish players. Today, their intraday bearish targets are at 1.0561 - 1.0528 - 1.0481 (supports of the classic pivot points). Changing the current balance of power will be possible after consolidating above key levels, which are currently at 1.0608 (central pivot point) and 1.0651 (weekly long-term trend). After that, in the event of bullish sentiment and advantages, attention will be focused on 1.0688 - 1.0721 (resistances of the classic pivot points).

***

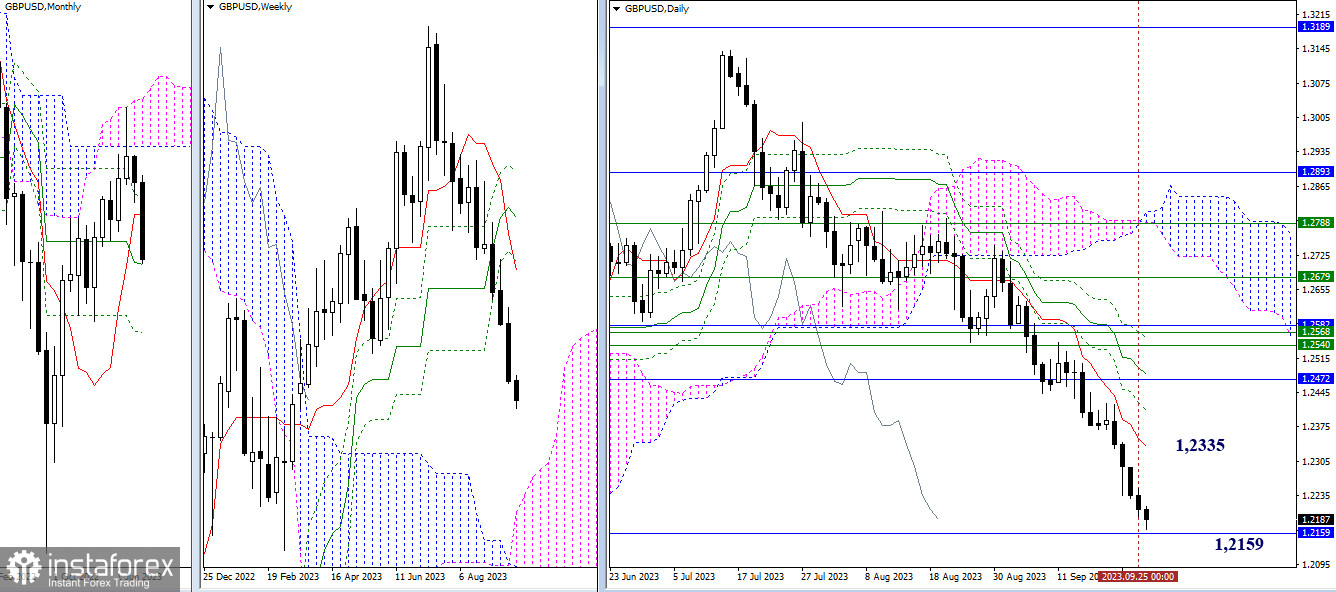

GBP/USD

Higher timeframes

Slowly but surely, the pair continues its descent towards the support of the monthly medium-term trend (1.2159). The outcome of this interaction can determine the further development of events over a fairly long period. The nearest resistance on the higher timeframes is at 1.2335 (daily short-term trend), which is currently at a significant distance from the price chart, so it is unlikely to come into play today.

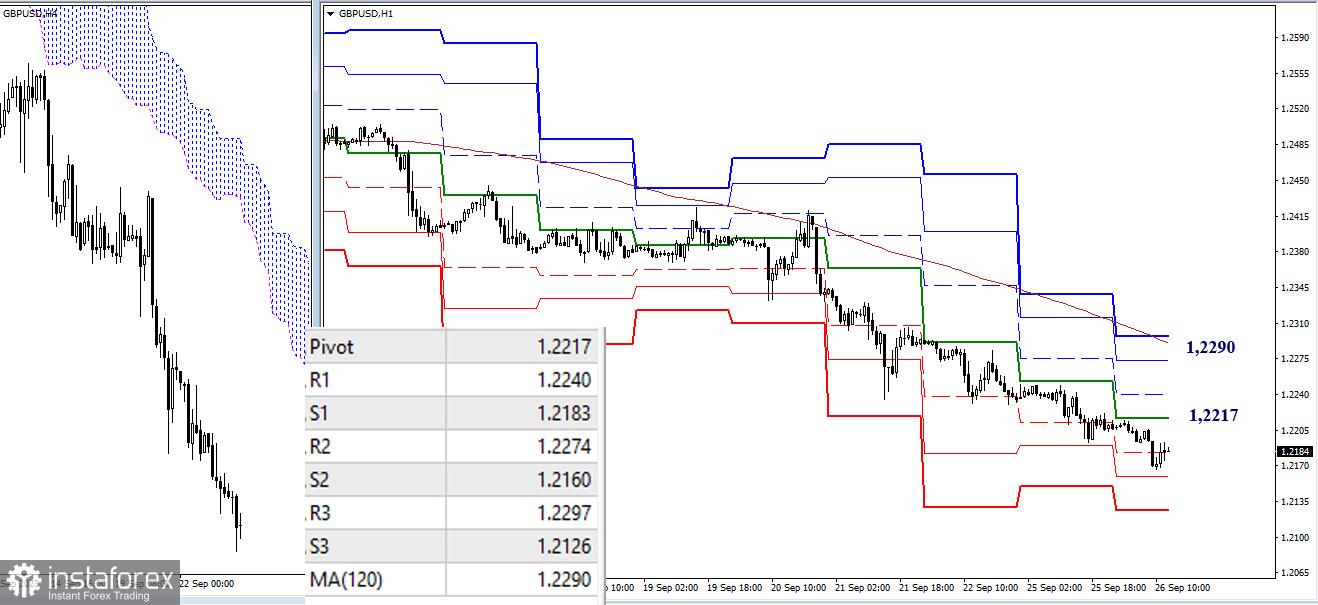

H4 – H1

The bearish players are developing a downward trend. Currently, they are battling for control over the first support of the classic pivot points (1.2183). Two other levels, S2 (1.2160) and S3 (1.2126), maintain their roles as intraday bearish targets. The key levels on the lower timeframes are acting as resistances today. Thus, in a change of sentiment and an upward movement, the first challenge for the bullish players will be the central pivot point (1.2217), and the testing of the weekly long-term trend (1.2290) will be of the utmost importance. Intermediate resistances on this path today may come from R1 (1.2240) and R2 (1.2274).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)