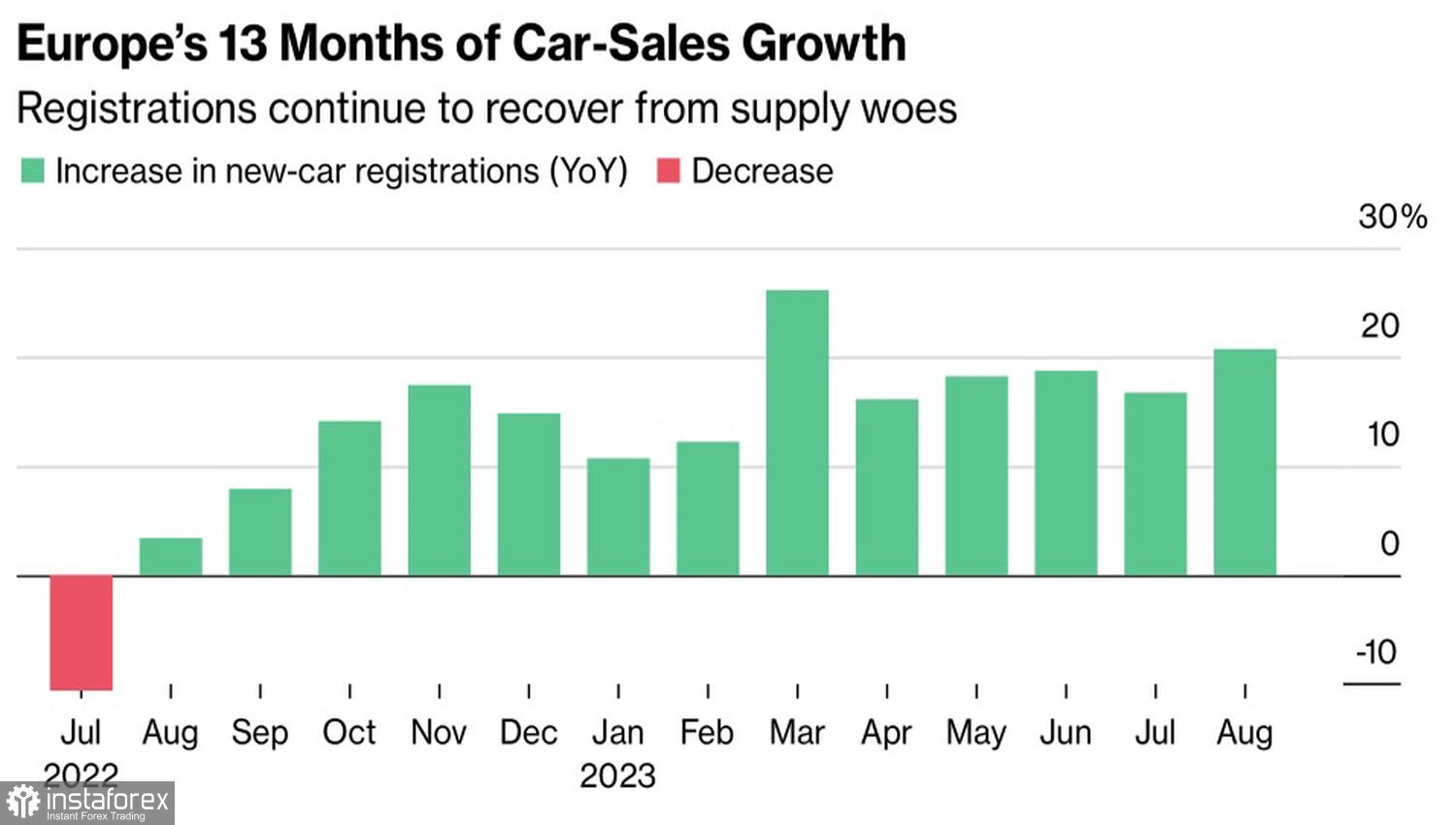

It wouldn't be worse. Launching an investigation into whether Beijing subsidized electric vehicle deliveries to Europe, the European Union has heightened concerns about the worsening situation in the currency bloc's economy. China, which has substantial experience in trade wars with the United States, could easily introduce retaliatory measures. This would be a real blow to the European automotive industry, as some companies export up to 40% of their products to China. Is it surprising that the EUR/USD has fallen below 1.06?

Dynamics of deliveries of Chinese electric vehicles to Europe

The eurozone is drowning in stagflation. The ECB does not predict a recession, but the dynamics of business activity data indicate that avoiding an economic downturn will not be possible. If the trade war between the EU and China knocks on the door, it will be a disaster. The divergence in economic growth between the United States and the currency bloc will increase even further, pushing EUR/USD, if not to parity, then to 1.02.

Don't think that the potential shutdown of the U.S. government in early October will harm the USD index. Yes, GDP may slow to 0.2–0.4% in the fourth quarter of 2023—the first quarter of 2024. Yes, Moody's may take away the United States' last top credit rating after Fitch and S&P Global did so. However, in the short term, the U.S. dollar will gain preferences as a safe haven. Moreover, the danger is less than during the debt ceiling battle. The current government shutdown will not affect the ability of the Treasury to meet its bond obligations.

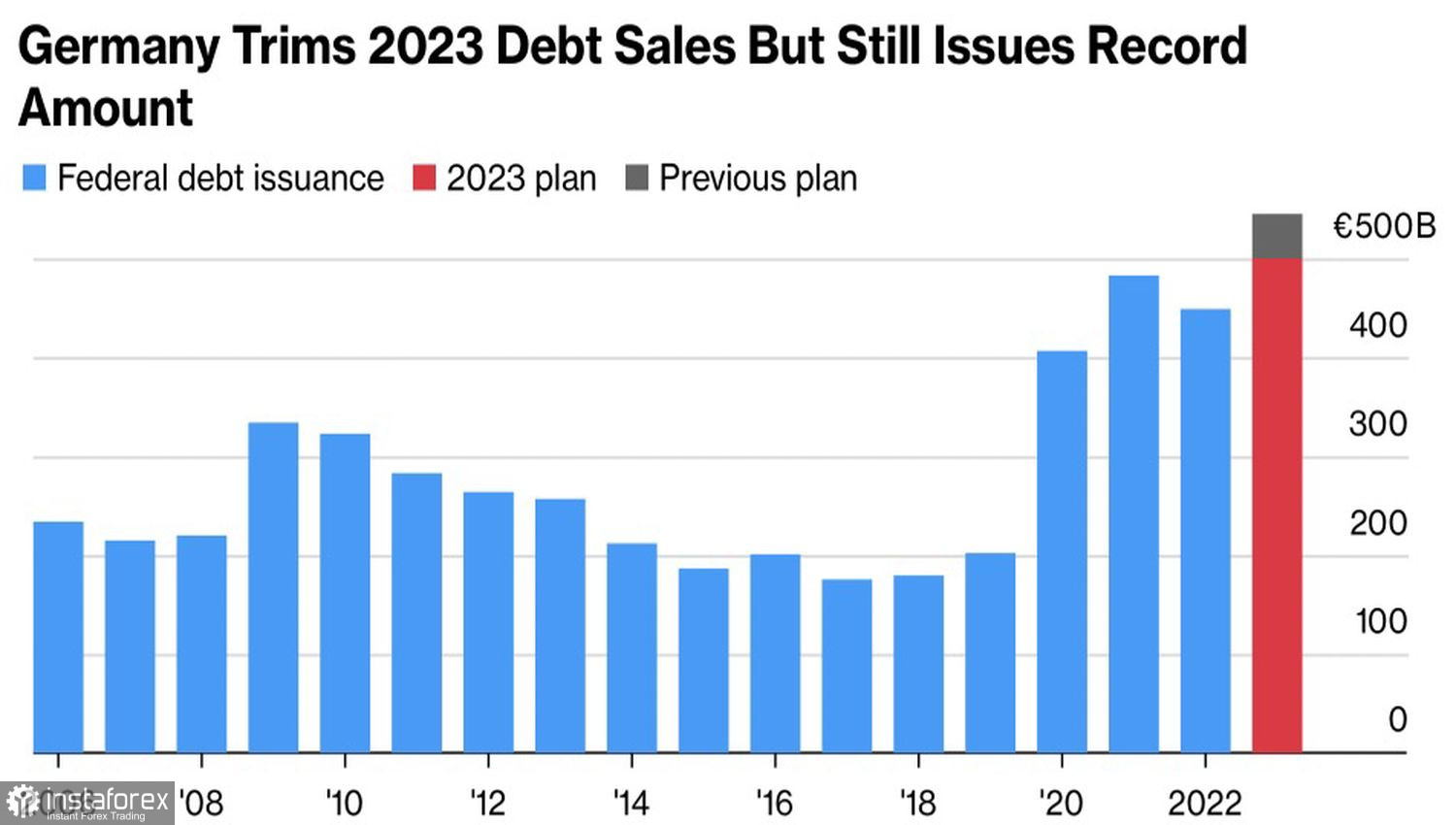

The market believes that such an outcome of negotiations between Democrats and Republicans will lead to an increase in bond and bill issuance, which contributes to a rally in yields. As a result, the "bears" on EUR/USD win. Their opponents are concerned about Germany's intention to reduce bond issuance by €45 billion to €500 billion due to the expiration of fiscal stimulus deadlines. The issuance is still at a record level.

Dynamics of the issue of German bonds

Therefore, U.S. bond yields will rise faster than their German counterparts, creating favorable conditions for the EUR/USD peak to continue. Moreover, JP Morgan warns that in the event of runaway inflation, the federal funds rate could rise to 7%. Will the U.S. economy be ready for this? I believe not. However, the U.S. dollar, on the contrary, will perceive such a borrowing cost dynamics as a new trump card.

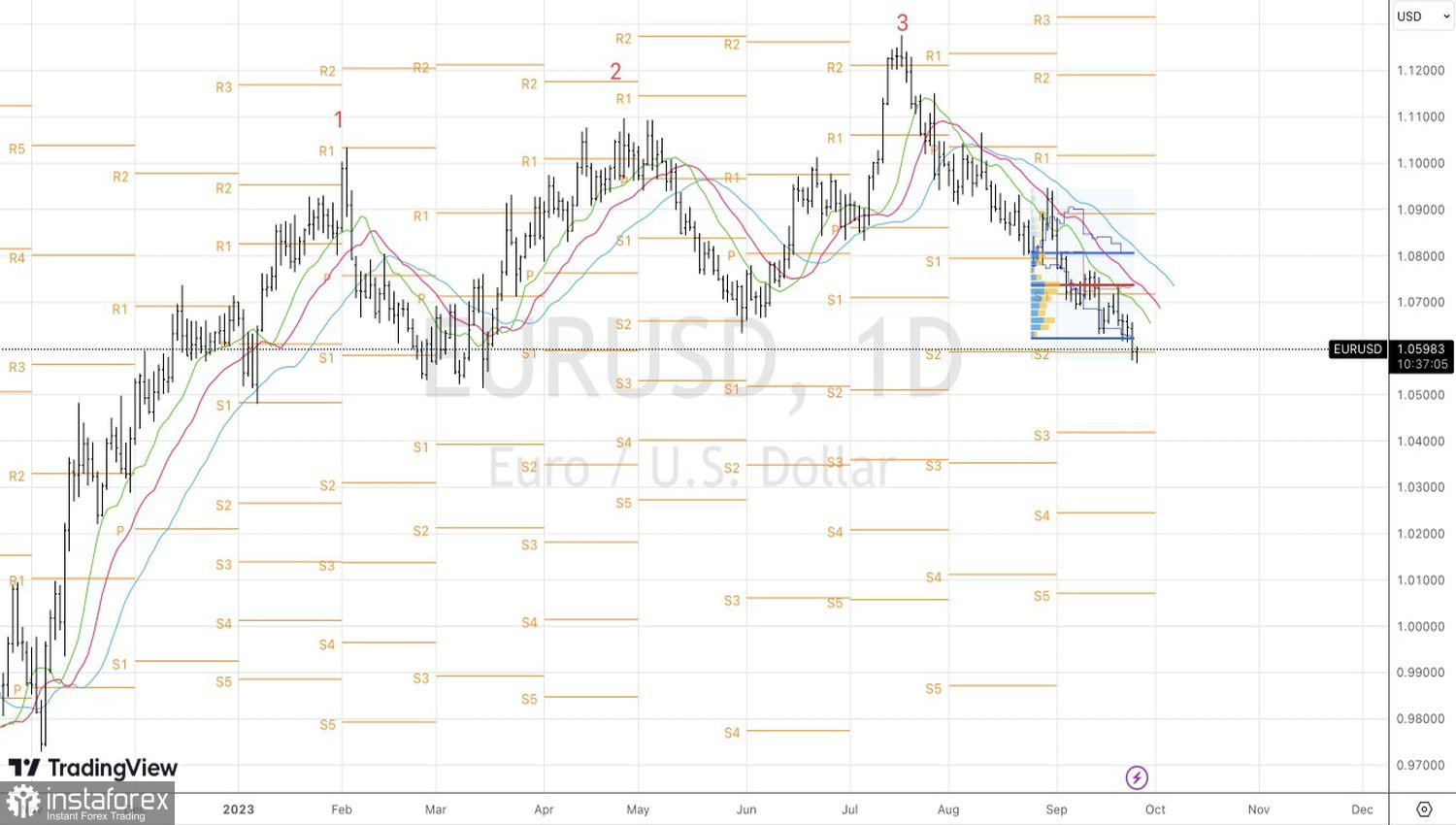

JP Morgan's expected ceiling may look shocking, but the readiness of FOMC officials to resume the monetary restriction cycle in faith and truth serves the EUR/USD sellers. Unlike them, European Central Bank President Christine Lagarde does not speculate on further deposit rate hikes. Lagarde only emphasizes that it will remain at 4% plateau for a very long time.

Technically, only a return of the EUR/USD to the fair value range of 1.0625–1.081 would allow us to speak of a correction. As long as the pair is trading below 1.0625, the focus should remain on selling towards 1.051 and 1.042.