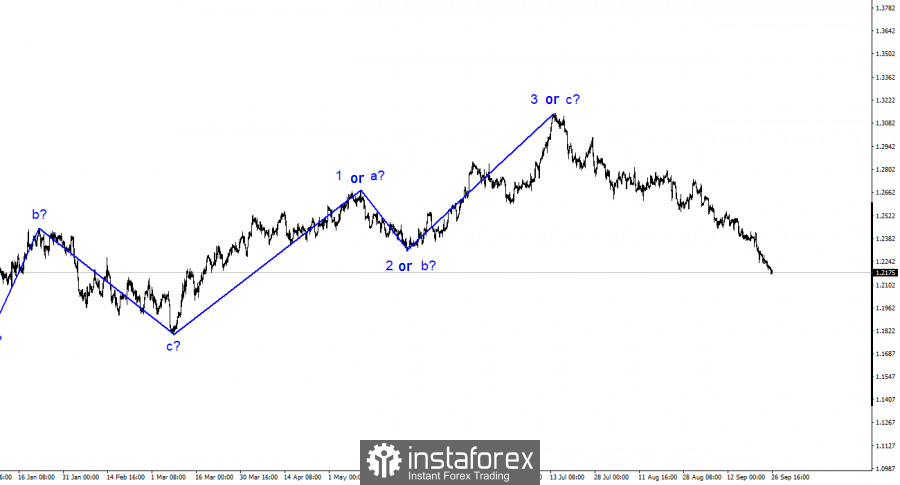

Regarding the pound/dollar pair, the wave labeling remains quite simple and clear. The construction of the ascending wave 3 or c has been completed, and the construction of a new descending segment of the trend has begun. In my opinion, there are no grounds for the British pound to resume its rise, so I simply do not consider the scenario of a new ascending segment. The first wave of the descending trend has already taken on an extended form, but the demand for the pound continues to decline. I would like to remind you that there are no specific target wave sizes. The first wave can be constructed for as long as necessary without any restrictions.

The internal wave structure of the first wave of the new trend segment looks complex, and it is difficult to discern five waves within it. However, five waves are visible in the Euro. If the construction of the downward set of waves is completed for the Euro, there is an 80% probability that it will also be completed for the pound. However, on Thursday, the pound made a successful attempt to break through the 1.2314 level, which corresponds to 61.8% according to Fibonacci, so it may fall, and the Euro also made a successful attempt to break through the 1.0637 level, so it may fall too. The construction of correction waves is currently being postponed.

The pound/dollar pair's exchange rate declined by another 30 basis points on Tuesday. Demand for the British currency decreases practically every day. The daily losses are small, but they occur every day. Since the peak on July 14th, the British pound has already fallen by 970 basis points. However, I have repeatedly stated in my reviews that I expect the construction of a downward set of waves, and now it looks even more convincing and extensive than I initially anticipated. I would also like to point out that only the first wave of the downward trend segment is still being constructed. Where could the pound fall in the third wave? And if a five-wave structure is built? I would say that in the coming months, the pound can only count on a corrective wave 2 or b, and in the next six months, the best-case scenario would be to hold positions above the 1.8 figure.

During one of his recent speeches, Bank of England Governor Andrew Bailey stated that the question of raising the interest rate cannot be considered closed yet. He mentioned that the Committee will closely monitor changes in the economy to determine whether further rate hikes are necessary. At the moment, the probability of a new rate hike at the next meeting in November is estimated at 64%. I dare to assume that tightening will occur because it is hard to imagine that the British regulator would conclude the tightening process so abruptly. At least one more rate hike is expected. Just like the FOMC, which is also preparing to raise rates in November. It may seem that the pound and the dollar are in similar conditions, but this is not the case, as the wave pattern currently implies the construction of a downward set of waves.

General Conclusions.

The wave pattern of the pound/dollar pair suggests a decline within a new descending segment of the trend. The maximum the pound can expect soon is the construction of wave 2 or b. However, even with a corrective wave, significant problems arise, as we can see. Currently, I would be cautious about staying in sales because the construction of an upward corrective wave may start soon, although there are no signals for the start of this wave yet.

On a larger wave scale, the picture is similar to the euro/dollar pair, but there are still some differences. The descending corrective segment of the trend continues its construction, and its first wave has already taken on an extended form and has nothing to do with the previous ascending segment.