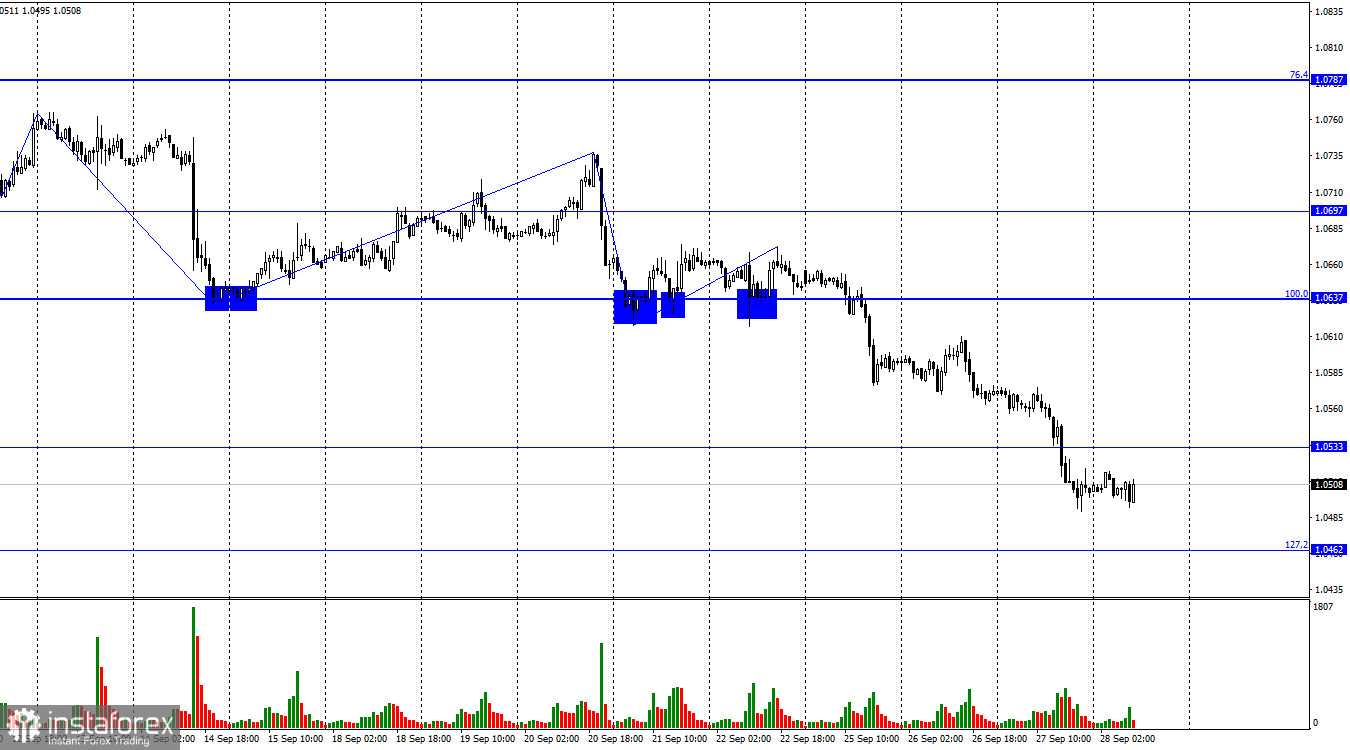

The EUR/USD pair continued its downward movement on Wednesday and confirmed its position below the level of 1.0533. Thus, the decline of the euro may continue towards the next Fibonacci level of 127.2% at 1.0462. A rebound of quotes from this level would favor the European currency and some growth, but the trend is currently bearish, and I would not expect a strong rally in the pair and place high hopes on it. A confirmed exchange rate below 1.0462 would increase the likelihood of further declines.

I would like to say something new about the waves, but it is impossible at the moment. For the fourth day in a row, a downward wave is forming, so there is nothing new to say right now. There is no sign of the bearish trend ending. In the near future (today or tomorrow), they are unlikely to appear.

Yesterday, the information background was quite weak, as there was only one report that could interest traders. But even this single report supported the bears, who are simultaneously acting as dollar bulls. Orders for long-term goods in the US in August increased by 0.2% compared to expectations of -0.5%. Orders for goods excluding transportation increased by 0.4% compared to expectations of +0.1%. Thus, even yesterday, traders had reasons to sell the pair.

Today, in a couple of hours, the consumer price index in Germany will be released. Traders expect it to decrease from 6.1% to 4.6%, which would be a significant slowdown, especially for Germany, which has not delighted us with inflation figures in recent months. If the forecast is correct, the burden and pressure on the ECB will ease slightly, but it is unlikely to relieve the pressure on the euro, as the market will become even more convinced of the lack of a need to raise rates at least one more time.

On the 4-hour chart, the pair has confirmed its position below the corrective level of 100% (1.0639) and continues to trade within a descending trend corridor. Thus, the process of quote decline may continue towards the next corrective level of 127.2% (1.0466). I recommend expecting a noticeable rise in the euro only after it closes above the corridor. A rebound in the pair's exchange rate from the level of 1.0466 will allow traders to anticipate some growth.

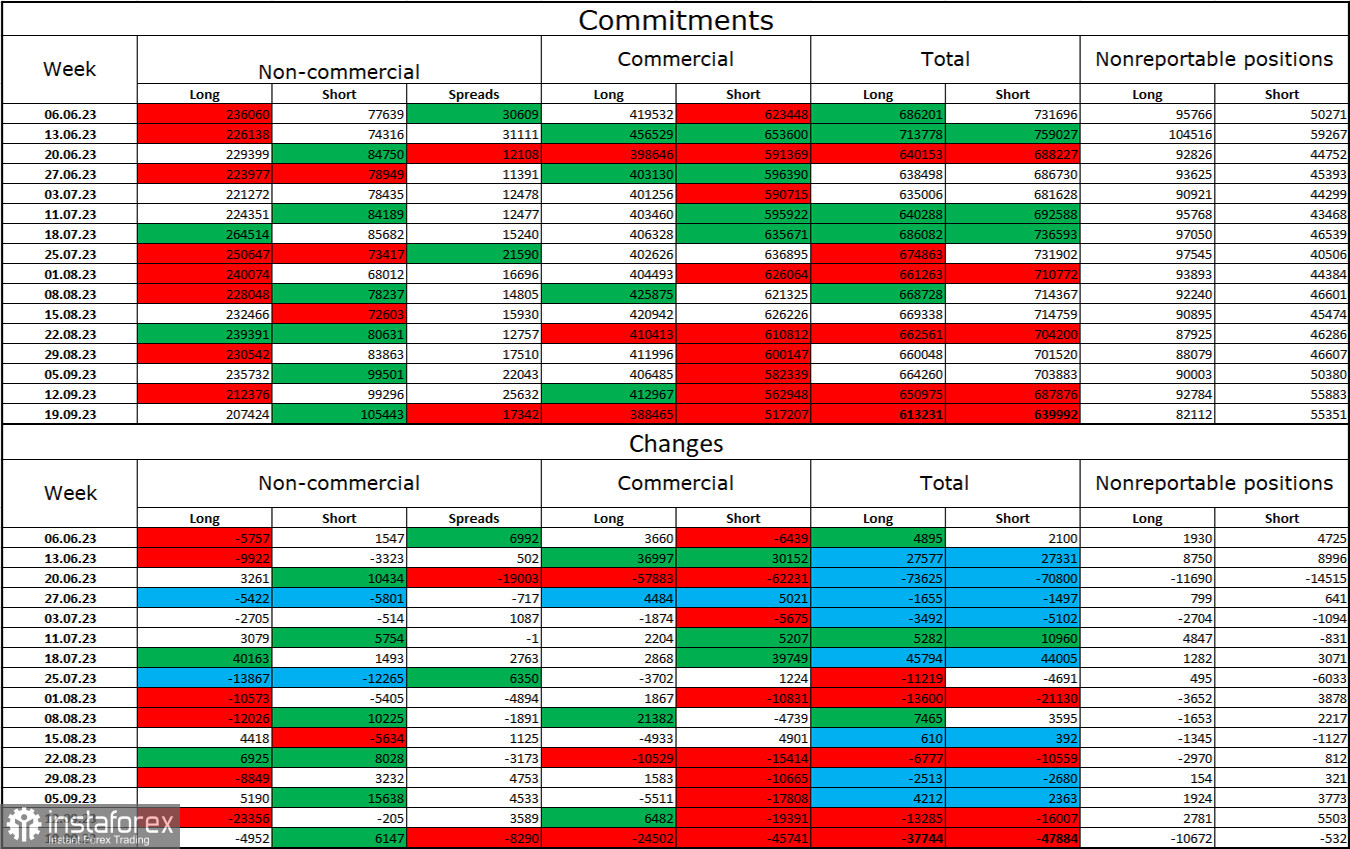

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,952 long contracts and opened 6,147 short contracts. The sentiment of major traders remains "bullish," but it has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators is now 207,000, while short contracts amount to 105,000. The difference is now only twofold. I believe that the situation will continue to shift toward the bears over time. Bulls have dominated the market for too long, and now they need strong information to maintain the bullish trend. Such a backdrop is absent. The high value of open long contracts suggests that professional traders may continue to close them in the near future. I believe that the current figures allow for further declines in the euro over the next few months.

News calendar for the US and the European Union:

European Union - Consumer Price Index (CPI) in Germany (12:00 UTC).

USA - GDP in the second quarter (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

USA - Speech by the Chairman of the Federal Reserve, Mr. Powell (20:00 UTC).

On September 28th, the economic calendar includes several significant events. The impact of the news on traders' sentiment today can be quite strong.

Forecast for EUR/USD and trader recommendations:

Selling the pair was possible when closing below the level of 1.0637 on the hourly chart, with targets at 1.0575 and 1.0533. Both targets have been reached and surpassed. Sales can be held with a target of 1.0462. Buying is possible on a rebound from the level of 1.0462 on the hourly chart, with a target of 1.0533.