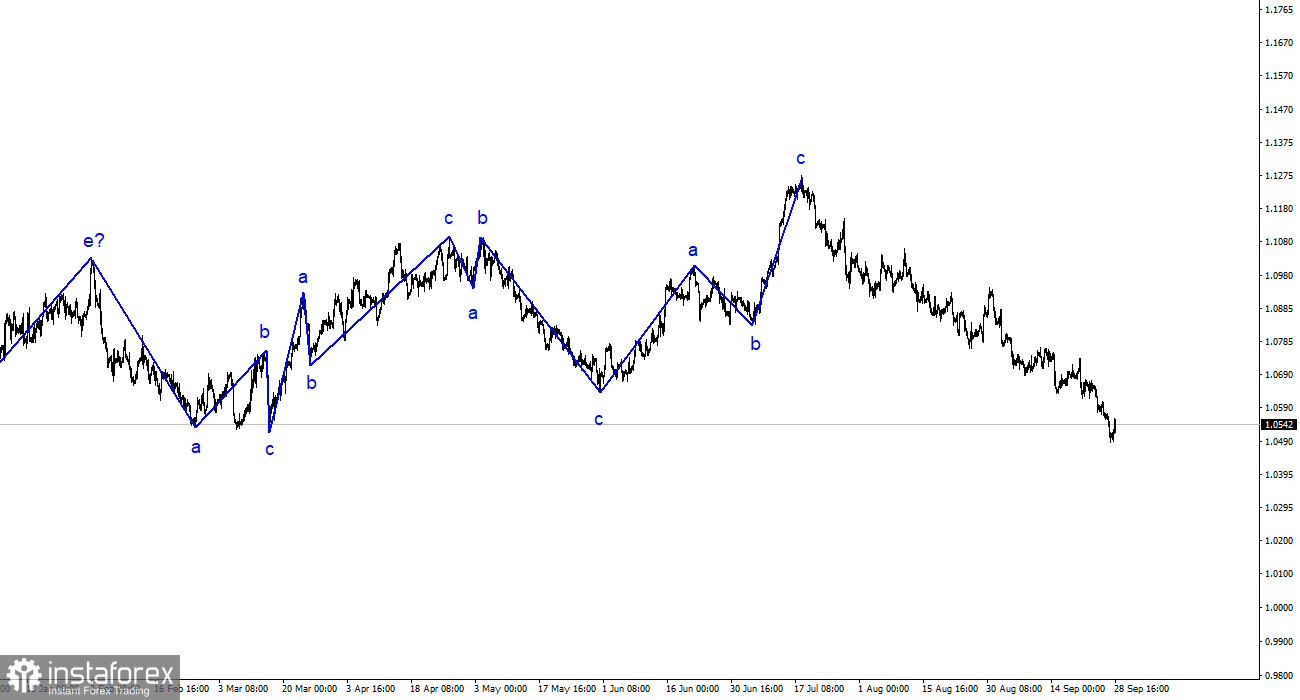

The wave analysis on the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have only seen three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to reach around the 5th figure, from where the construction of the last upward three-wave structure began. The pair has not yet dropped to the 5th figure, but it has already exceeded the 6th figure. And the first wave of the new downward trend section has not yet been completed. Can you imagine how low the euro may fall in a few months?

None of the recent price increases looked like a complete wave 2 or b. Therefore, all of them were internal corrective waves in wave 1 or a. If this is indeed the case, the decline in quotes may continue for some time during this wave. And this will not mark the end of the overall decline in the European currency, as the construction of the third wave is still required. Within the first wave, there are already five internal waves, so its completion is approaching. Nevertheless, a successful attempt to break through the level of 1.0637, which is equivalent to 100.0% according to Fibonacci, indicates the market's readiness for additional sales of the pair.

The euro continues to decline, regardless of the news background.

The euro/dollar pair increased by 35 basis points on Thursday. These 35 points are very hard to notice on the charts, as the entire first downward wave stretches for 800 points. Obviously, 35 points do not allow us to draw any conclusions. I believe that in the near future, a corrective wave 2 or b should begin to form, as the first wave turned out to be too long. It is longer than the entire previous upward three-wave structure. However, I do not see any prerequisites for the start of an upward wave yet. There are no technical signals, no strong news for the European currency, and no market willingness to stop selling.

Today, Germany released its inflation report for September. In August, the inflation rate was recorded at 6.1%, but the market expected it to drop to 4.6%, which is a significant decrease. In reality, the rate slowed down to 4.5% y/y. If demand for the euro was rising (albeit slightly) before this report was released, it has once again started to decline after the release. This phenomenon can be explained quite simply: the faster and stronger inflation falls, the fewer reasons the ECB has to continue tightening its monetary policy. I would like to remind you that almost all members of the ECB board have spoken in the last two weeks, and almost all of them have stated that the interest rate can now only be raised in case of an emergency. An emergency case would be a sudden surge in inflation. If inflation is decreasing, then there is no need to raise interest rates. This provides another reason for the euro to continue its decline.

General Conclusions

Based on the analysis conducted, I conclude that the construction of a downward wave set continues. I still consider targets in the range of 1.0500–1.0600 for the downward trend section quite realistic, especially since there is not much left to reach them. Therefore, I continue to recommend selling the pair. Since the downward wave did not end around the level of 1.0637, we can now expect a drop to the 5th figure and the level of 1.0465, which is equivalent to 127.2% according to Fibonacci. However, the second corrective wave will start sooner or later.

On the larger wave scale, the upward trend section's wave pattern has taken on an elongated form but is likely completed. We have seen five upward waves, which are likely the structure of a-b-c-d-e. Next, the pair formed four three-wave structures: two downward and two upward. Currently, it has likely entered the stage of building another extended downward three-wave structure.