On Thursday, the AUD/USD pair rebounded from recent lows amid the US dollar's broad weakness. However, the term "weakness" is not entirely accurate in this context. The US dollar has only retreated from Wednesday's highs, and there are no fundamental prerequisites for any significant turning point in the situation. The greenback is still quite strong in the major dollar pairs: the escalation of the political crisis in the US (prospects of a shutdown), rising treasury yields (multi-year highs), and rising oil prices create a favorable environment for the US dollar to strengthen further.

On the other hand, the Australian dollar is forced to follow the quoted currency. For example, on Wednesday, traders generally ignored the Australian Consumer Price Index report, which showed that inflation accelerated last month. Despite everything, the pair moved sharply lower, setting an 11-month low. This indicates that Australian fundamentals are not currently at play: the US dollar takes the lead, which is reacting to increased risk aversion and rising oil prices.

Nevertheless, despite the dollar rally, traders should pay attention to the Australian economic reports. These can be considered as "delayed-action releases." This is especially true for inflation, especially in light of recent events (change in leadership at the Reserve Bank of Australia, the "hawkish" minutes of the last central bank meeting, and so on). Therefore, the CPI report that was published on Wednesday still leaves an impression as the RBA is scheduled to hold its October meeting next week.

This will be the first meeting under the leadership of Michelle Bullock, who succeeded Philip Lowe. She held the position of deputy head of the RBA for a long time and has now taken the reins of the central bank. No extraordinary changes are expected, but her recent rhetoric has been somewhat hawkish. To be more precise, she has repeatedly expressed concern about the high level of inflation in the country and the slow pace of decrease in the rate of inflation. Bullock has stated that managing inflation will be a huge task and that the Bank may even consider raising interest rates again "if key inflation indicators start to pick up."

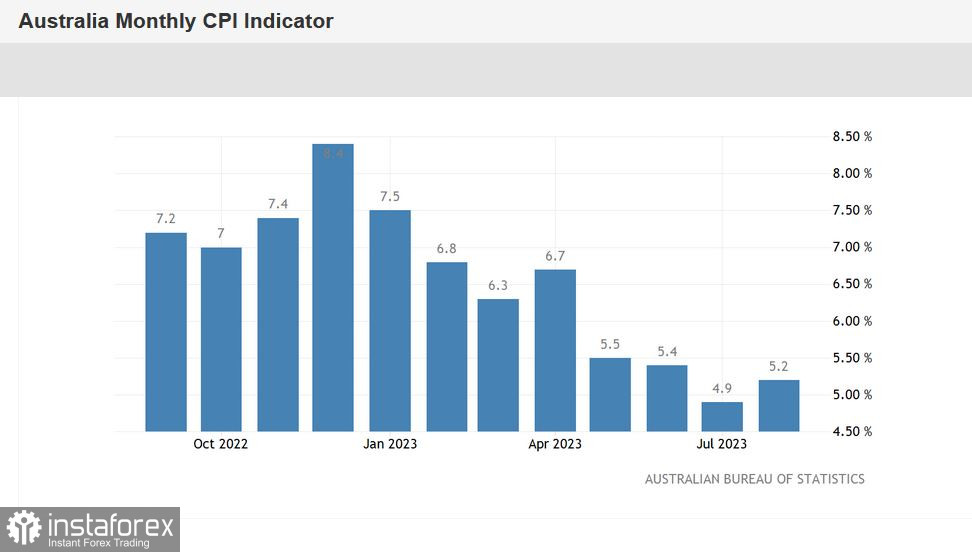

Her concerns have been validated - inflation in August showed an upward trend after several months of decline. For instance, Australia's inflation rate rose 5.2% y/y in August, up from 4.9% y/y in July. This marked the first acceleration in inflation since April when the figure was at 6.7%. The report's structure indicates that the most significant price increases occurred in the areas of housing (+6.6%), insurance and financial services (+8.8%), transportation (+7.4%), and food and non-alcoholic beverages (+4.4%).

And although the August CPI matched the consensus estimate, the fact remains: inflation in Australia is accelerating once again.

Take note that even before Wednesday's CPI report, some currency strategists (including Commerzbank economists) had alrady warned their clients that if inflation in August accelerated, then another rate hike in October or November "would not be so unlikely."

In my opinion, the likelihood of the RBA resorting to another rate hike in October is quite low because central bank members do not yet have data on inflation for the third quarter. However, there is a high chance of a more hawkish tone from the RBA at the upcoming meeting. Bullock may consider the possibility of a rate hike at the November meeting, linking this issue to the dynamics of quarterly inflation. China, which surprised RBA members with weak growth dynamics in August, can also play an (indirect) role here. After a series of disappointing reports from China, there was surprising growth in some indicators. For instance, retail sales in China grew by 4.6% in August from a year ago, beating expectations for a 3% growth forecast, and industrial production increased by 4.5% YoY, against a forecast of 3.9% growth.

The results of the October meeting will be announced next Tuesday. If by that time the dollar rally subsides and the RBA supports the aussie, AUD/USD bulls will have reason for a significant counterattack.

However, as of now, trading the pair seems risky. Long positions are risky because we are currently observing a correction of the US dollar, not the Australian dollar's strength. Moreover, the pair has not yet surpassed the resistance level of 0.6430 (the middle line of the Bollinger Bands indicator, coinciding with the Tenkan-sen line on the daily chart), which is a minimum requirement for further upward movement. Selling the pair is also risky because hawkish expectations regarding the RBA's future course of actions can hinder AUD/USD bears from conquering new price territories. Therefore, at the moment, it is most advisable to adopt a wait-and-see position regarding this pair.