Analyzing Thursday's trades:

GBP/USD on 30M chart

The GBP/USD traded with clear positivity at the end of Thursday. However, the descending trendline remains relevant, so the current upward movement is nothing more than a correction. Nevertheless, we have already warned you that a correction would start because the pound had been falling relentlessly every day, regardless of the fundamental and macroeconomic background. Therefore, a correction was inevitable, and the pair significantly rose on Thursday. Moreover, the macroeconomics and fundamentals had nothing to do with the upward movement.

To start with, there were no important or interesting events in Britain. Therefore, traders could only analyze US reports on GDP for the second quarter and jobless claims. The GDP in the third estimate came in line with forecasts, and jobless claims were better than expected. So, if any currency had the right to appreciate on Thursday, it should have been the dollar! However, the market got tired of constantly selling the pair, so a correction began. We believe it will continue.

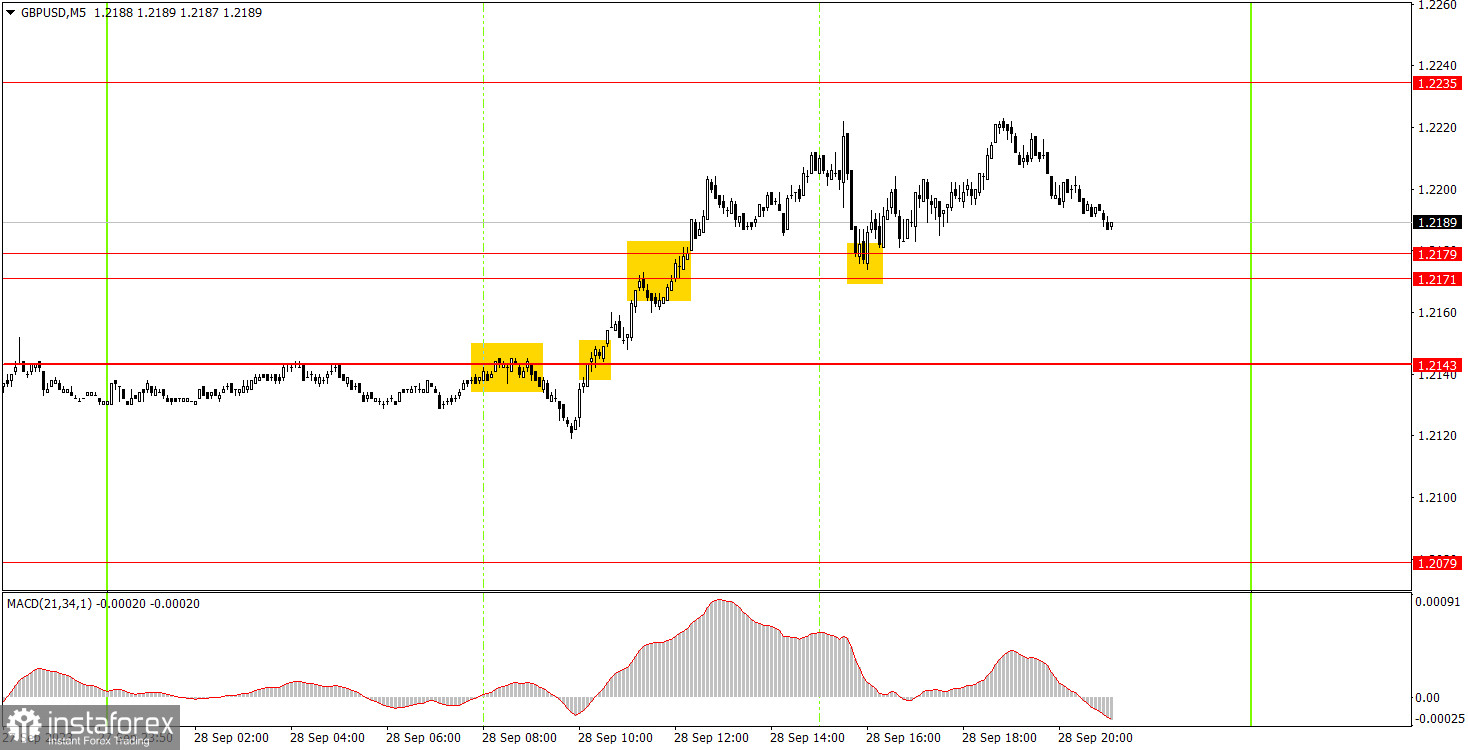

GBP/USD on 5M chart

The 5-minute chart showed decent volatility so the trading signals were quite interesting. Unfortunately, the first sell signal near the level of 1.2143 turned out to be false, and it was impossible to set a stop loss to breakeven on it. However, there was another buy signal, and the price subsequently surpassed the 1.2171-1.2179 range, then bounced off it from above and remained above this mark until the end of the day. Thus, the long position should have been manually closed closer to the evening with a profit of about 40-45 pips. This would have definitely covered the loss from the first trade.

Trading tips on Friday:

On the 30-minute chart, GBP/USD has finally entered a corrective phase. The pound may trade higher for quite some time, even without specific fundamental and macroeconomic reasons behind it. After that we expect it to resume its decline as we believe that the balance between the pair has not been fully restored yet. The key levels on the 5M chart are 1.1992-1.2008, 1.2065-1.2079, 1.2143, 1.2171-1.2179, 1.2235, 1.2307, 1.2372-1.2394, 1.2457-1.2488, 1.2544, 1.2605-1.2620, 1.2653, 1.2688. Once the price moves 20 pips in the right direction after opening a trade, you can set the stop-loss at breakeven. On Friday, the UK will release its GDP data for the second quarter, and the US will publish several secondary reports on personal spending and income, as well as consumer sentiment.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.