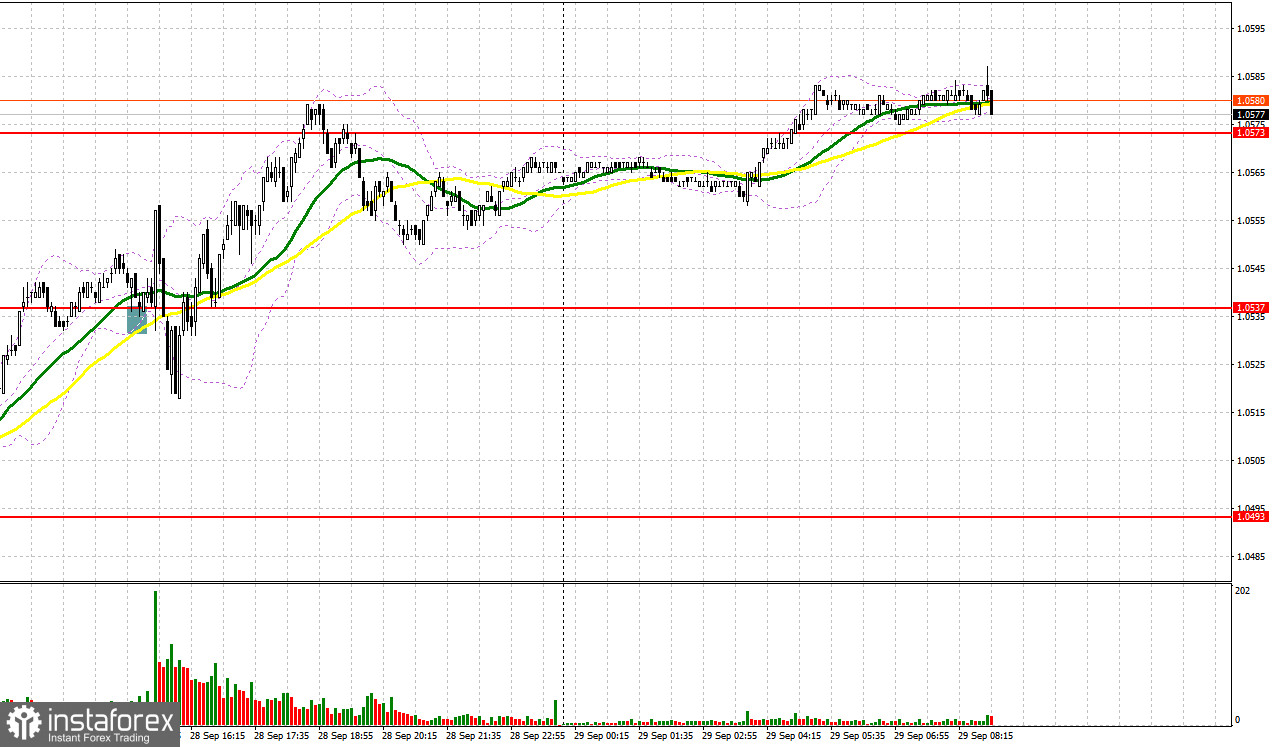

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0516 as a possible entry point. A rise and a false breakout at this mark produced a great sell signal, but the pair did not fall which shows that euro buyers are fairly active in the area of annual lows. In the afternoon, a breakout and consolidation above 1.0537 formed a buy signal, pushing the price up by 40 pips.

For long positions on EUR/USD:

The euro gathers recovery momentum, and today a lot will depend on the incoming fundamentals. In the first half of the day, we are expecting unemployment figures in Germany, as well as the flash version of the Eurozone Consumer Price Index. A fall in inflation will have a positive effect on the euro, while its growth will inevitably lead to another sell-off. In addition to all this, European Central Bank President Christine Lagarde, who has recently been very categorical in her statements regarding the future policy, will deliver a speech, which could exert pressure on the single currency. For this reason, I will act on a decline of the nearest support at 1.0563, formed at the end of yesterday. Slightly below this level is marked by moving averages that can support the pair. A false breakout around that mark will confirm the entry point for long positions, in hopes of building an upward correction and updating the nearest resistance at 1.0608. A breakout and a downward test of this range, bolstered by strong data from the eurozone, will increase demand for the euro, providing a chance for a surge to 1.0643. The furthest target would be the 1.0671 area, where I plan to take profits. If EUR/USD declines and there is no activity at 1.0563, the pressure will return. In such a case, only a false breakout near 1.0531 will signal a buying opportunity. I will open long positions directly on a rebound from 1.0493, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The sellers slightly retreated at the end of the month, but that was expected as dealing with yearly lows the first time around is not easy. An increase in eurozone inflation will enable bears to defend the nearest resistance at 1.0608, where a false breakout will give a sell signal, paving the way towards the 1.0563 low. Only after breaching this range and settling below it, on the back of strong US data, and after completing an upward retest, do I anticipate another sell signal with a target at 1.0493, where I expect significant buyer activity. The furthest target is the 1.0439 area, where I plan to take profit. If EUR/USD moves upwards during the European session and bears are absent at 1.0608, bulls will continue the upward correction. In such a scenario, I would delay short positions until the price hits the resistance at 1.0643, where the euro has already fallen once. I would also consider selling there but only after an unsuccessful consolidation. I will open short positions directly on a rebound from the high of 1.0671, considering a downward correction of 30-35 pips.

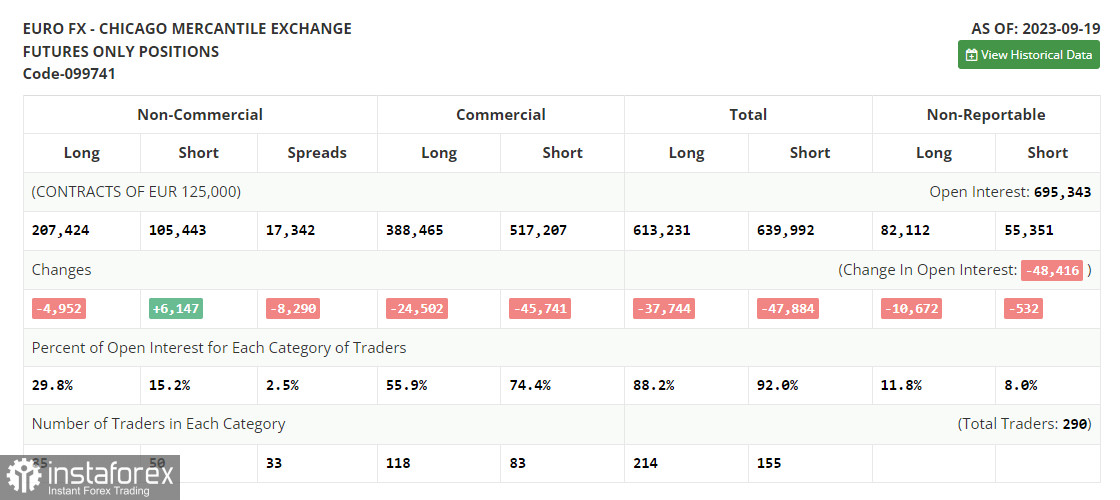

COT report:

The COT report for September 19 showed a sharp decline in long positions and a rise in the short ones. Adverse shifts in the Eurozone's economic landscape and looming threats of further interest rate hikes by the European Central Bank (ECB) have bolstered the prevailing bearish sentiment. Interestingly, the euro did not find much respite even after the Federal Reserve decided to hold rates steady. However, it is worth noting that the Fed clearly communicated the possibility of another rate increase before the year ends. The COT report indicates that non-commercial long positions dipped by 4,952 to stand at 207,424. Conversely, non-commercial short positions saw an increase of 6,147, reaching a total of 105,443. As a result, the spread between long and short positions narrowed by 8,290 contracts. The closing price dropped to 1.0719 from 1.0736, further underscoring the bearish market sentiment for EUR/USD.

Indicator signals:

Moving averages:

Trading above the 30- and 50-day moving averages indicates an upward correction of the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0531 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.