EUR/USD

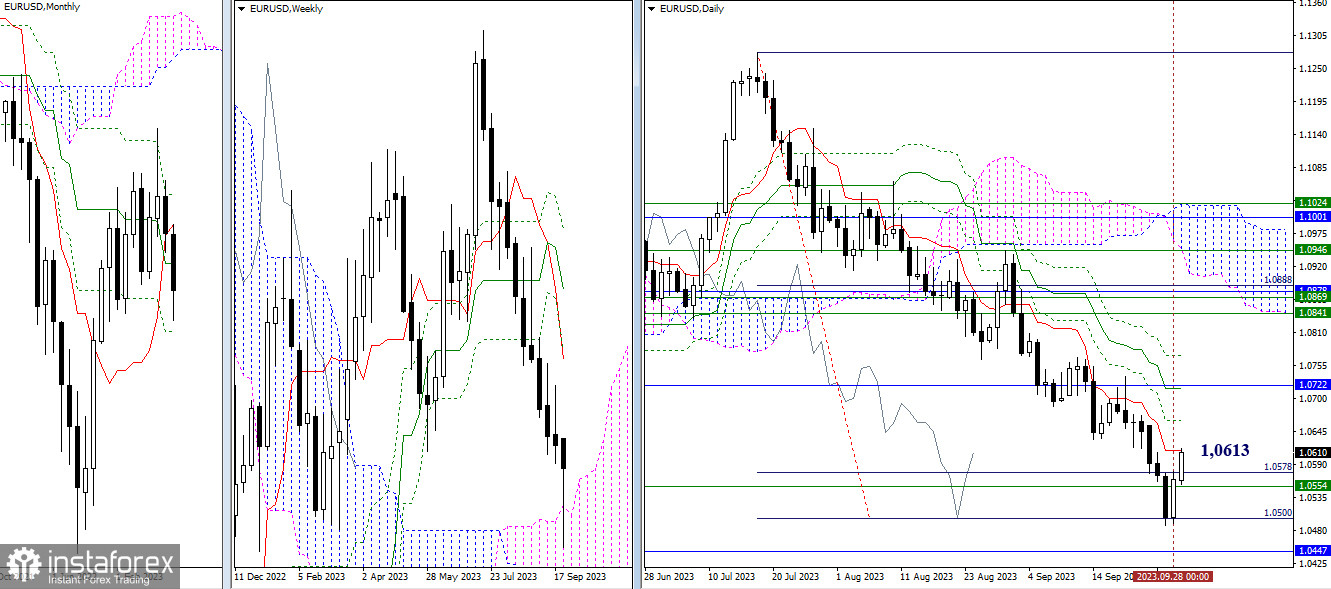

Larger timeframes

Today is the last working day of September. The outcome of the trading day is crucial because the one-month candlestick's correction over the last two days has already indicated a rather long lower shadow. If the result is confirmed and sustained, we can affirm that the bears have fulfilled their goals in this chart section. They have achieved a 100% daily target by breaking through the Ichimoku cloud (1.0500) and testing the upper border of the weekly cloud (1.0554).

The upward correction which started yesterday reached its first target today: the resistance of the daily short-term trend (1.0613). Breaking this level and a further development of the correction will indicate that the bulls have higher targets in this area. The next task in this scenario will be testing and possibly offsetting the Ichimoku's intraday Death Cross (1.0664 – 1.0717 – 1.0771), which is now reinforced by the one-month medium-term trend (1.0722). If the corrective rise is limited to what has been achieved, the return of the bears will shift market focus to the final level of the Ichimoku's one-month Golden Cross (1.0447).

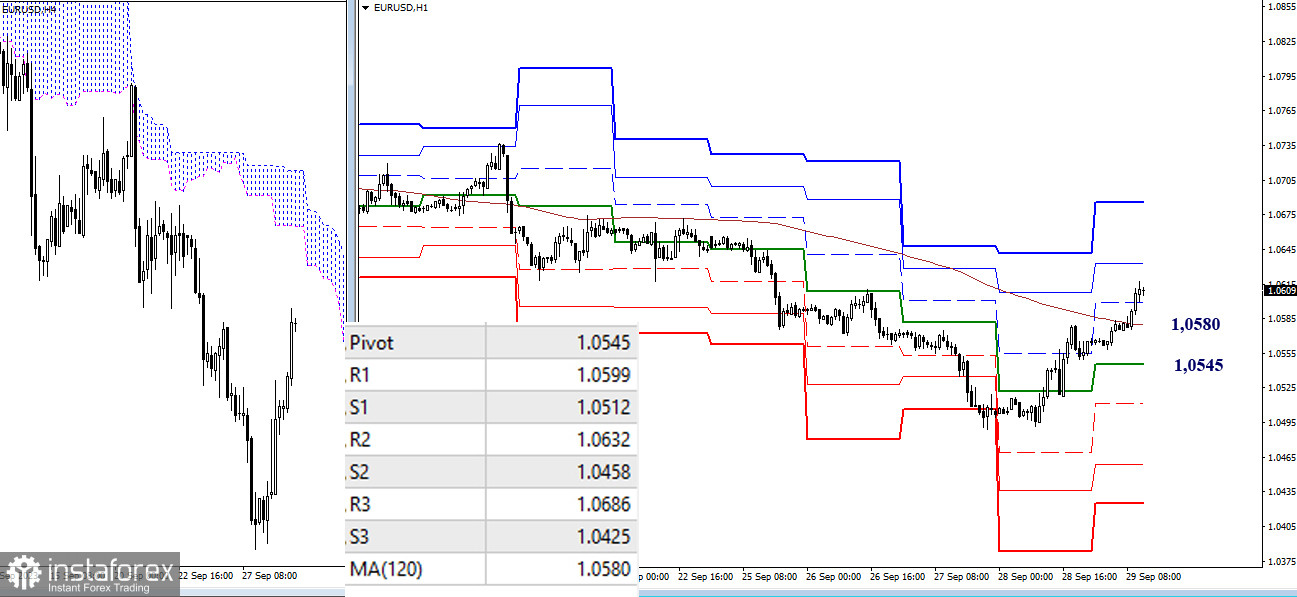

H4 – H1

On the shorter timeframes, the bulls have, by now, signaled an intention to change the current balance of trading forces. The bulls managed to overcome and settle the price above the weekly long-term trend (1.0580). Their intraday targets can be pinpointed at 1.0632 – 1.0686 (classic pivot levels). Returning the key levels, with today's being located at 1.0580 (weekly long-term trend) and 1.0545 (central daily Pivot level), in favor of the bears will bring back the bearish targets, which are currently determined within 1.0512 – 1.0458 – 1.0425 (supports of classic pivot levels).

***

GBP/USD

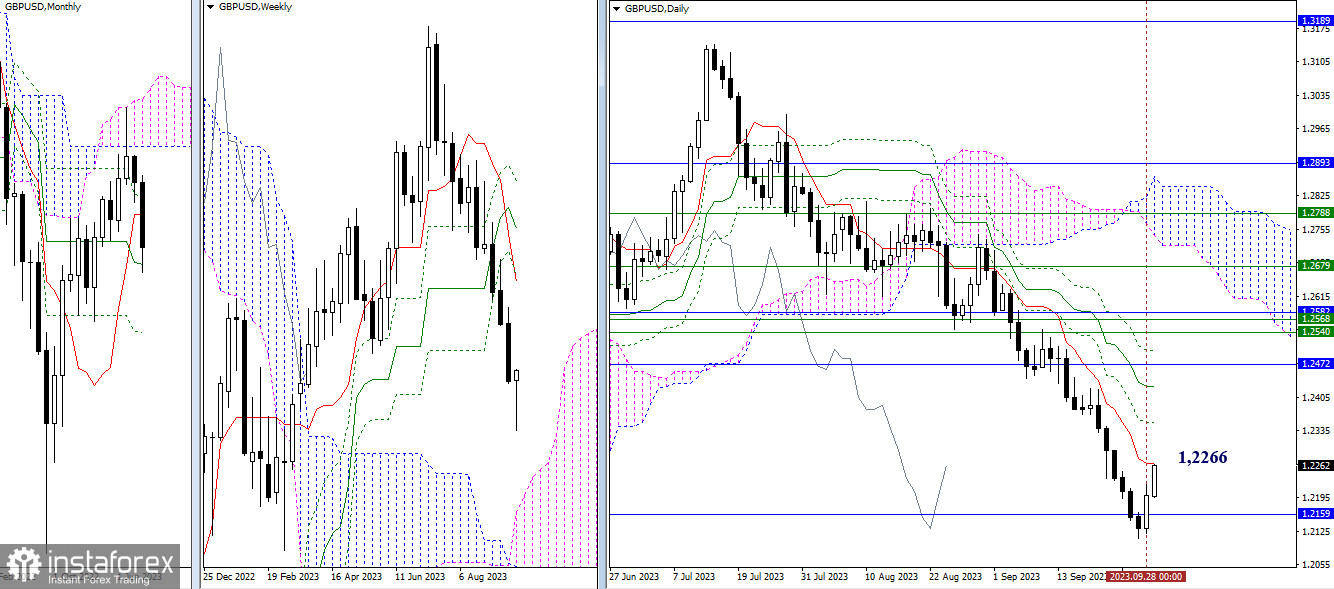

Larger timeframes

Testing the one-month medium-term trend (1.2159) opened the door for an upward correction. The bulls for the current period managed to push GBP/USD to the daily short-term trend (1.2266). Today, the instrument is closing the week and the month. If the bulls can secure the result, we can expect new a new bullish sequence and testing subsequent resistances (1.2352 – 1.2427 – 1.2472 and so on).

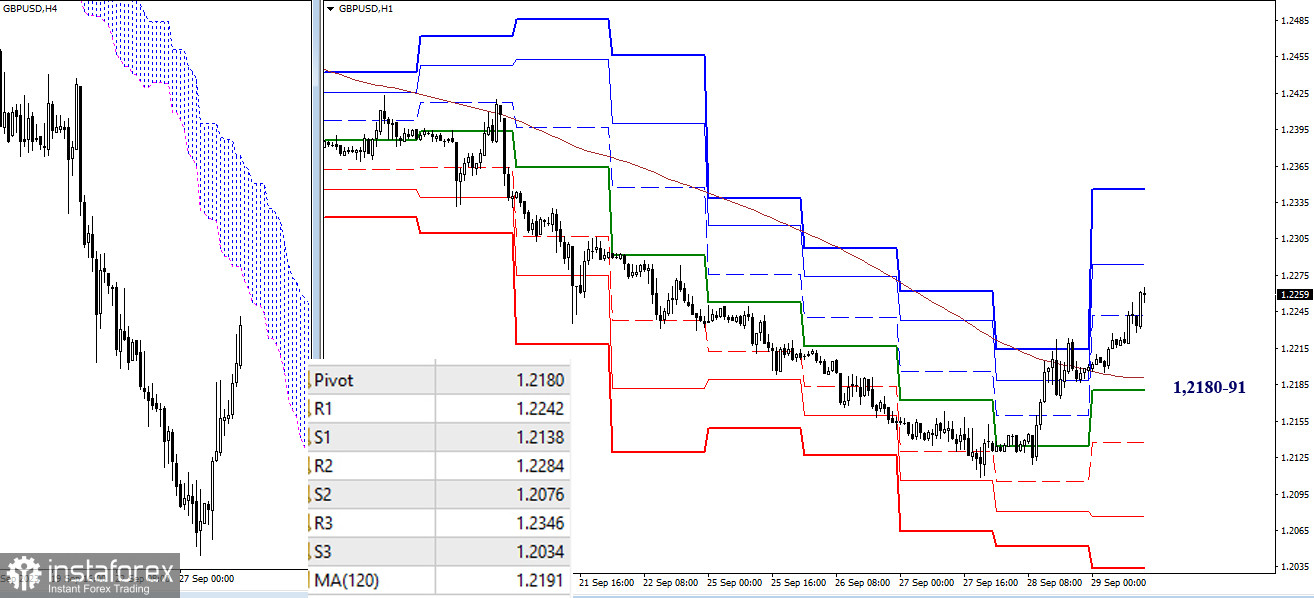

H4 – H1

On shorter timeframes, the bulls have taken the primary advantage. Traders are strengthening bullish sentiment. Intraday targets are the resistance levels of classic pivot points. The first pivot level has been breached, with the next significant levels possibly being R2 (1.2284) and R3 (1.2346). Key levels for these timeframes today act as supports seen as a cluster around 1.2180-91 (central daily pivot level + weekly long-term trend). If the bulls lose control over these levels, this could again shift the balance of trading forces in favor of the bears.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 – classic pivot

points + 120-period Moving Average (weekly long-term trendline)