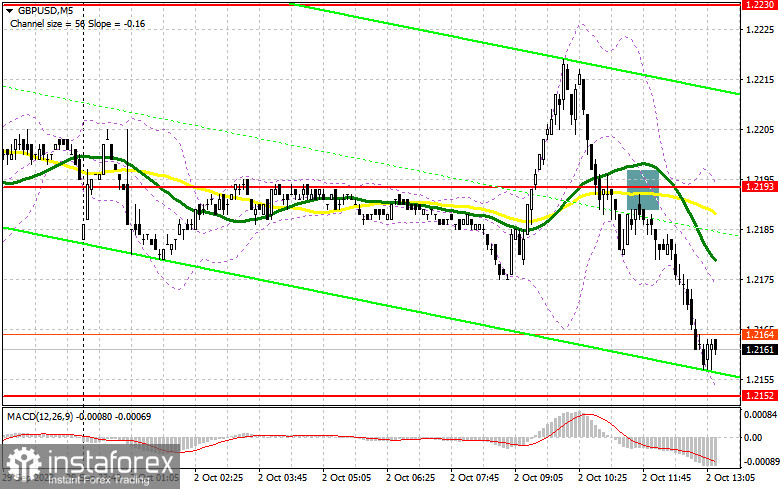

In my morning forecast, I drew attention to the level of 1.2193 and recommended making entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The return and test from below this range after the release of rather weak data from the UK led to a selling signal, resulting in a drop of almost 40 points. In the second half of the day, the technical picture was reevaluated.

To open long positions on GBP/USD, the following is required:

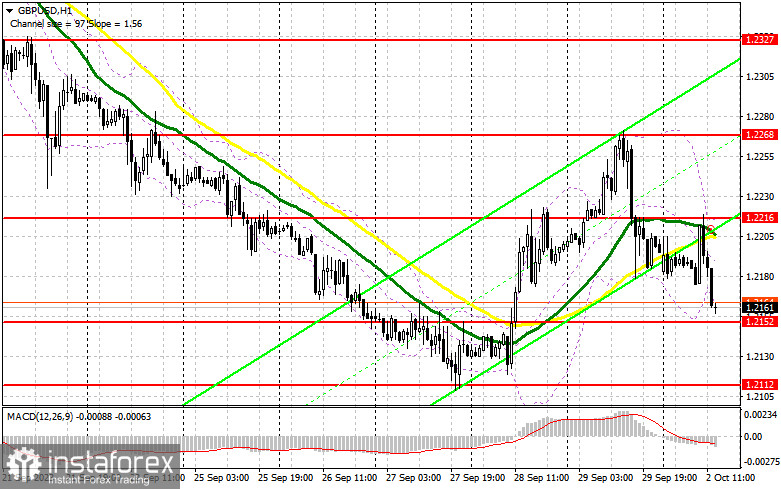

Considering that the final data on manufacturing activity in the UK for September did not bring good news, pressure on the pound has returned. Ahead of us are similar indicators, but this time for the US. The ISM Manufacturing Index will determine the direction of the pair in the second half of the day, and good data is likely to weaken the pound even further. Traders will pay close attention to speeches made by John Williams, Patrick T. Harker, and the Chairman of the Federal Reserve, Jerome Powell. If the pressure on the pound persists, buyers will need to demonstrate their presence around 1.2152. The formation of a false breakout at this level will provide an entry point for long positions with a target correction towards 1.2216, a new resistance formed during the day. Breaking and holding above this range will strengthen the confidence of buyers, giving a signal to open long positions with an exit at 1.2268, where I expect larger sellers to appear. The ultimate target will be the area around 1.2327, where I will take a profit. In the scenario of a decline to 1.2152, as well as the absence of buyer activity there in the second half of the day, pressure on GBP/USD will intensify. In this case, only the defense of the monthly minimum at 1.2112, as well as a false breakout there, will signal the opening of long positions. I plan to buy GBP/USD on a rebound only from the minimum of 1.2072 with a target correction of 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Apparently, the correction in the pound has ended, barely having a chance to start. Of course, selling around daily lows is a rather challenging task, so a more optimal scenario would be short positions on the rise after defending the new resistance at 1.2216, where the moving averages, favoring the bears, are also located. A false breakout will provide an entry point, paving the way to 1.2152. Breaking and retesting this range from bottom to top will deliver a more significant blow to the bullish positions, canceling out the entire upward correction and providing an opportunity for a drop to the support at 1.2112. The ultimate target remains the area around 1.2072, where I will take a profit. In the event of GBP/USD rising and no activity at 1.2216, which is a new resistance level coinciding with the local daily high, buyers will have an excellent chance to continue building an upward correction. In this case, I will postpone selling until a false breakout at 1.2268. If there is no downward movement, I will sell the pound immediately on the rebound from 1.2327, but only with the expectation of a pair correction down by 30-35 points within the day.

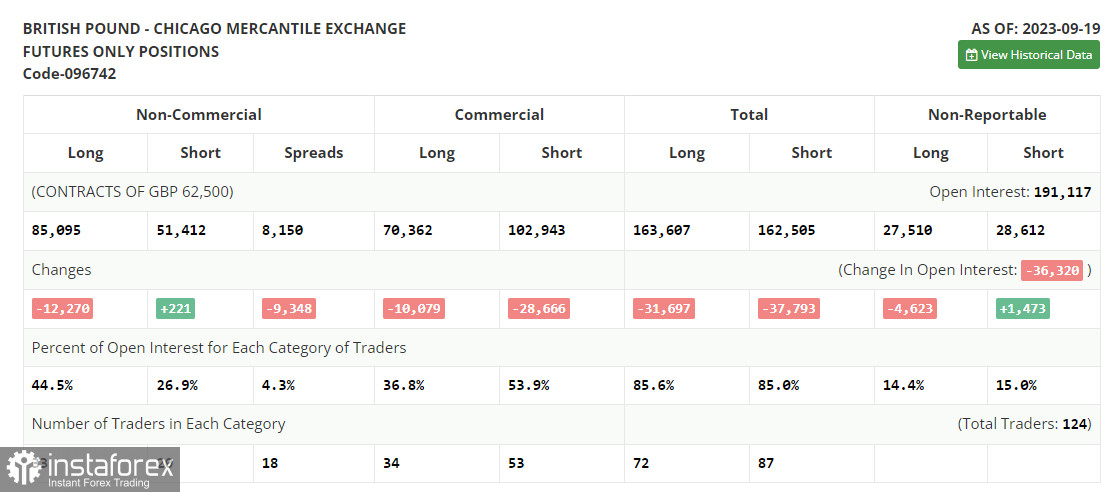

In the COT report (Commitment of Traders) for September 19th, there was a reduction in long positions and a minimal increase in short positions. This indicates that while there are fewer pound buyers, there is no clear increase in sellers. The released data on inflation reduction in the UK influenced the Bank of England's decision to keep rates unchanged, surprising many. Traders perceived this news as negative, as it appears that the regulator is at the peak of its rate hike cycle, making the pound less attractive in this position. In the latest COT report, it is stated that long non-commercial positions decreased by 12,270 to a level of 85,095, while short non-commercial positions increased by only 221 to a level of 51,412. As a result, the spread between long and short positions decreased by 9,348. The weekly price dropped to 1.2390 from 1.2486.

Indicator signals:

Moving averages

Trading is taking place below the 30 and 50-day moving averages, indicating clear problems for pound buyers.

Note: The period and prices of the moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator around 1.2170 will act as support.

Description of indicators:

Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.Bollinger Bands. Period 20.Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.Long non-commercial positions represent the total long open positions of non-commercial traders.Short non-commercial positions represent the total short open positions of non-commercial traders.The net non-commercial position is the difference between the short and long positions of non-commercial traders.