With the unemployment rate decreasing from 6.5% to 6.4%, labor market in the eurozone showed some improvement. However, in reality, the data remains slightly worse than forecasts, as analysts expected unemployment to rise from 6.4% to 6.5%.

This resulted to dollar continuing to rise, which dragged euro and pound down. Other markets, such as the commodity market, fell as well.

At the time of writing, dollar surpassed psychological levels, remaining excessively overbought. The market will likely seize this opportunity to trigger a correction, especially amid today's release of data on job vacancies in the US. Forecasts say it will decrease from 8.8 million to 8.6 million. This, together with the report from the US Department of Labor last Friday, will cause some weakening to dollar.

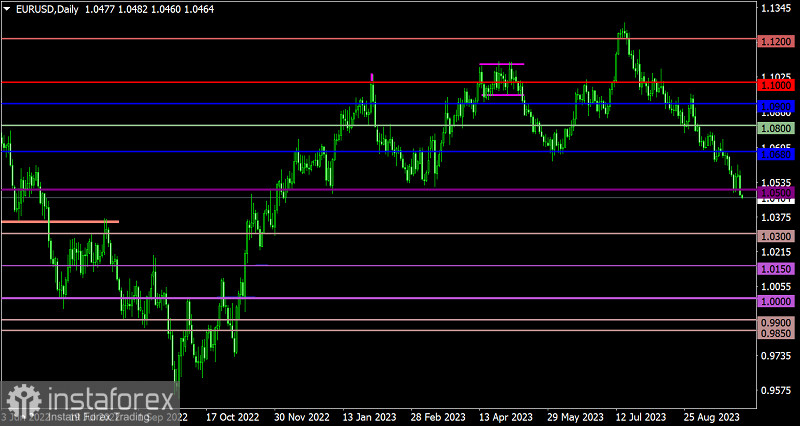

During an intense decline, EUR/USD broke through the support level of 1.0500, causing the downward trend to extend. This indicates high speculation among traders, so staying below 1.0500 will likely lead to the further fall of the pair. However, although the quote lost nearly 800 pips since the beginning of the downward cycle, no complete correction occurred in the pair.

GBP/USD also extended the downward cycle, with sellers targeting the psychological level of 1.2000. Traders may reduce their short positions around this area.