EUR/USD

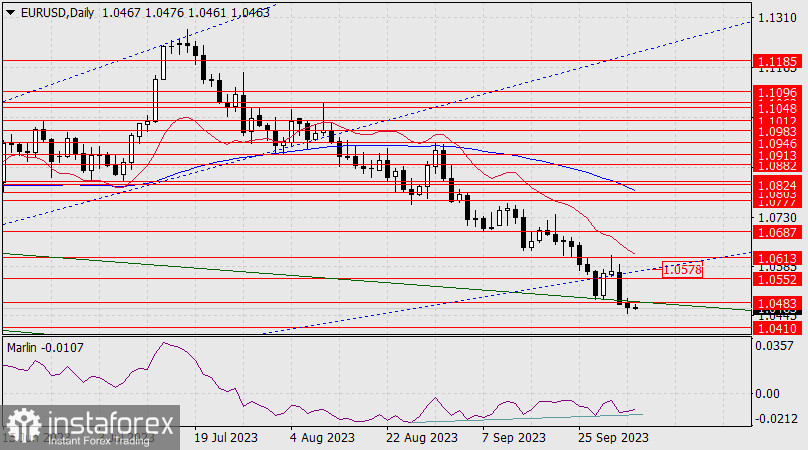

Yesterday, the euro settled below the level of 1.0483 and the channel line. Now the price may fall to the support level of 1.0410 since it consolidated below the support level. However, a corrective rise towards the level of 1.0552 or a retest of the Fibonacci ray (1.0578) is also quite ripe. Clearly, market players are preparing for the release of the US employment data.

The consensus forecast for the non-farm payrolls is for a rise by 163,000 in September, down from 187,000 in August. Based on unemployment claims, we do not expect non-farms to deviate significantly from forecasts. However, the forecast for unemployment at 3.7% versus the previous 3.8% is highly doubtful, as the ISM employment sub-index and the main ISM Services PMI are expected to decline. If it deviates significantly from forecasts, the euro may rise today.

On the 4-hour chart, a convergence between the price and the oscillator has already formed. It can provide support for the weak convergence on the daily chart, but it may be broken due to bearish technical factors on the higher timeframe. To resolve such a situation, let's wait for the release of US data.