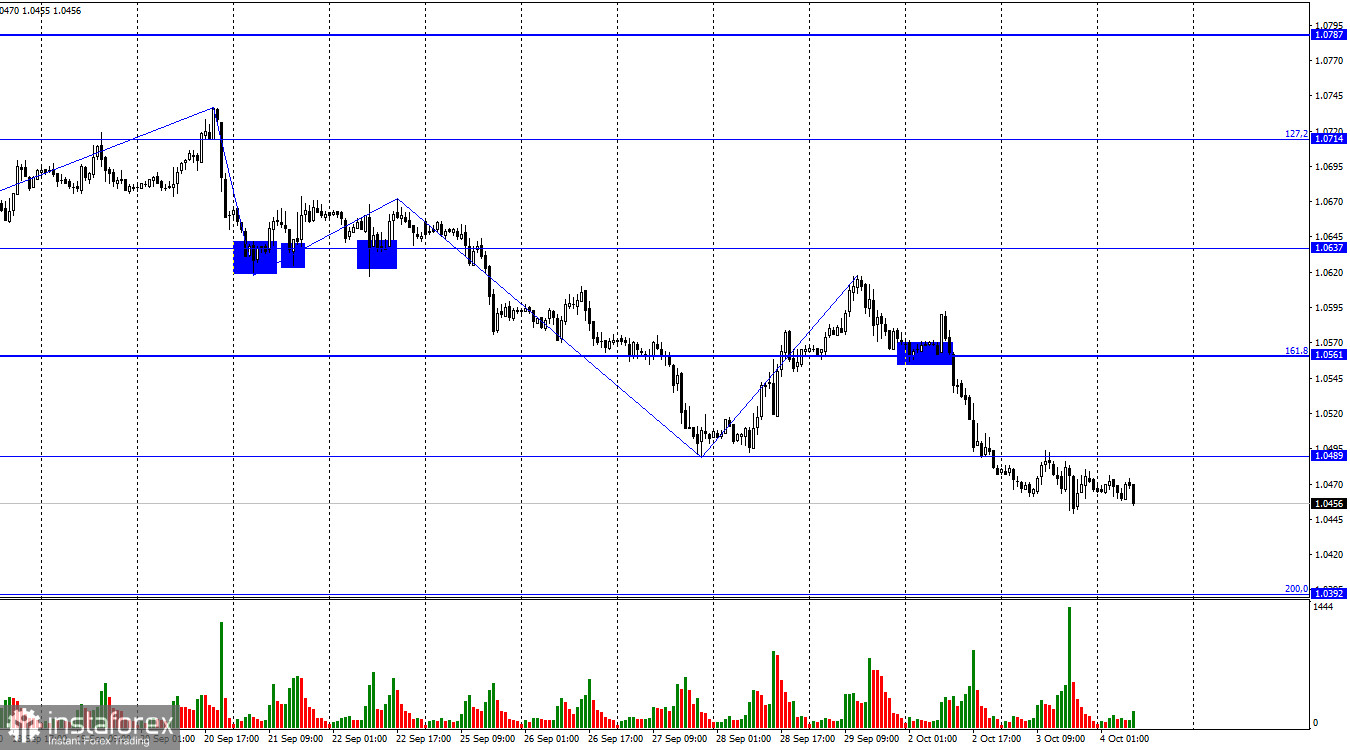

On Tuesday, the EUR/USD pair rebounded from the 1.0489 level from below, allowing it to continue its decline toward the next corrective level of 200.0% (1.0392). If the pair can establish itself above the 1.0489 level, traders can expect a reversal in favor of the European currency and some growth towards the 161.8% Fibonacci level at 1.0561.

Yesterday, the pair's movement was very weak and even horizontal. Trader activity was minimal, so there were no changes in the graphical or wave analysis. Thus, the bearish trend remains intact, with the last wave being downward, and there is no sign of a trend reversal. As I mentioned earlier, it may take several days for signs of a bullish trend reversal to appear, as two new waves are needed, or the pair needs to rise to at least 1.0620.

The background information on Tuesday was also weak, but the one report that became known can have significant consequences for the US dollar. The Job Openings and Labor Turnover Survey (JOLTS) in the US showed 9.61 million job openings in August, beating traders' expectations of 8.8 million. The July figure was revised upward to 8.92 million. While bearish traders did not take advantage of this report yesterday to further their cause, the overall prospects for the US dollar remain favorable. The first US labor market report of the week can be considered positive. If the others do not disappoint, we may see another strong rise in the US currency.

On the 4-hour chart, the pair has fallen to the 127.2% Fibonacci retracement level at 1.0466. A rebound from this level would allow for a reversal in favor of the European currency and a new upward movement toward the upper boundary of the descending trend corridor. I still recommend expecting a strong rise in the euro only after it closes above the corridor. If the pair's rate consolidates below the level of 1.0466, the likelihood of further decline toward the next corrective level of 161.8% (1.0245) increases.

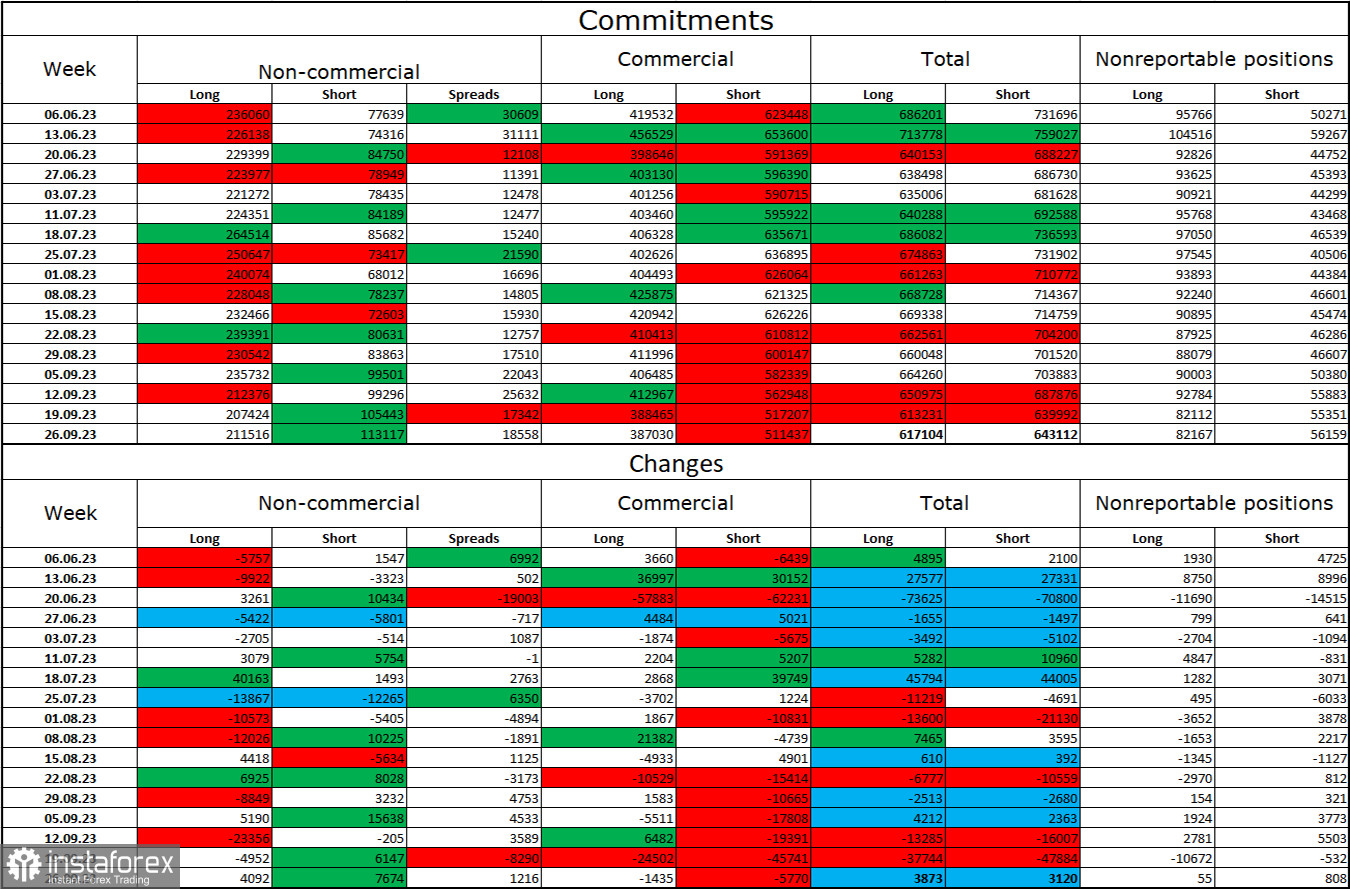

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,092 long contracts and 7,674 short contracts. The sentiment of large traders remains bullish but has noticeably weakened in recent weeks and months. The total number of long contracts held by speculators is now 211,000, while short contracts amount to 113,000. The difference is now only double, whereas a few months ago, the gap was threefold. I believe that the situation will continue to change in favor of the bears over time. Bulls have dominated the market for too long, and now they need a strong information background to sustain the bullish trend. Such a backdrop is currently absent. The high value of open long contracts suggests that professional traders may continue to close them in the near future. I believe that the current numbers allow for a continuation of the euro's decline in the coming months.

News Calendar for the US and the European Union:

European Union - Germany's Business Activity Index in the Services Sector (07:55 UTC).

European Union - Business Activity Index in the Services Sector (08:00 UTC).

European Union - Retail Sales Volume (09:00 UTC).

USA - Change in Non-Farm Employment from ADP (12:15 UTC).

USA - S&P Global Services PMI Business Activity Index (13:45 UTC).

USA - Institute for Supply Management (ISM) Non-Manufacturing Purchasing Managers' Index (14:00 UTC).

European Union - ECB President Lagarde will deliver a speech (16:00 UTC).

On October 4th, the economic events calendar includes several important entries. The impact of the information background on traders' sentiment today can be significant.

Forecast for EUR/USD and trader recommendations:

Selling the pair was possible when it closed below the level of 1.0561 on the hourly chart with a target of 1.0489. The first target has been reached and surpassed; you can continue selling with a target of 1.0392. There's no need to rush into buying today; you can consider opening small, long positions when it closes above the level of 1.0489 on the hourly chart with a target of 1.0561.