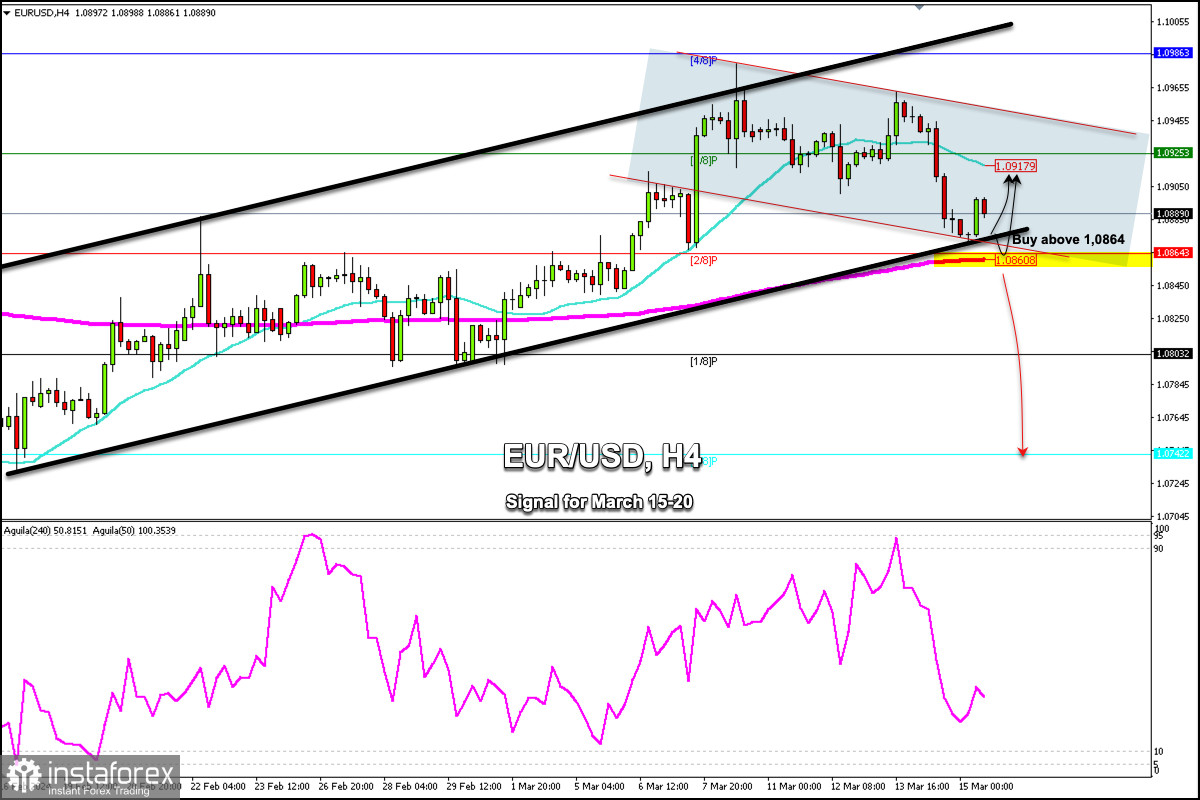

The euro is trading around 1.0886, bouncing after having reached the bottom of the uptrend channel forming since February 16. The instrument is expected to continue rising in the next few hours and could reach the 21 SMA around 1.0917.

If the Euro bounces around 2/8 Murray located at 1.0864 or around the 200 EMA (1.0860) in the next few hours, we could expect it to resume its bullish cycle and could reach 1.0925 and could finally reach the top of the downtrend channel around 1.0940.

The euro has been trading within a downtrend channel since March 6. EUR/USD is expected to trade above 1.08648 and below 1.0950 in the coming days.

In case a strong break below 1.0860 (200 EMA) occurs, a fall towards 0/8 Murray located at 1.0775 is expected to follow. This could be interpreted as a change in trend and an opportunity to sell in the short term.

As long as the euro trades above 1.0864, the outlook could remain bullish in the short term and EUR/USD could reach the psychological level of 1.10. Our trading plan for the next few hours is to buy the euro above 2/8 Murray located at 1.0864 or at the current price levels of 1.0889 with targets at 1.0917, 1.0925, and 1.0945,