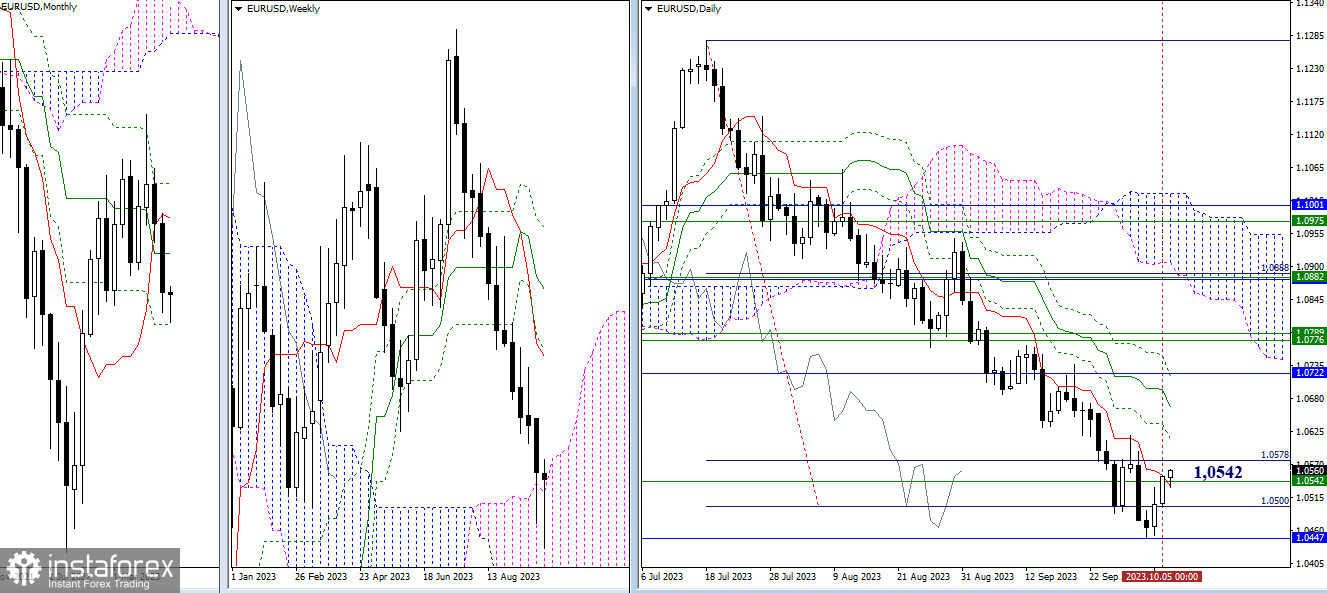

EUR/USD

Higher Timeframes

The working week is coming to an end, forming another long shadow on the weekly candlestick chart. If the bulls can maintain the current result, the rebound from the weekly cloud (1.0542) may continue to develop. This means that the bullish players will start implementing the following tasks: eliminating the death cross (1.0614 - 1.0665 - 1.0717) on the daily chart and testing strong levels such as the monthly medium-term trend (1.0722) and the weekly short-term trend (1.0756). If the bulls fail to accomplish this, consolidation may occur. Finding new prospects for bearish players is only possible after a reliable breakdown of the final support of the golden cross of the monthly Ichimoku cloud (1.0442).

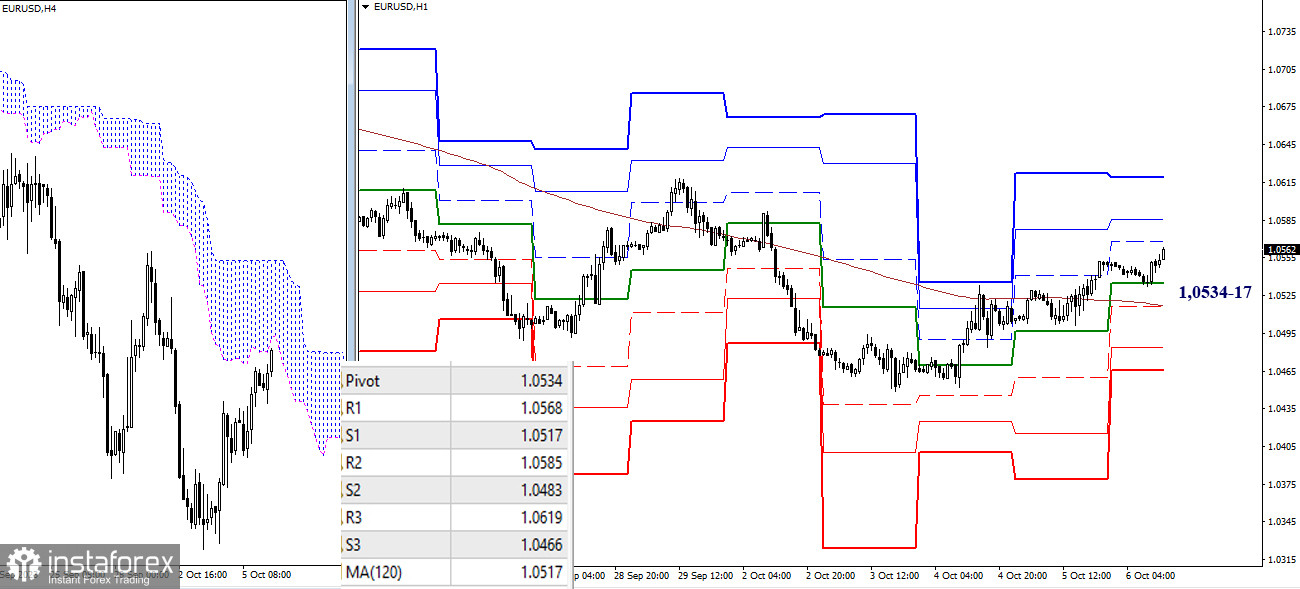

H4 - H1

On the lower timeframes, bullish players have established themselves above the weekly long-term trend (1.0517). The reference points for the intraday ascent are the resistances of the classic pivot points, which are located today at 1.0568 - 1.0585 - 1.0619. Losing 1.0517 may bring bearish plans and sentiments back to the market. In this case, the most important task will be to update the low (1.0449), and support on this path may come from 1.0483 - 1.0466 (classic pivot points).

***

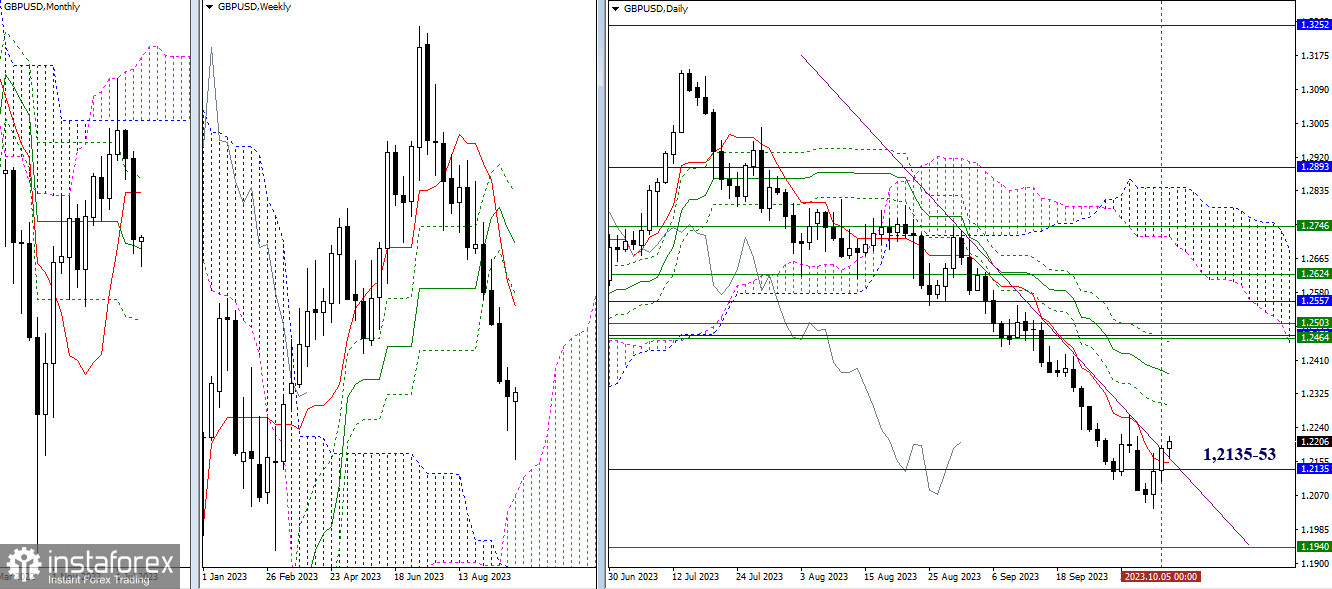

GBP/USD

Higher Timeframes

Yesterday, bulls closed the day above the range of 1.2135 - 1.2153 (monthly medium-term + daily short-term trends). The end of the workweek is approaching, and maintaining the current character of the weekly candlestick will allow for new prospects for the ascent. The nearest resistances could be the levels of the daily Ichimoku cloud (1.2294 - 1.2374), and then monthly and weekly reference points will come into play. The completion of the correction on the daily chart and the formation of a rebound from the area of 1.2135–53 will allow considering opportunities to restore the downward trend (1.2036) and open the way to the upper boundary of the weekly Ichimoku cloud (1.1940).

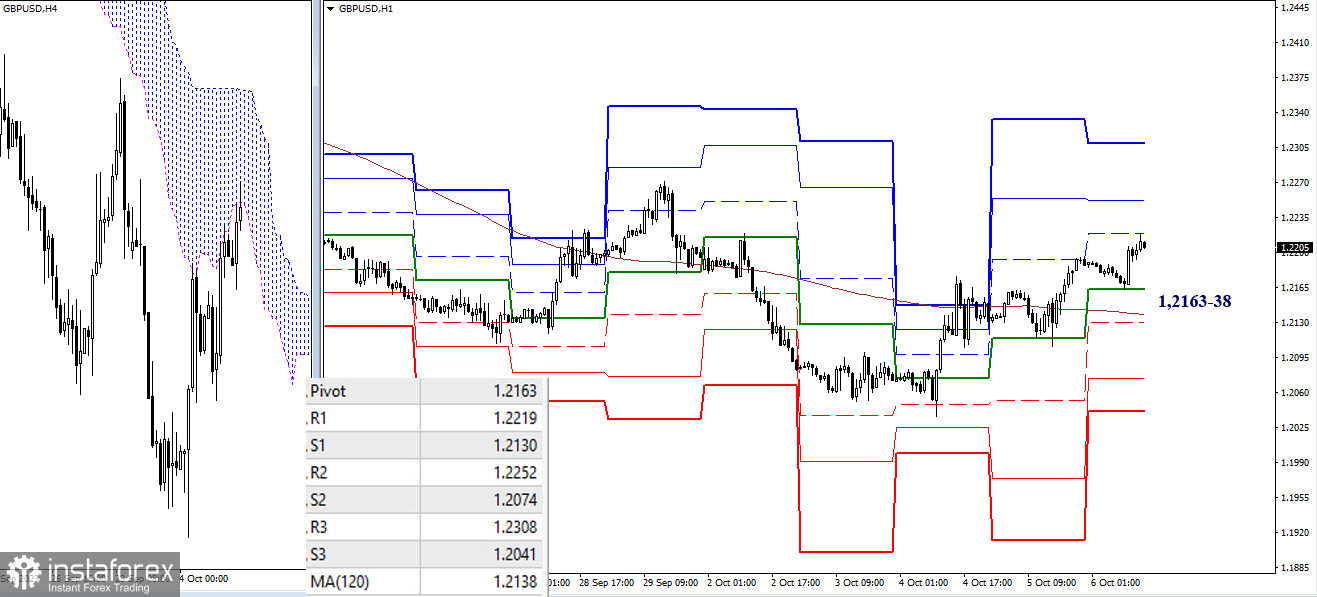

H4 - H1

On the lower timeframes, bears have gained the upper hand. As a result, they are now testing the first resistance of the classic pivot points (1.2219), with 1.2252 (R2) and 1.2308 (R3) located next. To change the current balance of power, bearish players need to regain key levels, which today unite their efforts in the range of 1.2163 (central pivot point of the day) - 1.2138 (weekly long-term trend). After that, bears' attention within the day will be directed towards breaking through the supports of the classic pivot points (1.2130 - 1.2074 - 1.2041).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)