If someone thinks that only newcomers lose money in the market, they are mistaken. Looking at the dynamics of speculative positioning on the U.S. dollar and knowing what happened with it over the past year, one can come to an interesting conclusion. The market seems to be leading hedge funds by the nose, only to leave them looking foolish in the end. And this circumstance gives hope to the "bulls" on EUR/USD.

Dynamics of speculative positions on the U.S. dollar

Throughout the first half of the year, investors were confident that a recession would occur in the third or fourth quarter. The federal funds rate is unlikely to rise above 5%, and at the start of 2024, its decline or the so-called dovish pivot of the Fed will begin. It will happen very quickly, and by the end of next year, borrowing costs will drop by 100 bps. As a result, the U.S. dollar was supposed to fall, as most Reuters experts predicted. Their EUR/USD forecast at the end of 2023 was 1.12. Some economists were talking about 1.15.

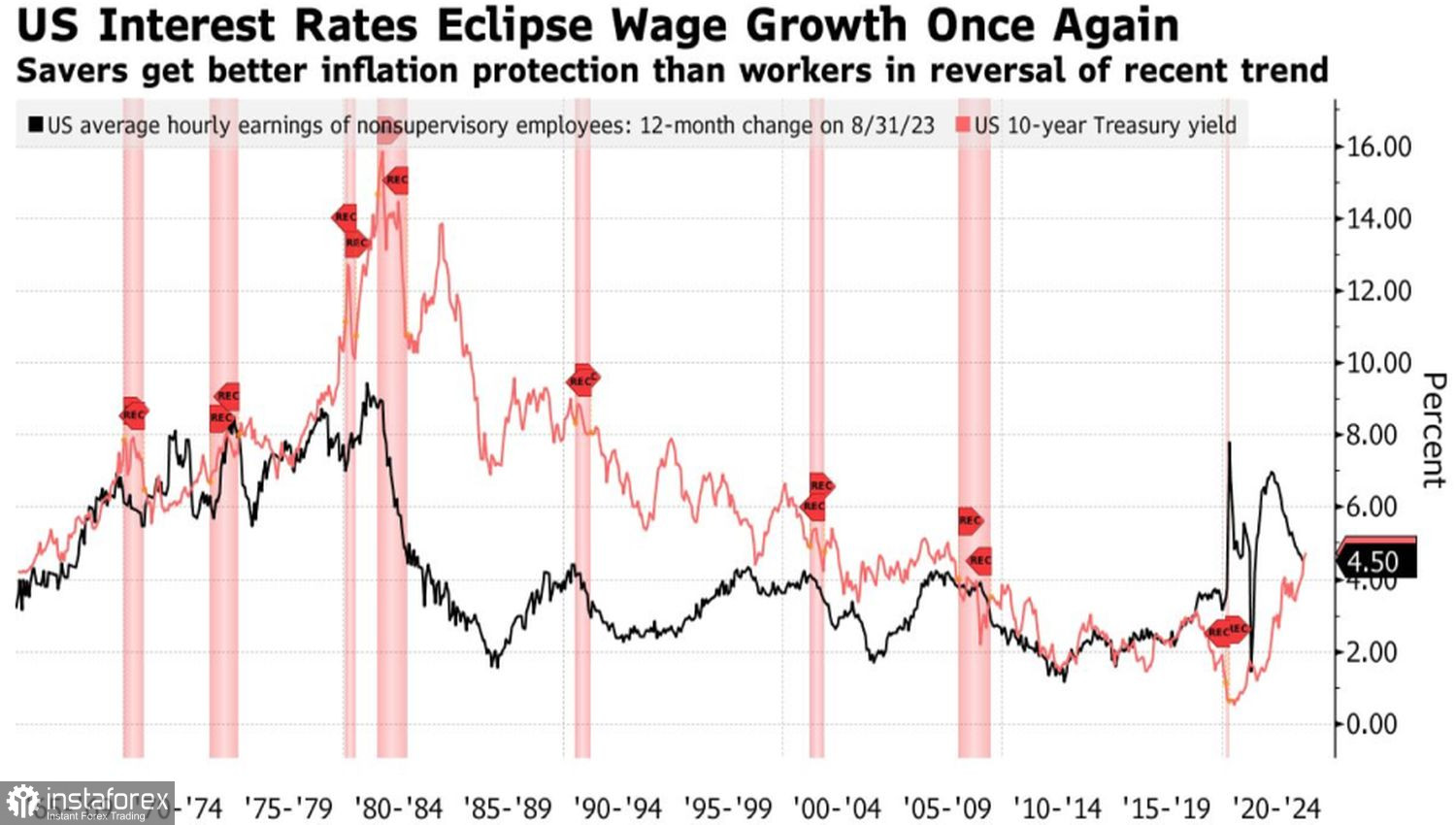

Unfortunately, betting on the weakening of the U.S. dollar did not work. The Fed made it clear that there would be no help for financial markets this time. The central bank intends to lower the federal funds rate only once in 2024 and does not rule out an increase to 5.75% in 2023. It has adopted a "higher and longer" policy. The cost of borrowing will remain at a plateau for a long time. If, of course, macroeconomic statistics allow it.

The first rider of the apocalypse could be the September U.S. labor market report. Bloomberg believes that by the end of the first month of autumn, it will retain its strength, but in October, due to mass strikes in the automotive industry and a sharp tightening of financial conditions, non-farm payrolls outside the agricultural sector will increase by less than 100,000 per month. Such dynamics will provoke a sharp increase in unemployment, a decrease in wages, and bring back talk of a recession to the market. As a result, the yield on U.S. Treasury bonds will fall, and the EUR/USD bulls will launch a counterattack.

Dynamics of bond yields and average wages in the U.S.

However, who knows, perhaps the apocalypse will happen already in early October after the release of September employment statistics. Just imagine the blow that will be dealt to the U.S. dollar if non-farm payrolls slow down to 70,000–90,000. Everyone will immediately forget about the weakness of the eurozone economy and the ECB's reluctance to raise deposit rates further. Investors will only be concerned about the collapse of U.S. Treasury bond yields and the rise of EUR/USD.

Such a risk undoubtedly exists, but its chances may be small. And figures in the range of 120,000–170,000 will only lead to a temporary rise in the main currency pair. After some time, everything will return to normal.

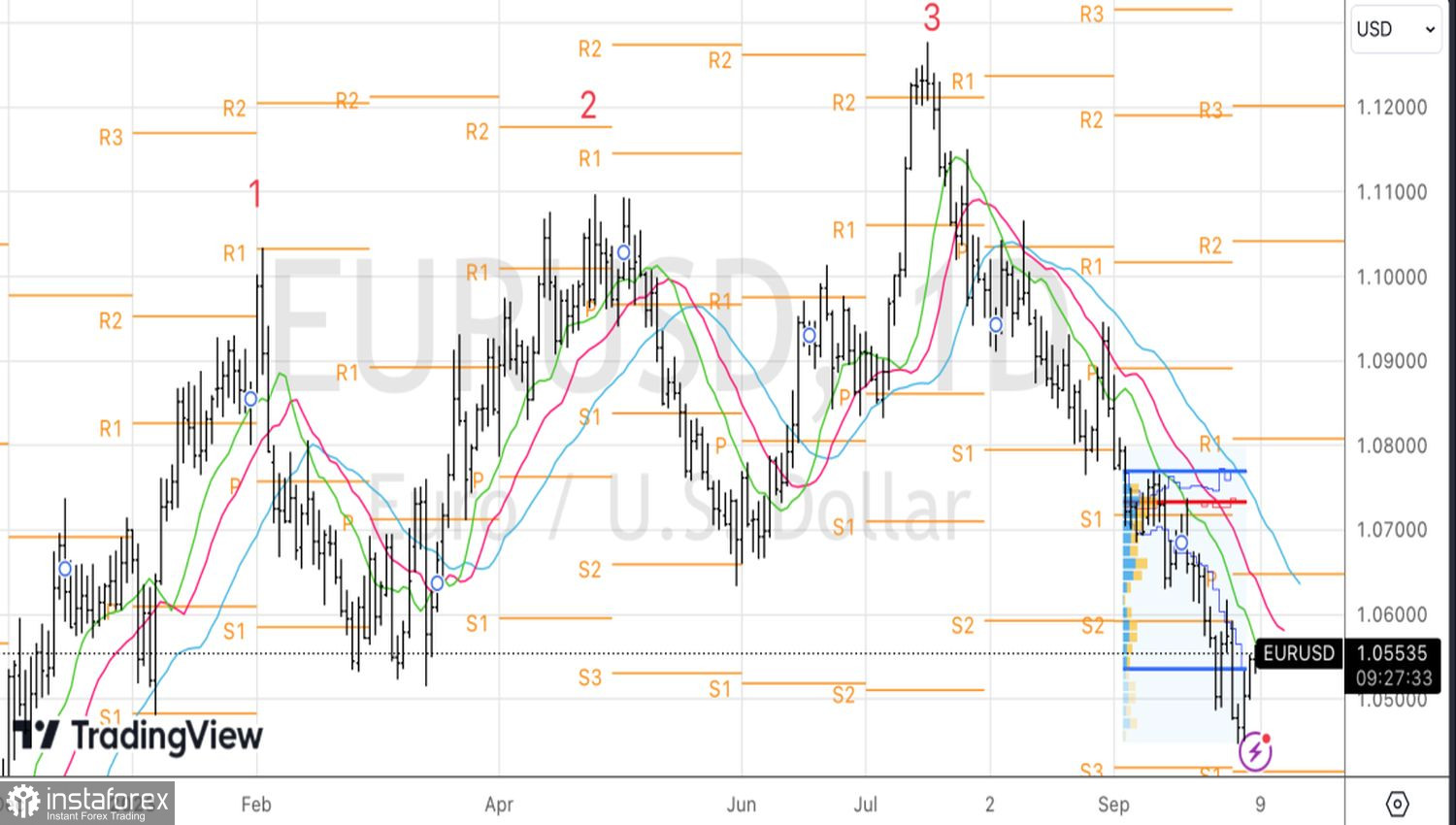

From a technical standpoint, the return of EUR/USD quotes to the fair value range of 1.053–1.077 can be seen as a success for the bulls. However, the downward trend remains in force. Therefore, a rebound from resistances at 1.0595 and 1.0645 or a drop below 1.053 should be used for selling.