USD/JPY

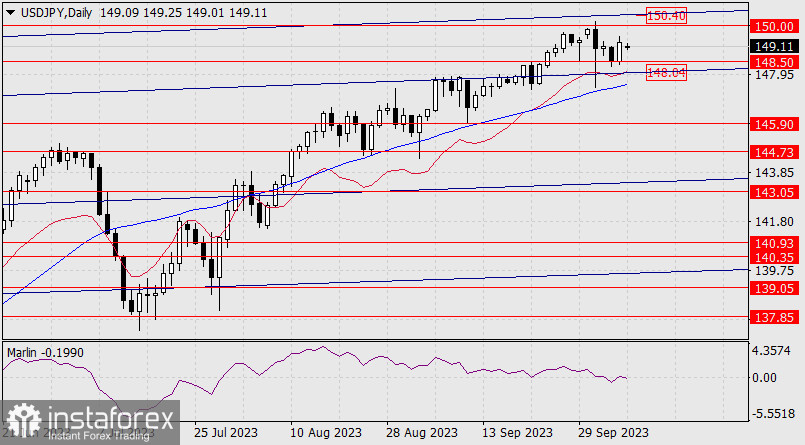

Ignoring the short-term price dip caused by the Bank of Japan's intervention, the yen is consolidating within the range of 148.50 to 150.00. The persistent downward movement of the Marlin oscillator since the second half of August indicates that the price practically doesn't have a chance to break above the consolidation. Although, for purely speculative reasons, the price may temporarily break above the critical level of 150, which the central bank defended, it would only be for middle players to trigger stop-loss orders.

The upper limit for growth is the price channel line around the 150.40 mark. If the price consolidates below the MACD indicator line (147.46), a false breakout to the upside is unlikely. The first target for the decline is 145.90. However, there are two supports on the path to the MACD line: the September 29th low at 148.50 and the price channel line at 148.04.

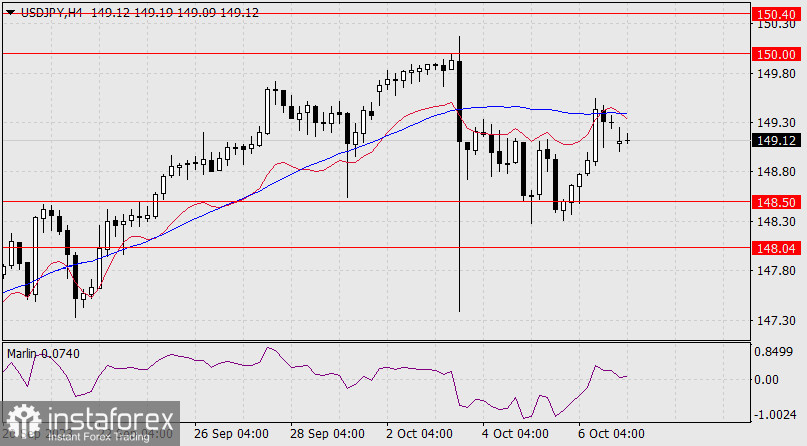

On the 4-hour chart, the price has stalled below the balance and MACD indicator lines. Marlin is already in the growth territory and is trying to assist the price in overcoming these resistances. The attempt will likely succeed, but the growth is expected to be short-lived.