If there were questions about the relatively low unemployment rate in the United States, despite the very small number of jobs being created, the content of Friday's report from the Department of Labor has already addressed them. Firstly, the previous data was revised upward from 187,000 to 227,000. Secondly, instead of 150,000, a whopping 336,000 new jobs were created. So, it's not surprising that the unemployment rate remained at 3.8%. However, the dollar continued to lose ground. Although the state of the labor market clearly points to another interest rate hike by the Federal Reserve by the end of this year. It seems that the dollar's overbought condition has proven to be so strong that it extended the pair's corrective movement that began on Wednesday. To the point that even such strong labor market data was not enough to stop the pair from correcting even higher. Most likely, the pound will start to slow down its upward movement today.

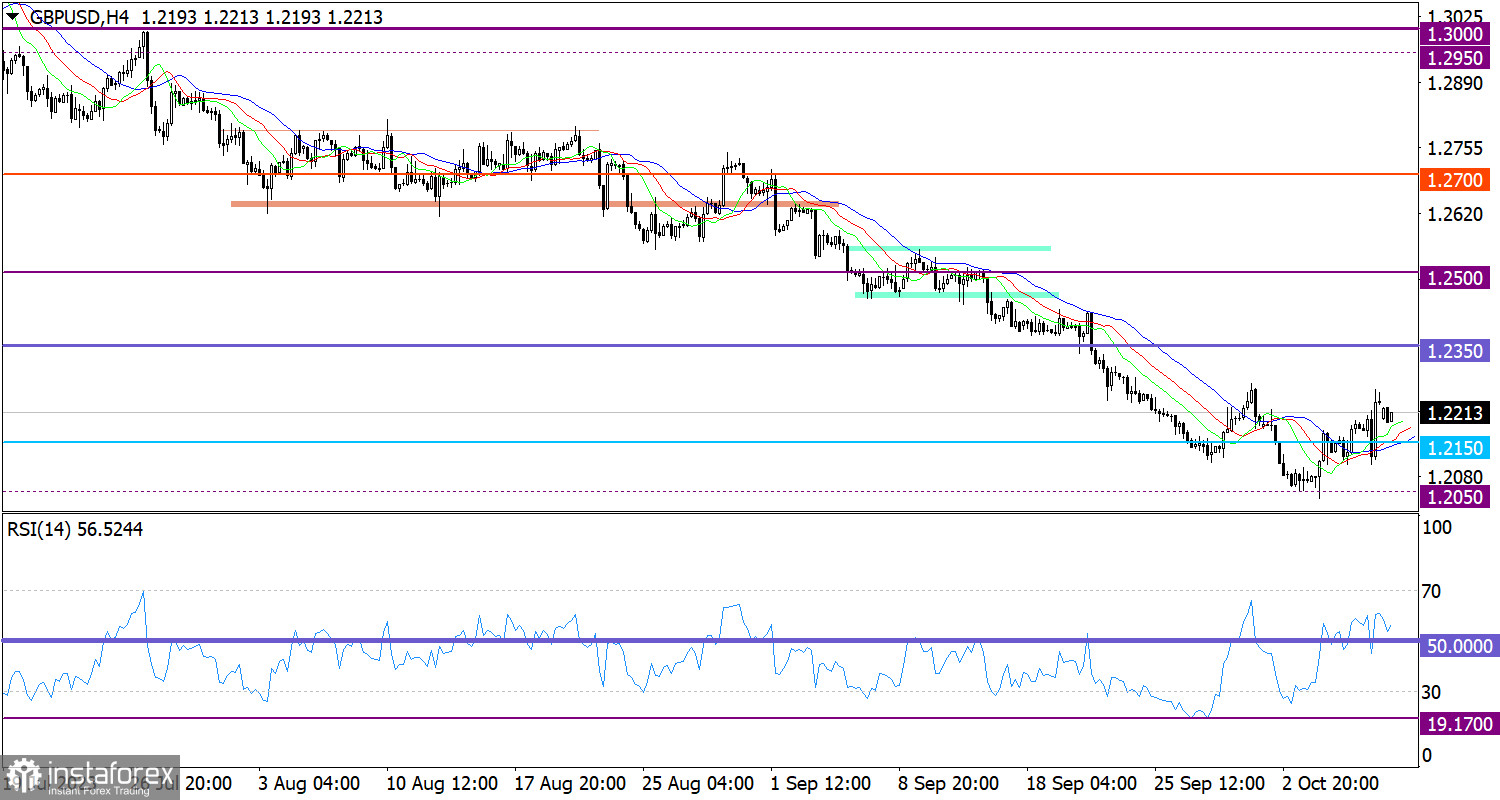

The GBP/USD pair has almost reached the level of 1.2270, which is the local high of the previous correction. The volume of short positions decreased at this mark, which led to a slowdown in the corrective phase.

On the four-hour chart, the RSI indicator is moving in the upper area of 50/70, which corresponds to the correction.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

In order to extend the corrective phase, the price must consolidate above the level of 1.2270. In this case, the price will gradually rise towards 1.2350.

The bearish scenario will come into play if the price returns below the level of 1.2100. In this case, traders might consider updating the local low, with the lower area of the psychological level of 1.1950/1.2000 acting as support.

Complex indicator analysis indicates a corrective phase in the short-term and intraday periods. Meanwhile, in the mid-term period, the indicators are reflecting a downward cycle.