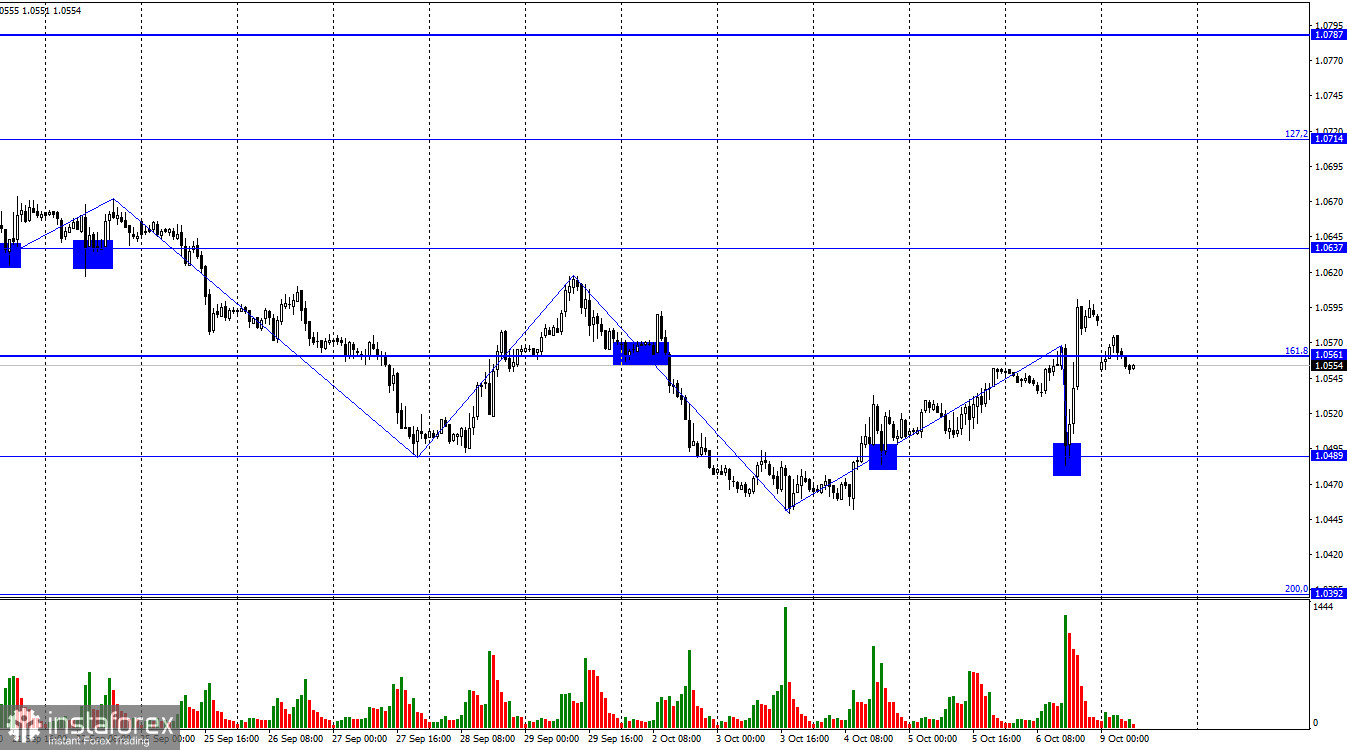

On Friday, the EUR/USD pair bounced off the Fibonacci retracement level of 161.8% at 1.0561 and fell to 1.0489. Then, it rebounded from this level and resumed its rise, moving above the retracement level of 1.0561. On Monday, the pair closed below 1.0561, suggesting a further decline towards 1.0489. Yet, all these maneuvers on Friday and Monday were driven by the market's emotional reaction to the news. In other words, we saw some hectic trading amid a strong information background. In fact, the close below and above the 1.0561 can have no significance at all.

The wave setup slightly changed on Friday, and we received the first sign of the bearish trend coming to an end, yet a very weak one. The pair formed a descending wave, with its low falling to break below the previous low as a new upward wave was formed right away. Its high broke above the high of the previous wave. However, all these moves on Friday were driven by emotions and they could have never happened if not for the NFP release. Therefore, I would not rush to declare the change of the bearish trend to a bullish one.

The number of new jobs in the non-agricultural sector increased by 336,000, twice exceeding traders' expectations. The August value was revised to 227,000, while the unemployment rate stayed at 3.8% and wages rose to 4.2% year-on-year in September. The last two reports were overshadowed by the NFP data which revealed the resilience of the US labor market. This data provided strong support to the pair bears. It was quite surprising to see an ascending wave on Friday as a strong downward wave would have been more logical. This is another thing that is worrying me. I think that on Monday or Tuesday, the pair may show a significant drop.

On the 4-hour chart, the pair rebounded from the retracement level of 127.2% at 1.0466 and rose to the upper line of the descending channel where it made the third attempt to settle. The first two attempts did not result in a bullish trend, and now we can see a bearish divergence being formed, signaling a possible resumption of a downtrend. This is a worrisome sign. I still do not expect to see a strong rise in the euro.

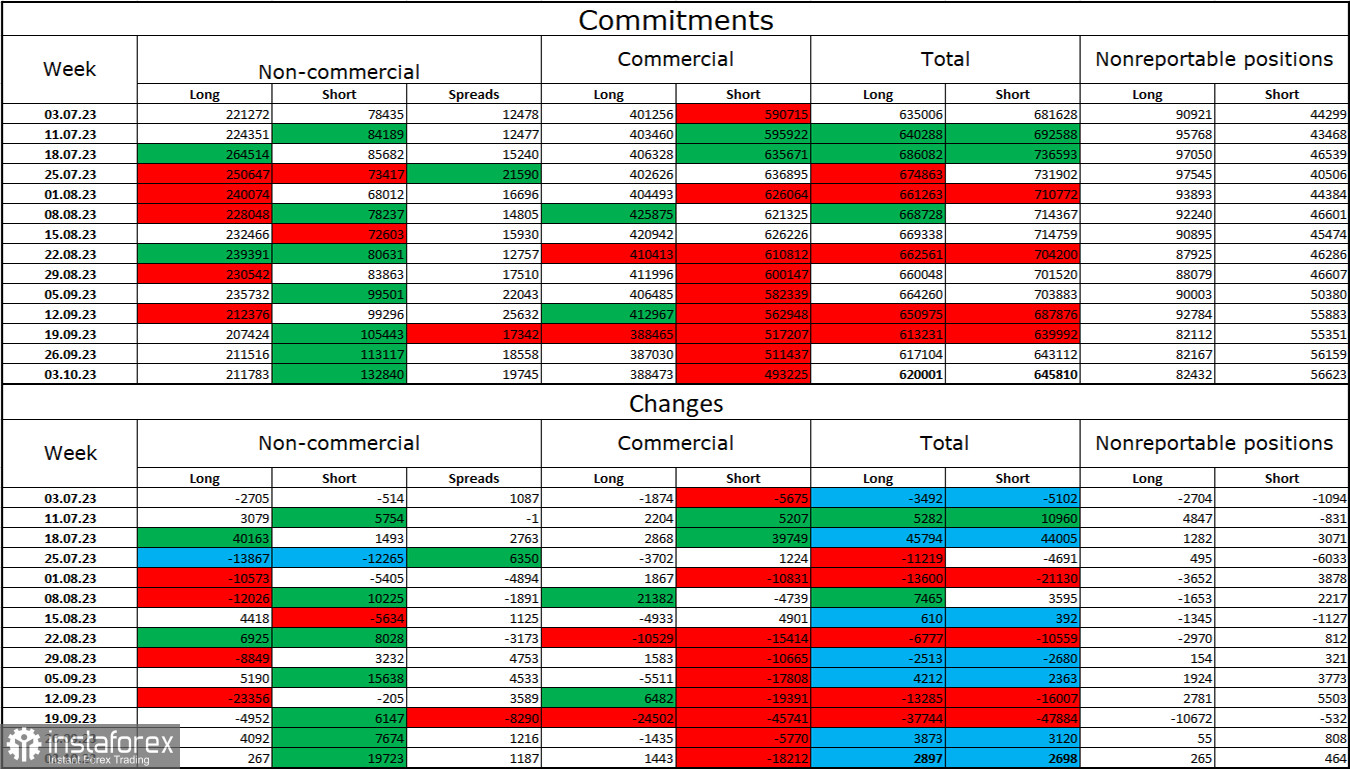

COT report

In the last reporting week, speculators opened 267 Long contracts and 19,723 Short contracts. The sentiment of large market players remains bullish but has been noticeably weakening in recent weeks and months. The total number of Long contracts now stands at 211,000 while Short contracts amount to 133,000. The difference is a bit less than twofold, although a few months ago the gap was threefold. I think that the situation will continue to change in favor of the bears over time. Bulls have dominated the market for too long, and now they need a strong information background to maintain the bullish trend. There is no such background at the moment. Professional traders may continue to close long positions in the near future. I think that the current values suggest a further decline in the euro in the coming months.

Economic Calendar for US and EU:

EU – German Industrial Production (06-00 UTC).

On October 9, the economic calendar has only one entry of minor importance. Therefore, the information background will have little or no influence on the market sentiment.

EUR/USD forecast and trading tips:

It is possible to sell the pair today after a close below the 1.0561 level on the H1 chart, aiming for 1.0489 and 1.0450. Long positions can be opened on a close above 1.0561 on H1, with the target at 1.0637. However, I would advise you to be very careful with buying the pair.