While the UK economy teeters on the brink of recession and stagflation, the futures market is indicating an 80% probability of another repo rate hike to 5.75%. However, neither Bloomberg experts nor the Bank of England believe this scenario. The pound continues to move under the influence of external factors. Sterling has become one of the main beneficiaries of the market's unexpected reaction to the U.S. employment report for September. Nevertheless, no one can guarantee that the bullish momentum for GBP/USD will last long.

It seemed that the increase in employment by 336,000 should have buried the opponents of the U.S. dollar. The indicator showed the best performance since January. Unemployment continues to be at its lowest level in half a century, and the pace of wage growth outpaces inflation. The growth of real incomes for the population is good news for the economy. However, for the Federal Reserve, it's a real puzzle. Despite aggressive monetary tightening, why is the U.S. GDP not slowing down? Should they resume tightening monetary policy? Or will the debt market do all the dirty work for the Central Bank through a rally in yields?

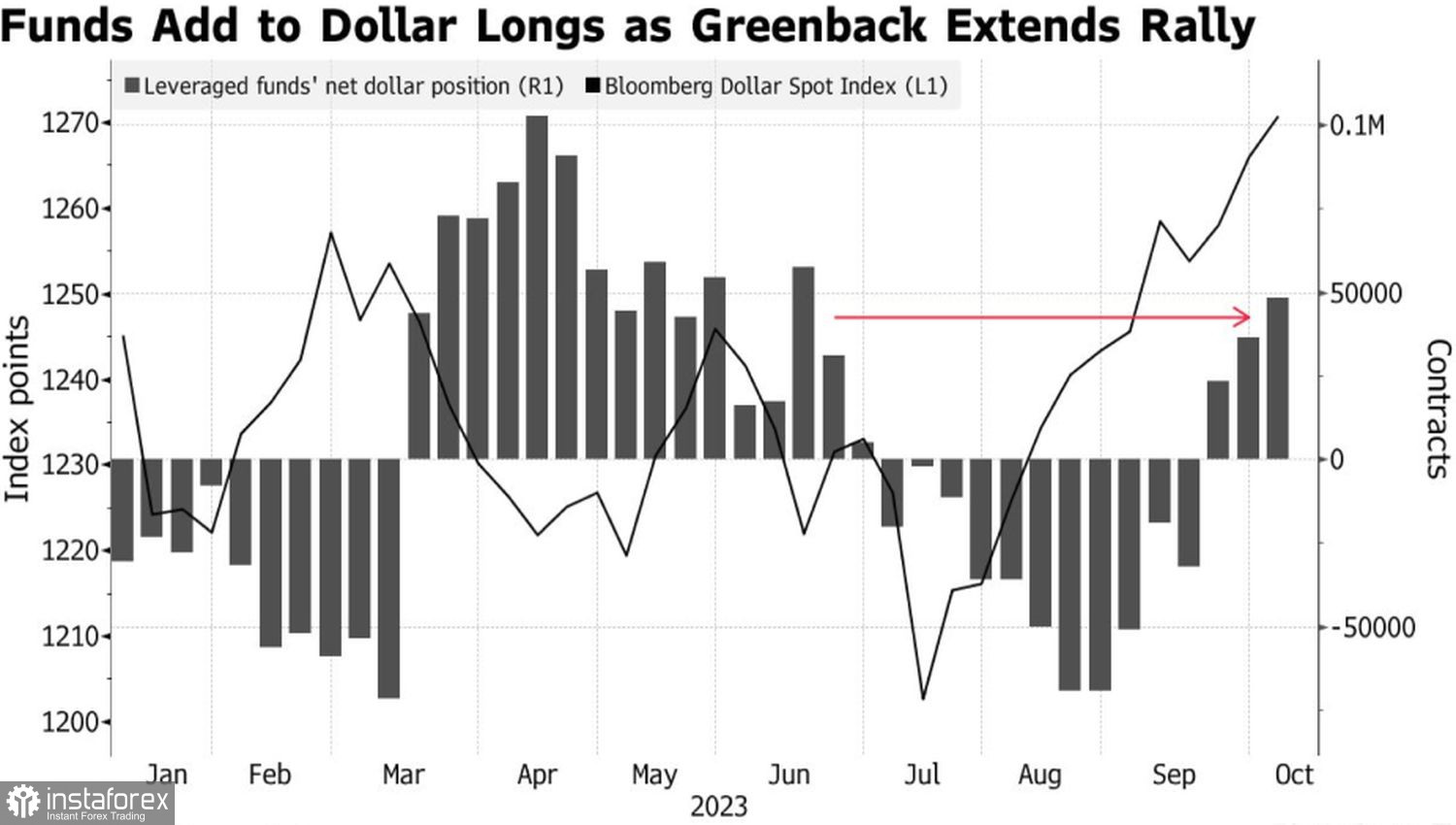

Judging by positioning, speculators were counting on good labor market statistics ahead of the U.S. employment report for September. Hedge funds increased their long positions in the U.S. dollar for three consecutive weeks, pushing them to their highest level since June. Asset managers have been the least bearish on the U.S. dollar for about a year.

Dynamics of the USD index and hedge fund positions in the U.S. dollar

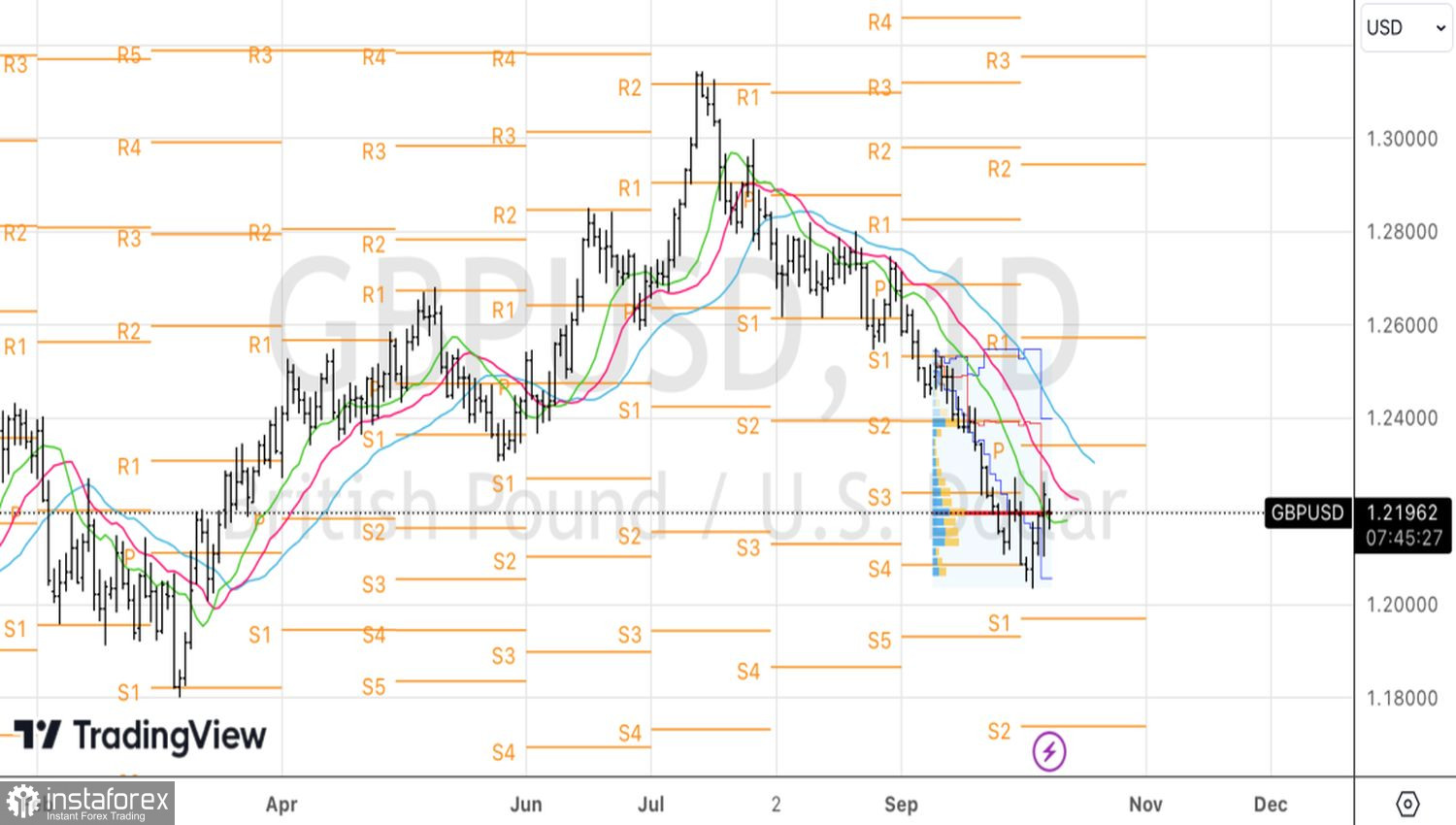

The "buy the rumor, sell the fact" principle worked predictably. Instead of dropping below 1.204, GBP/USD surged above 1.225. However, the sterling enthusiasts' celebration is likely to be short-lived.

Speculative position closure is one thing, fundamentals are another. The downward trend in GBP/USD is based on the divergence in monetary policies between the Federal Reserve and the Bank of England and the divergence in economic growth between the United States and Britain. Yes, the United States faces tough challenges. The delayed effects of the Fed's monetary tightening, the resumption of student loan payments, the still-possible government shutdown, and rising oil prices will all impact GDP. However, we've heard all this before, both about economic cooling and recession. Nevertheless, the United States continues to stand firm, and its dollar remains a favorite in Forex.

Britain cannot compete with a strong economy or the Bank of England's desire to resume a cycle of monetary tightening. Even though the latest data on UK business activity turned out slightly better than expected, the PMI is still below the critical 50 mark, signaling a contraction in GDP. There's no way for the country to compete with the United States.

Technically, on the GBP/USD daily chart, there's a battle for the fair value at 1.219. If an inside bar is formed at the end of trading on October 9th, it makes sense to place pending orders to sell the pound from the level of 1.217 and to buy from 1.223.