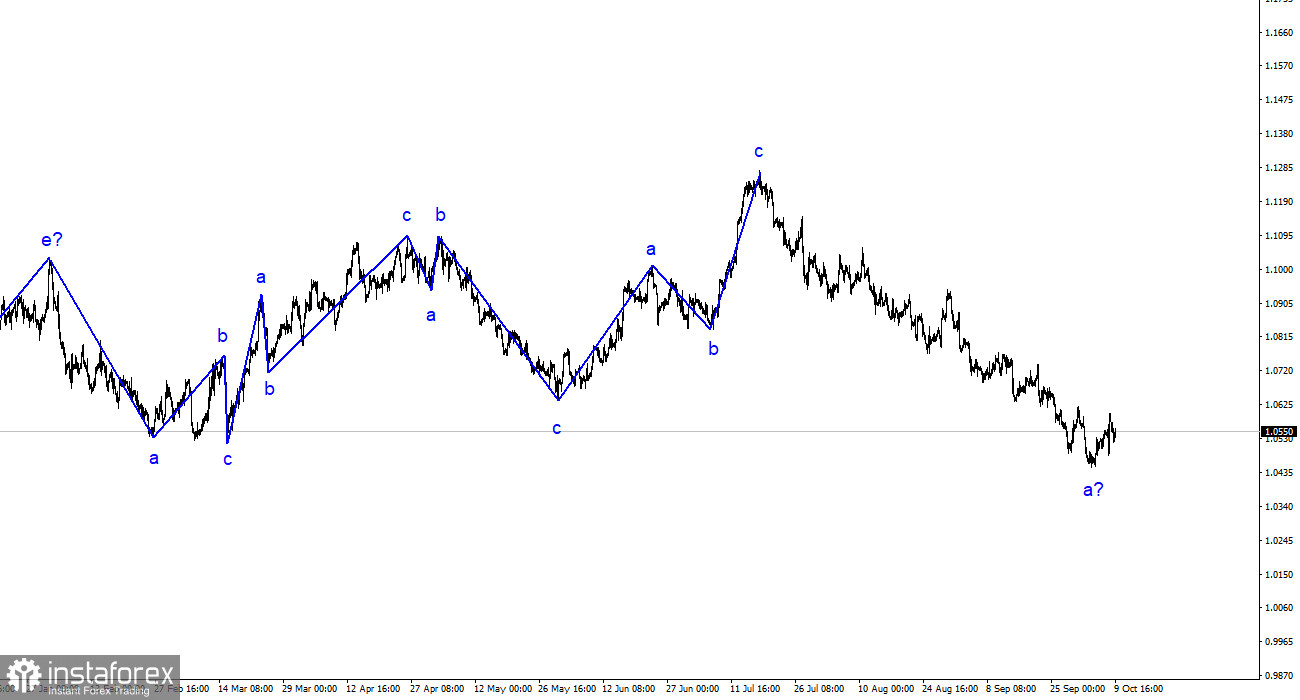

The wave analysis on the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the instrument to reach the 1.5 figure, from where the construction of the last upward three-wave structure began. This target was reached after a two-month decline. The presumed first wave of the new downtrend may continue its formation, although there are currently some signs of its completion.

None of the recent price increases resembled a full-fledged wave 2 or b. Therefore, all of these were internal corrective waves within wave 1 or a. If this is indeed the case, the decline in prices may continue for some time during this wave. And this will not mark the end of the overall decline of the European currency, as the construction of the third wave is still required. Within the first wave, five internal waves are already visible, so its completion is approaching. An unsuccessful attempt to break through the 1.0463 mark, which is equivalent to 127.2% on the Fibonacci, indicates the market's readiness to start building a corrective wave.

The euro has found a "bottom" around the level of 1.0463.

The exchange rate of the euro/dollar pair remained unchanged on Monday, despite a corrective wave during the day. The total retreat of quotes from the achieved lows is currently just over 100 points. I cannot interpret such a segment as wave 2 or b. This means that the likelihood and danger of a new resumption of presumed wave 1 or a remain high. Despite the unsuccessful attempt to break through the 1.0463 mark. The problem for the euro now is that the news background often supports the US currency. Even on Friday, some of the most important labor market and unemployment reports in the United States turned out to be quite positive. It turns out that, on the one hand, the market is set for the construction of a corrective wave, and on the other hand, it receives information that supports the dollar. What can be done in this situation?

I believe that the construction of a corrective wave will continue for some time. Although a lot can change in the currency market in the near future, due to the armed conflict in Israel, oil prices may skyrocket and lead to inflation in many countries around the world. The governor of the ECB, Klaas Knot, stated this today. He also added that for many countries, the new surge in inflation will be a shock, as interest rates have already been raised to "very restrictive" levels. Further rate hikes may be affordable for very few, and a situation may arise where inflation is rising at the highest possible rates. And this is a shock for the economy.

General Conclusions:

Based on the analysis conducted, I conclude that the construction of a downward set of waves continues. Targets around the 1.0463 mark have been ideally worked out, and an unsuccessful attempt to break this mark indicates the market's readiness to build a corrective wave. In my recent reviews, I warned that it is worth considering closing short positions, as the likelihood of building an upward wave is now high. A breakthrough of 1.0463 will indicate another "false alarm," and you can again sell the instrument with targets located around the 1.0242 mark, which corresponds to 161.8% on the Fibonacci.

On a larger wave scale, the wave analysis of the upward trend has taken on an elongated form, but it is likely completed. We have seen five upward waves, which most likely constitute a structure of a-b-c-d-e. Next, the pair built four three-wave structures: two down and two up. Now, it probably transitioned to the stage of constructing another extended downward three-wave structure.