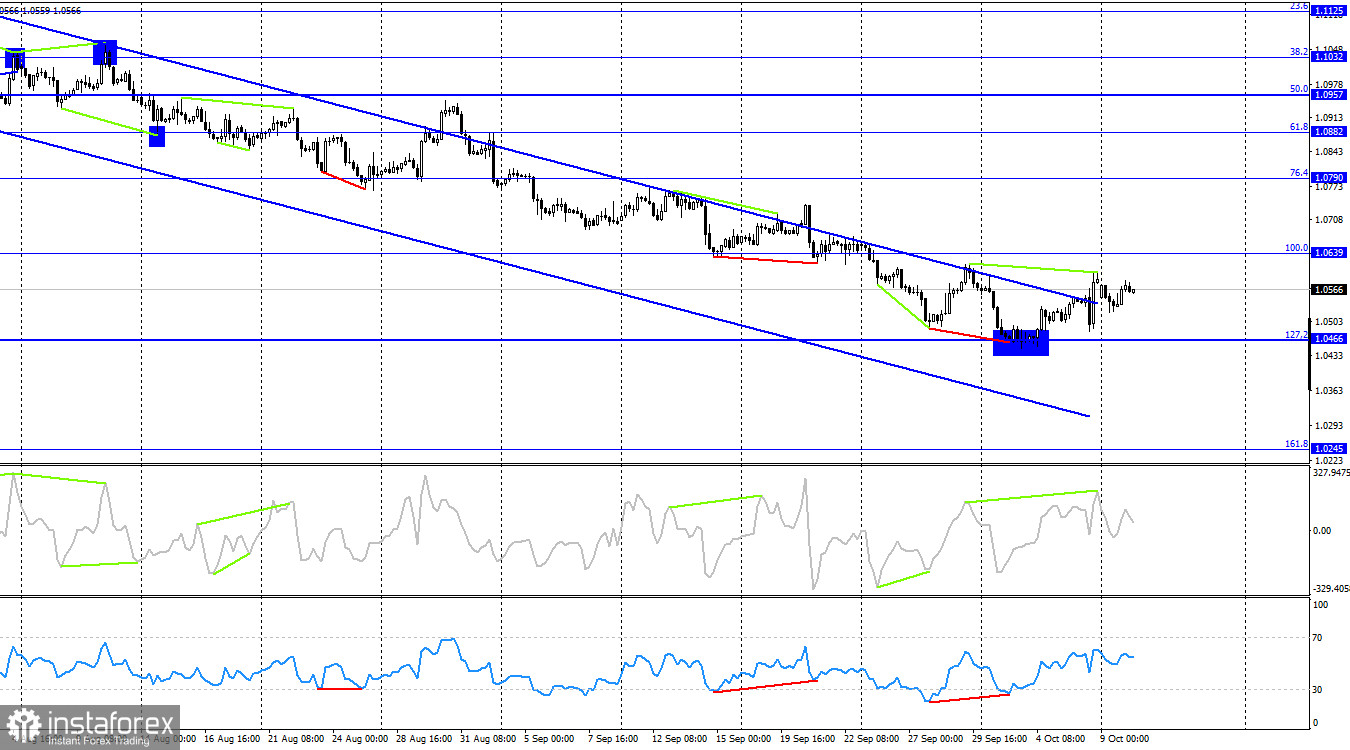

On Monday, the EUR/USD dropped slightly from the Fibonacci retracement level of 161.8% at 1.0561 but returned above it by the end of the session. and fell to 1.0489. This sets the stage for a further rise towards 1.0637. Consolidation below 1.0561 will favor the US dollar and prompt a further decline in the euro towards the level of 1.0489 or even lower.

The current wave setup looks quite uncertain. Yesterday, I mentioned that there were signs of the bearish trend coming to an end. However, today, we may already get indications of a finished bullish trend that has been developing for four days. This happens because of Friday's upward wave formed amidst robust news from the United States, implying its impulse nature. If we disregard this wave, it seems that the bearish trend persists because the price has not yet crossed the high of September 29. If Tuesday sees a new decline in the euro and yesterday's low is broken, the downtrend will resume or the pair will transition into a sideways movement.

The news background was almost absent on Monday. Traders may have taken notice of Germany's industrial production report, which, of course, turned out to be weaker than expected. Also, ECB Vice President Luis de Guindos stated that it was too early to talk about rate cuts in the near future. I did not expect the ECB's monetary policy to ease any time soon, and it is unlikely that there is anyone in the market who would seriously expect this to happen before the year's end.

Today, I expect the pair to fall if it closes below 1.0561. This is my trading scenario for Tuesday.

On the 4-hour chart, the pair rebounded from the retracement level of 127.2% at 1.0466 and rose to the upper line of the descending trend channel, above which it made the third attempt to settle. The first two attempts failed to prompt a bullish trend, and now we can see a bearish divergence being formed, signaling a possible resumption of a downtrend. In the current circumstances, I still do not expect to see a strong rise in the euro.

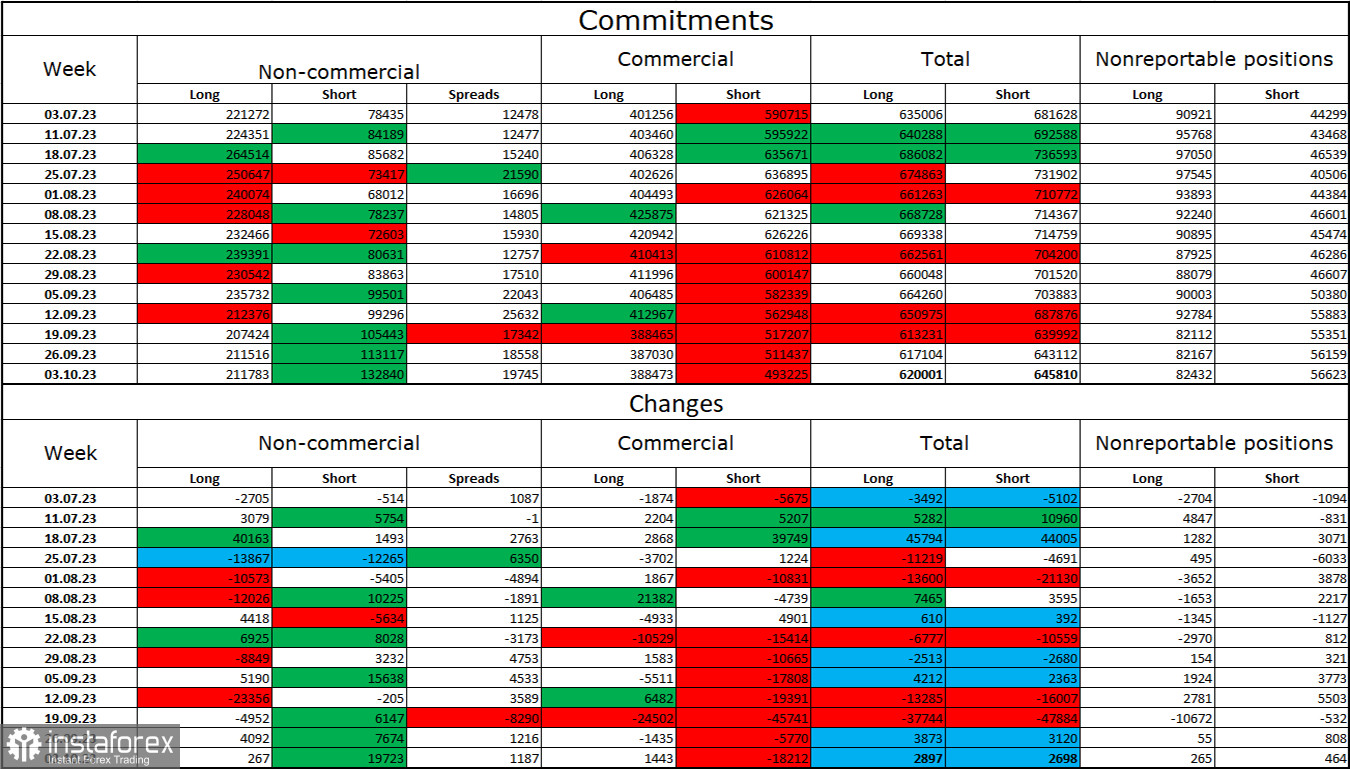

COT report

In the last reporting week, speculators opened 267 Long contracts and 19,723 Short contracts. The sentiment of large market players remains bullish but has been noticeably weakening in recent weeks and months. The total number of Long contracts now stands at 211,000 while Short contracts amount to 133,000. The difference is a bit less than twofold, although a few months ago the gap was threefold. I think that the situation will continue to change in favor of the bears over time. Bulls have dominated the market for too long, and now they need a strong information background to maintain the uptrend. There is no such background at the moment. Professional traders may continue to close long positions in the near future. I think that the current values suggest a further decline in the euro in the coming months.

Economic Calendar for US and EU:

EU – ECB President Lagarde Speaks (12-00 UTC)

On October 10, the economic calendar features the speech by Christine Lagarde which is considered a potential market mover. Therefore, the information background may have a moderate influence on the market sentiment.

EUR/USD forecast and trading tips:

It is possible to sell the pair today after a close below the 1.0561 level on the H1 chart, aiming for 1.0489 and 1.0450. Long positions can be opened on a close above 1.0561 on H1, with the target at 1.0637. However, I would advise you to be very careful when buying the pair.