Officials from the Federal Reserve are rallying around the idea that tightening financial conditions could replace an additional rate hike in the federal funds rate. Mary Daly of the San Francisco Fed, Lorie Logan of the Dallas Fed, and Federal Reserve Vice Chairman Philip Jefferson all stated in unison that the markets are doing part of the central bank's job. The chances of a federal funds rate hike in 2023 have fallen from 40% to 28%, allowing EUR/USD bulls to mount a counterattack.

Every trend requires a correction. Given that everything in financial markets currently depends on U.S. Treasury bonds, investors eagerly anticipated a pullback in bond yields. This was triggered not only by disappointing macroeconomic statistics in the United States but also by rising geopolitical risks in the Middle East and the Fed's fear of tightening financial conditions.

FOMC officials genuinely believed that hawkish rhetoric, including signals of further rate hikes, would prompt the markets to rule out the idea of an early dovish pivot. However, the surge in the yield of 10-year U.S. bonds to their highest levels since 2007 convinced them that the central bank had overdone it. Financial conditions tightened too rapidly, which could lead not only to inflation slowing to 2% but also to a recession. As a result, the Federal Reserve is taking a step back, leading to a correction in yields. However, this does not negate the new mode of operation of the U.S. debt market.

Dynamics of U.S. Treasury Bond Yields

The pullback also occurred due to events in Israel, which prompted investors to invest in a safe haven asset like U.S. Treasury bonds. While analysts speculated that the armed conflict in the Middle East was beneficial to the U.S. dollar as a refuge currency, and Credit Agricole warned of new troubles for oil-dependent regions like the Eurozone and China, the decline in Treasury bond yields extended a helping hand to EUR/USD bulls.

According to Credit Agricole, the U.S. dollar was expected to start losing ground in the fourth quarter, as the Fed would cut rates in April-June 2024 amid a cooling U.S. economy. Investors will be factoring in the prospect of a rapid easing of monetary policy into EUR/USD quotes, allowing the pair to move higher. Meanwhile, the rise in Brent due to the escalation of geopolitical conflict in the Middle East will hit oil-importing countries and regions like China and Europe.

All of this makes sense; however, it pertains to medium-term perspectives. The market is fixated on U.S. Treasury bond yields. Therefore, events in Israel should be viewed through the lens of changes in the U.S. debt market landscape. And here, bad news is beginning to emerge for the U.S. dollar.

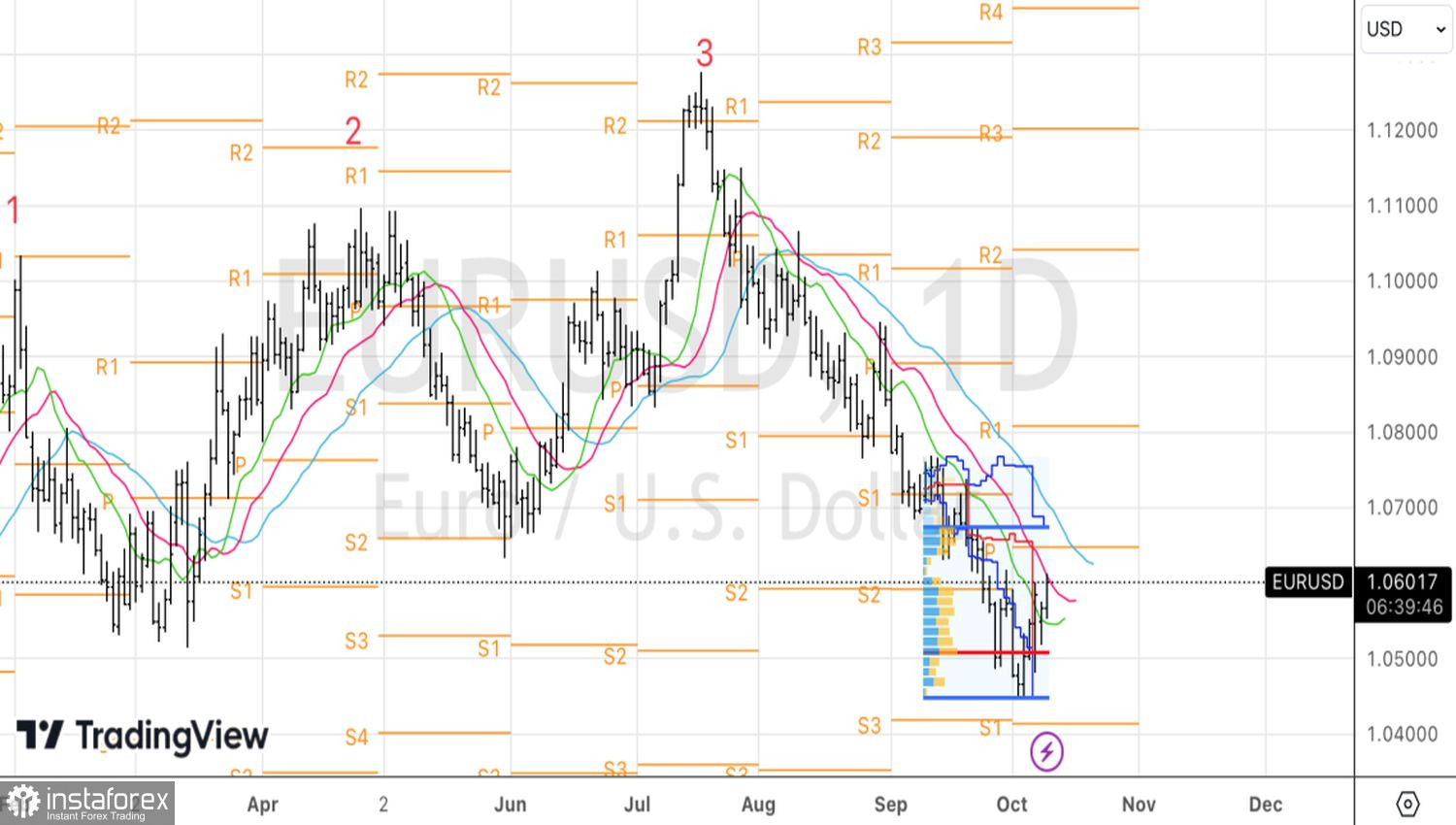

Technically, on the daily chart, EUR/USD has formed a bullish inside bar, allowing us to establish long positions on a breakout above its upper boundary at 1.0575. The correction may continue towards pivot levels at 1.065, 1.067, and 1.071. For now, we hold longs and await a reversal signal.