The market situation did not actually change at the end of trading on Monday. However, yesterday the single European currency showed some growth, albeit insignificant. Still, the growth itself was clearly sustainable. At the same time, the information background remained unchanged. So, the strengthening of the single European currency was more likely of a technical nature, since it is still considerably oversold.

At the same time, today EUR/USD's quotes may return to the levels at which the instrument traded on Monday. The reason will be data on the producer price index in the United States. The PPI rate may well accelerate from 1.6% to 1.7%. The acceleration itself clearly indicates limited potential for a further slowdown in inflation. And that's the best case scenario. If we take into account that the producer price index has been growing for two months in a row, accelerating factory inflation poses a risk of rising consumer inflation. Thus, the issue of another increase in the refinancing rate before the year end seems to have already been resolved. Moreover, if inflation does accelerate, the Federal Reserve will find it appropriate to go ahead more rate hikes next year. This, in turn, creates the preconditions for moving towards parity between the single European currency and the US dollar.

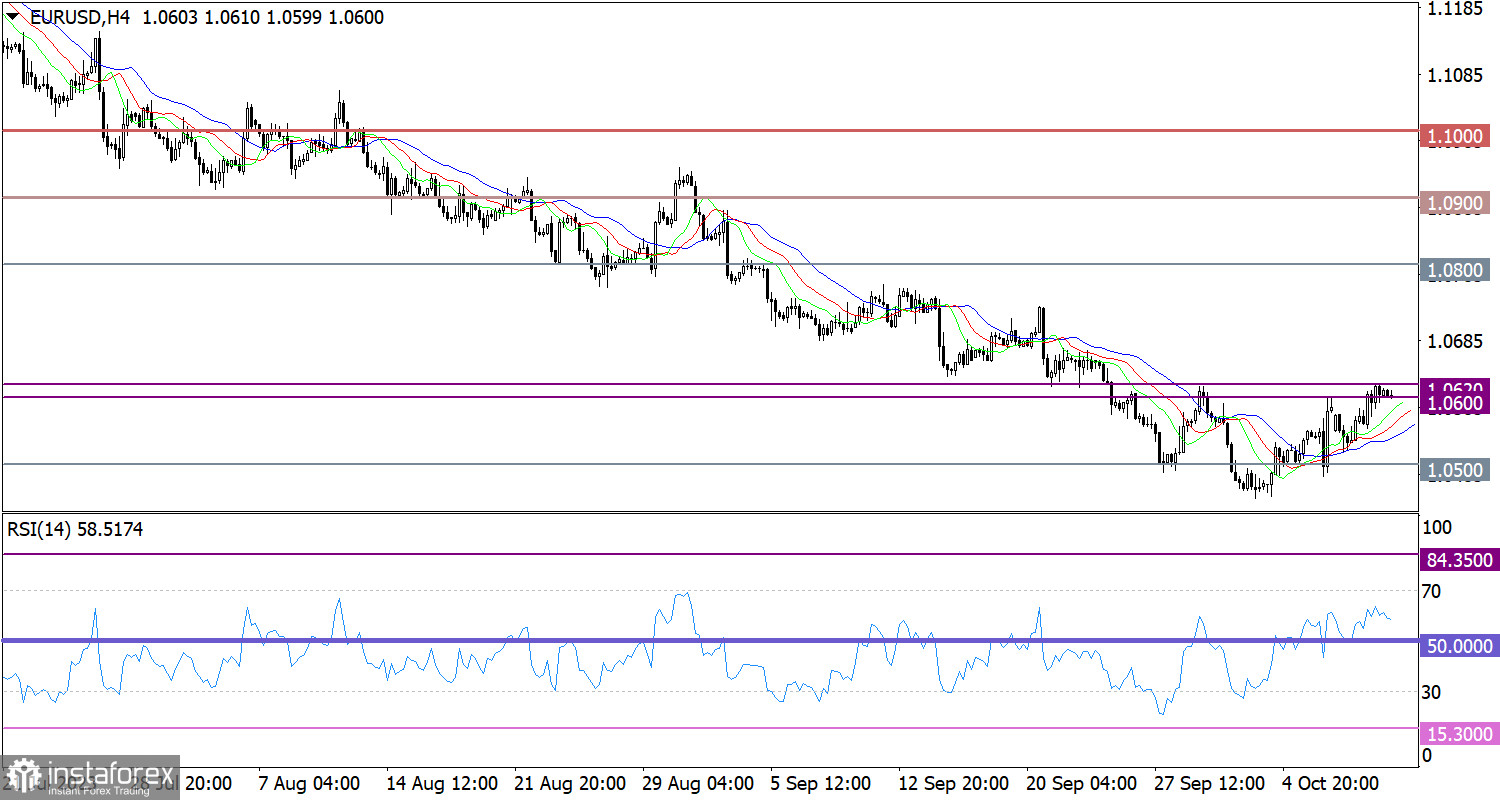

During the correction phase, the EUR/USD pair reached the upper border of the resistance area of 1.0600-1.0620. As a result, traders cut on long positions, which pushed the price into a triangle pattern.

From the point of the technical instrument RSI H4, the indicator is moving inside the upper 50/70 area, which corresponds to a correctional cycle.

As for the Alligator H4 indicator, the moving average lines are directed upward, which also corresponds to a correctional move.

Outlook and trading tips

To encourage the next bullish sequence, the price must settle above the resistance area. In this case, EUR/USD may grow in the direction of 1.0680. Otherwise, the instrument could dip in the direction of 1.0550.

Comprehensive short-term and intraday indicator analysis indicates the correction stage. In the medium term, indicators signal a downward cycle.