Details of the Economic Calendar on October 10

The macroeconomic calendar on Tuesday remained practically empty, and the information agenda remained unchanged. Thus, the strengthening of the euro and the British pound appeared to be more of a technical nature.

Analysis of Trading Charts from October 10

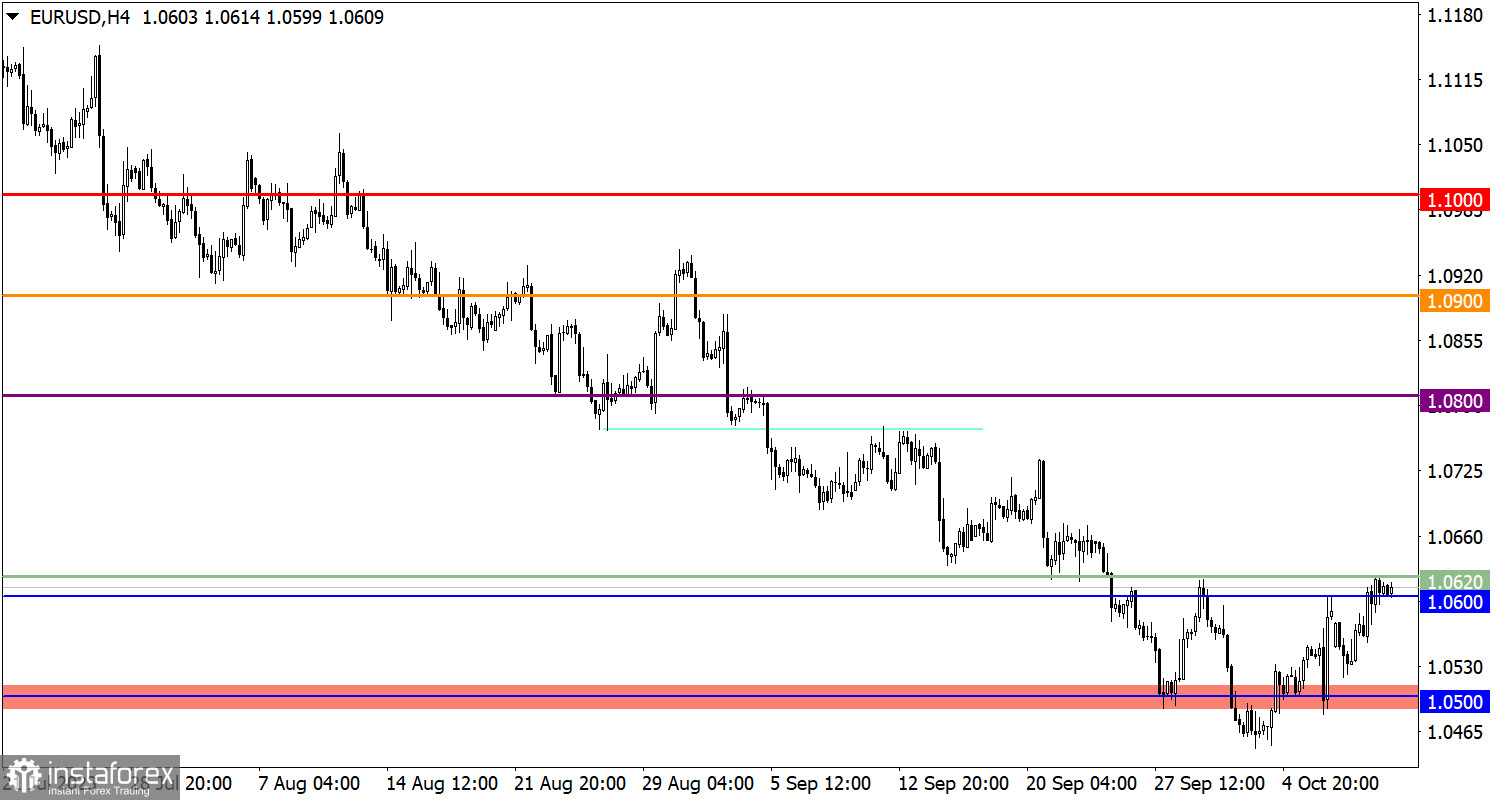

The EUR/USD currency pair reached the upper boundary of the resistance area in the range of 1.0600-1.0620 during the correction phase. This led to a reduced volume of long positions and a slowdown in movement.

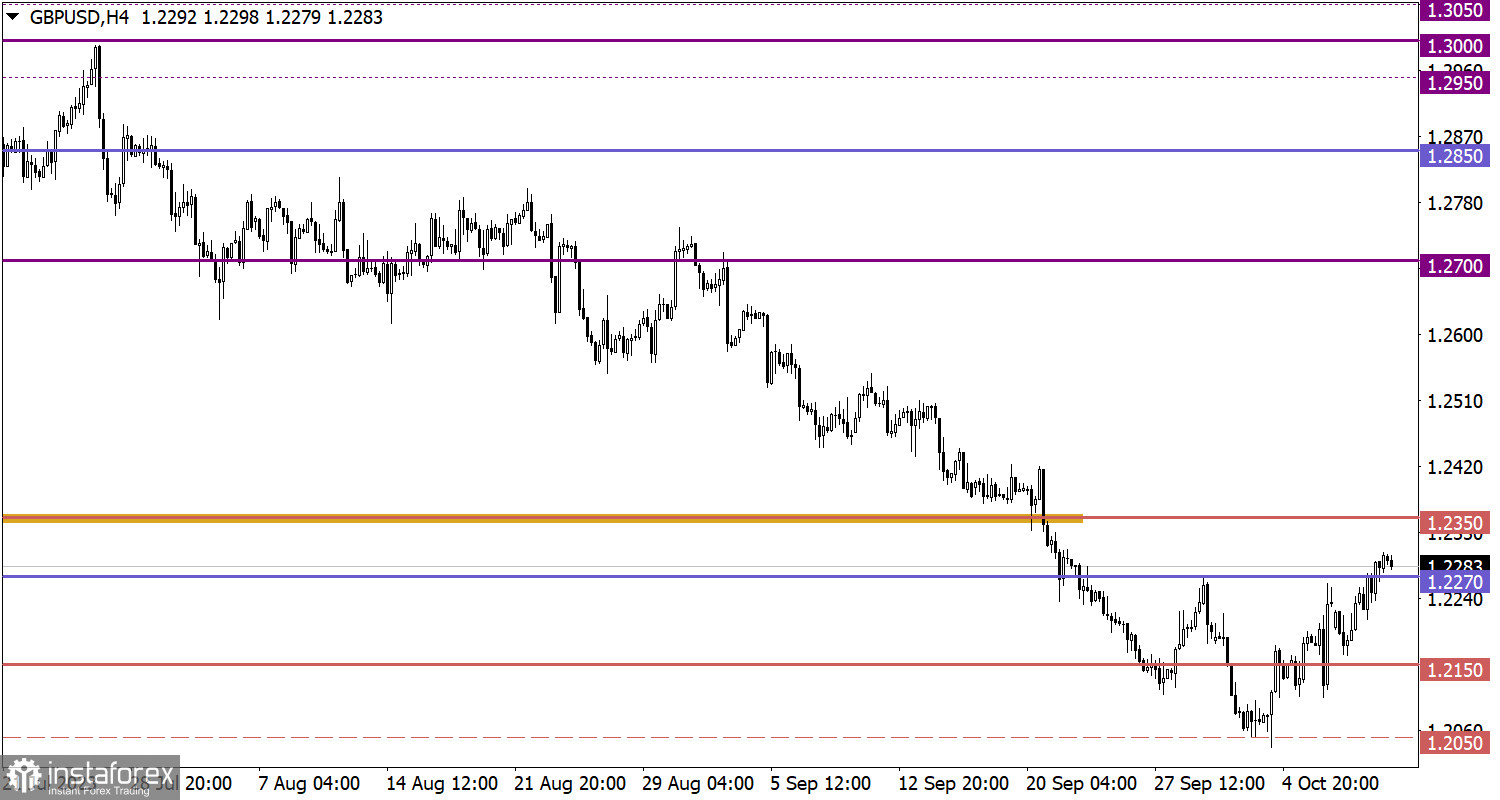

On the other hand, the GBP/USD pair successfully surpassed the 1.2270 resistance level during the corrective movement.

Economic Calendar on October 11

Today, data on the Producer Price Index in the United States is expected to be published, which growth rates may accelerate from 1.6% to 1.7%. Acceleration in prices indicates limited potential for further inflation slowdown. Therefore, the probability of an additional interest rate hike at least once by the end of this year remains high.

EUR/USD Trading Plan for October 11

To continue the subsequent upward movement, it is necessary for the price to hold above the resistance level. In this case, further growth to the level of 1.0680 is possible. However, if the price does not sustain above this level, a corrective movement towards 1.0550 is possible.

GBP/USD Trading Plan for October 11

If the price maintains its upward trajectory, an increase in the volume of long positions is possible, with potential further movement towards 1.2350.

Regarding the downside scenario, for its consideration, the price first needs to return below the level of 1.2250.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.