Producer price growth in the US turned out to be higher than anticipated. It did not only reach 2.2%, but previous results also revised upward from 1.6% to 2.0%. However, considering that the index rose for three consecutive months, inflation could start rising again. Today's consumer price data will confirm whether or not such a scenario will really occur.

The rise in PPI also increases the likelihood of another interest rate hike by the Fed. It could be the reason why dollar immediately rose as soon as the data came out. Later on, it returned to the levels before the publication due to the contents of the Fed minutes, which suggests that the central bank plans to keep interest rates at current levels until inflation stabilizes. However, as recent data show, this plan will likely undergo significant adjustments because despite the high level of interest rates, inflation climbs up again.

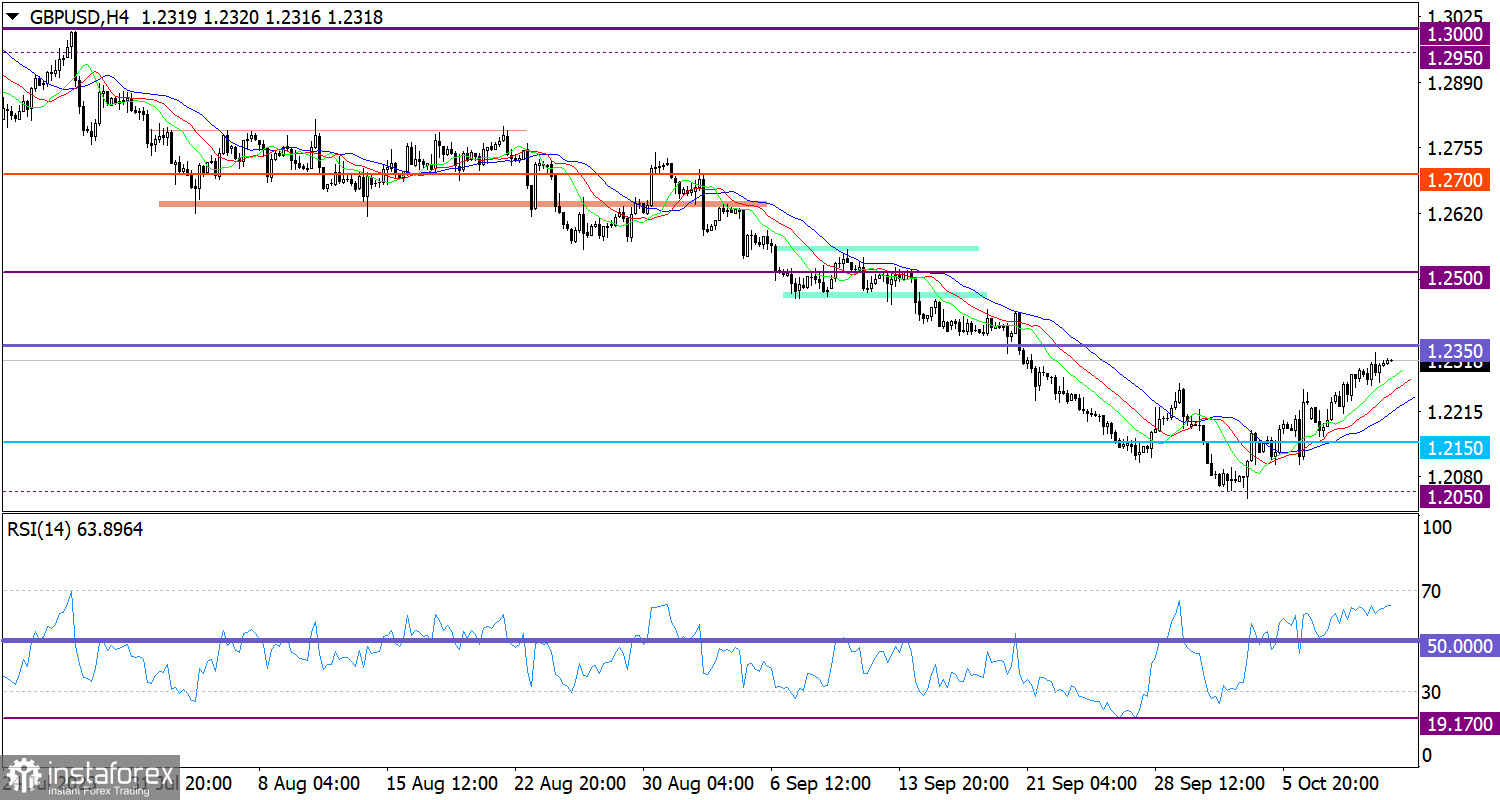

GBP/USD almost hit the resistance level of 1.2350 during the correction. Since the start of the upward cycle, it gained over 2% or about 300 pips.

The RSI H4 indicator shows movement in the upper range of 50/70, corresponding to a correction.

As for the Alligator H4 indicator, the moving MA lines point upward, also in line with the correction.

Outlook and trading tips:

The level of 1.2350 may put pressure on buyers, which could lead to the partial recovery of dollar's positions. To extend the correction, the pair needs to stay above the level of 1.2350 in the daily chart.

Comprehensive short-term and intraday indicator analysis indicates the correction stage.