On Wednesday, the EUR/USD pair advanced to 1.0637, bounced off it with a further decline, and then rebounded back to this level. The movement took place within the ascending trend channel, meaning that the bullish sentiment is still in place. A new pullback from 1.0637 will favor the US dollar and will most likely result in a close below the trend channel. In this case, we can expect a deeper decline in the euro towards 1.0561 and 1.0489. A firm positioning above 1.0637 will validate a further rise towards the next retracement level of 127.2% at 1.0714.

The situation with the current wave setup has cleared up. Now that a new ascending wave has broken above the high of the previous wave, we can confirm the formation of a bullish trend. The ascending trend channel is another confirmation of this development. Therefore, we have two analysis methods that confirm the uptrend in the euro. I doubt that this upside momentum will last for too long, but this is not so relevant at the moment. A new bearish trend can be spotted with emerging reversal signals, such as a close below the trend channel or a breakout of the low of October 9 at 1.0520.

The news background for the euro and the dollar remains quiet today. Yesterday's PPI report from the US turned out to be slightly above traders' expectations, implying a possible acceleration of inflation in the future. The CPI report is set to be published today. The FOMC minutes did not impress the markets, so trading activity was rather low throughout the day. The reaction to the US inflation figures may be stronger as this data is considered important. Yet, it is hard to predict where the market will move next.

On the 4-hour chart, the pair continues to rise towards the retracement level of 100.0% at 1.0639. Two bearish divergences stopped the dollar from a reversal. A rebound from the 1.0639 level may trigger a decline. At the moment, I don't expect the euro to show considerable growth. The trend channel and the wave setup on the H1 chart indicate a bullish trend. These are the main factors confirming the uptrend for now. A close above 1.0639 will open the way for a further rise towards the 76.4% Fibonacci level of 1.0790.

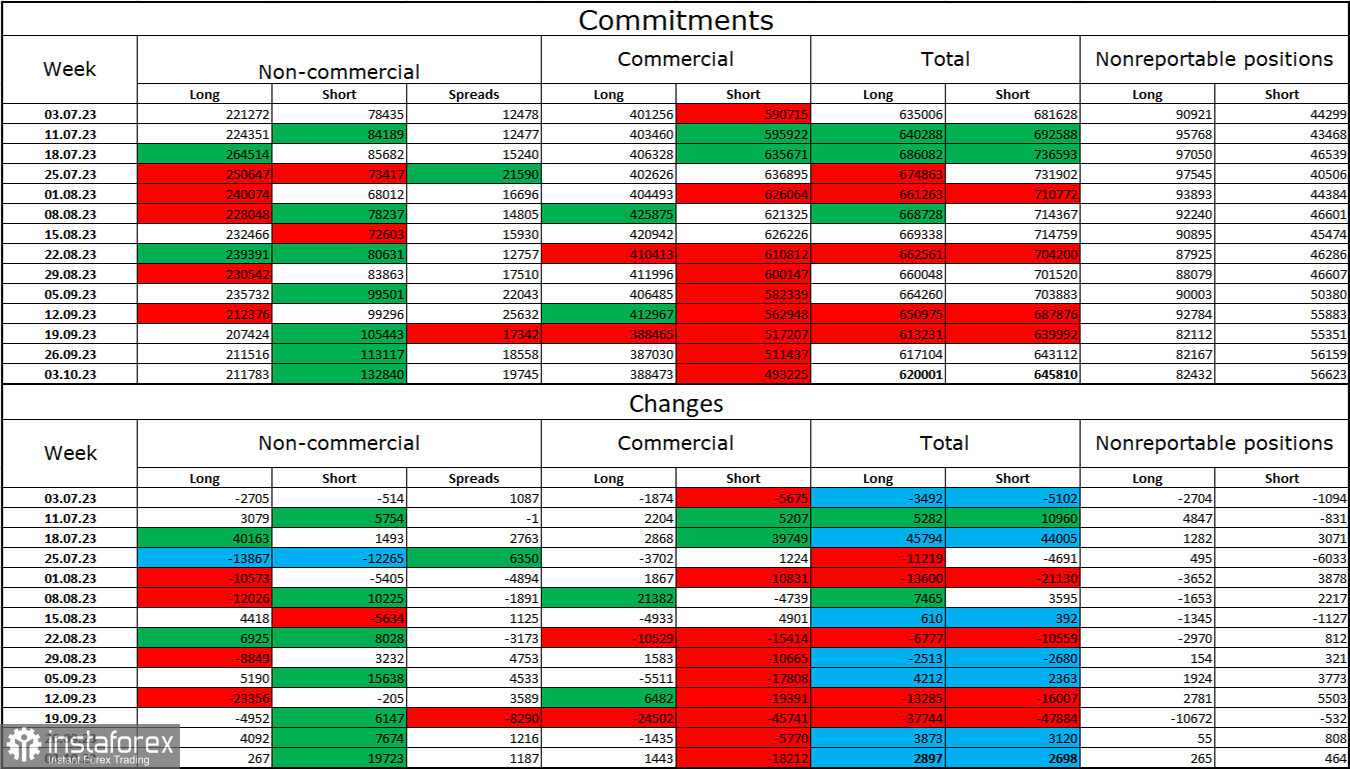

COT report

In the past reporting week, speculators opened 267 Long contracts and 19,723 Short contracts. The sentiment of large market players remains bullish but has been noticeably weakening in recent weeks and months. The total number of Long contracts now stands at 211,000 while Short contracts amount to 133,000. The difference is a bit less than twofold, although a few months ago the gap was threefold. I think that the situation will continue to change in favor of the bears over time. Bulls have dominated the market for too long, and now they need a strong information background to maintain the uptrend. There is no such background at the moment. Professional traders may continue to close long positions in the near future. I think that the current values suggest a further decline in the euro in the coming months.

Economic Calendar for US and EU:

US – Consumer Price Index (12-30 UTC)

US – Initial Jobless Claims (12-30 UTC)

On October 12, the economic calendar features two important events, with the US inflation report being of most interest to traders. Therefore, the information background may have a moderate influence on the market sentiment.

EUR/USD forecast and trading tips:

It is possible to sell the pair today after a close below the trend channel on H1 with the targets at 1.0561 and 1.0525. I recommended going long on a close above 1.0561 on H1, with the target at 1.0637. This target has been reached. Now the next target is seen at 1.0714 after firm positioning below 1.0637.