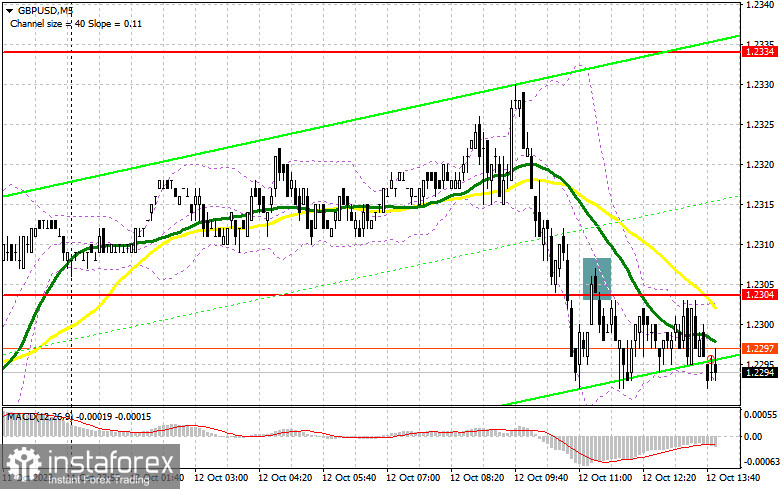

In my morning forecast, I drew attention to the level of 1.2304 and recommended making decisions based on it for market entry. Let's take a look at the 5-minute chart and analyze what happened there. The breakout and subsequent retest of 1.2304 signaled a selling opportunity, but significant downward movement for the currency pair has not materialized yet. The technical picture remained unchanged for the second half of the day.

To open long positions on GBP/USD, the following is required:

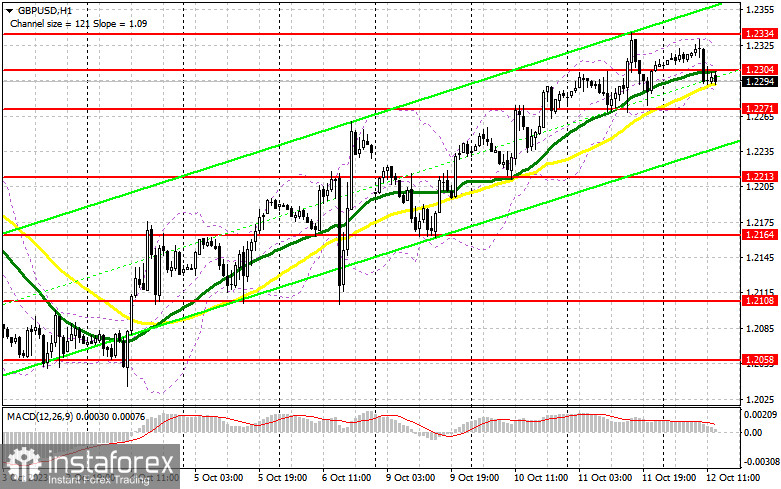

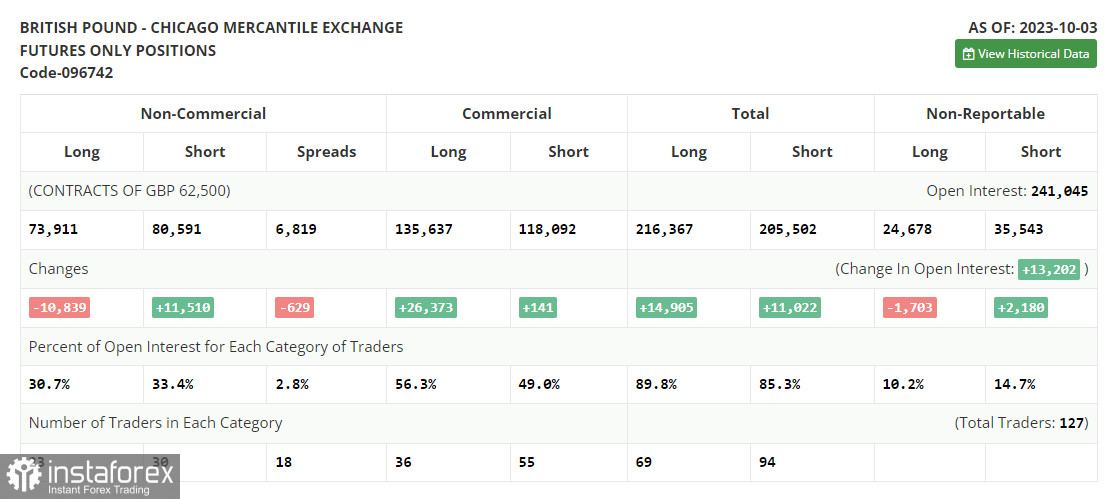

I believe it's clear to everyone that everything depends on inflation data. Considering that the U.S. labor market is showing strength, an increase in U.S. inflation is likely to compel the Federal Reserve to raise rates in November this year, which would lead to a decline in the pound today. However, if U.S. inflation decreases in September, it will be another reason to buy GBP/USD, especially after the discussions of Federal Reserve representatives earlier this week, indicating a softer stance. The best approach for buying is on a decline following the formation of a false breakout near the nearest support at 1.2271, which would provide a signal for a move to the weekly high around 1.2304, where bears have already shown themselves once today. A breakthrough and consolidation above this range would allow buyers to establish their new bullish trend, providing an opportunity to target 1.2334. The most distant target will be the area around 1.2376, where I will take a profit. In the scenario of a decline to 1.2271 and a lack of activity there in the second half of the day, which seems to be the case, trading will return to a sideways channel, and the situation for pound buyers will deteriorate. This would also open the path towards 1.2213. A false breakout in that area, following the pattern I discussed earlier, would provide a signal for opening long positions. I plan to buy GBP/USD immediately on a rebound only from the minimum at 1.2164, aiming for an intraday correction of 30-35 points.

To open short positions on GBP/USD, the following is required:

The bears need to continue defending the nearest resistance at 1.2304. Only a false breakout at this level, similar to what I discussed earlier, and data indicating strong inflation growth would provide a selling signal capable of pushing the pair to 1.2271. A breakthrough and retest from below this range will deal a more serious blow to buyer positions, paving the way for 1.2213. The more distant target will be 1.2164, where I will take a profit. In the case of GBP/USD rising and a lack of activity at 1.2303 in the second half of the day, which cannot be ruled out, demand for the pair will only increase, giving buyers a chance to continue the upward trend. In that case, I will postpone sales until a false breakout at 1.2334. If there is no downward movement, I will sell the pound immediately on a rebound from 1.2376, but only in anticipation of a downward pair correction of 30-35 points.

Indicator Signals:

Moving averages

Trading is taking place around the 30 and 50-day moving averages, indicating a sideways market trend.

Note: The author examines the period and prices of moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator around 1.2280 will act as support.

Description of indicators

Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.MACD Indicator (Moving Average Convergence/Divergence) - Fast EMA period 12. Slow EMA period 26. SMA period 9.Bollinger Bands - Period 20.Non-commercial traders - speculators, including individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.Long non-commercial positions represent the total open long positions of non-commercial traders.Short non-commercial positions represent the total open short positions of non-commercial traders.The net non-commercial position is the difference between the short and long positions of non-commercial traders.